- If you suddenly realize the "4% rule" and having to sell a portion of your assets every year to create adequate income to live on just won't cut it.

- If you do not have another 10-30 years to let your DGI portfolio recover from the crash that happens right before you were planning to retire.

- If you just had too much fun living and didn't save enough along the way and you are suddenly at "retirement" age thinking WTF do I do now?

- If you have champagne tastes but your current investments just produce a beer income.

- If you finally figure out Cramer screaming BOOYAH! BUY!!! and then 2 seconds later screaming BOOYAH! SELL! is not an investing philosophy but is just for entertainment.

Then you might be ready for.....

The Frankenstein Fund1 - Income Generation On Steroids For The New Age...

Upfront Disclosures:

As this is an actual portfolio i.e. my real life personal income portfolio, (all names have been changed to protect the neighbors reputations) for better or worse all the figures used are the actual prices paid and returns generated.

Future updates will be quarterly after rebalancing, (September, December, March, June) and will include total income received, total margin interest paid, any changes in the portfolio allocation, any additions/deletions to the portfolio asset selection, and NAV.

"Total Return" as traditionally used to define investment performance will be calculated each year, although for the purpose this portfolio was designed for it is not a relevant measure as no assets are going to be sold to create income, so the NAV and net realized yield or ROI might be a better measure to evaluate performance.

I have some other assets that will mature in January-February of 2016 and after distribution the cash will be added to The Fund at the next rebalancing event.

I have some other non dividend stocks currently tied up with long term (1 & 2 year) call option hedges and if/when those shares are called away the funds released will be added to The Fund.

ALL the positions in this account are leveraged at the portfolio level and all but one of them are leveraged internally. Talk about bang for the buck. Don't try this at home without adult supervision or understanding the risks/rewards involved of using margin.

I am 62 going on 63 and took SS early before it is means tested and I have no chance of getting my lifetime contributions back. 1 years total payments might last me 3 weeks. A very bad joke.

-----------------------------------------------------------------------------

OK, enough of that, lets get to it

This Income Portfolio, as originally discussed here and updated here and here, (I'll assume you go read them or did already anyway so this article does not turn into a book) was designed to eventually provide over 3X the amount of net income desired, so that a significant portion of the realized yield produced could be reinvested to compound the income generated and pay off the margin over time, and to ensure that even a -50% drop in net income due to adverse market conditions was a yawner and not my personal "Black Swan" moment...

How did I figure the amount needed?

I made a back of the napkin list: (Yearly)

Property taxes: $13K

car & home insurance: $12K

car payments: $60K

3.5% 30/yr mortgage (30%LTV) $24K

The old lady's paycheck: $48K

Grad school for #1 daughter: $40K (1.5 more years)

various monthly BS: $24K

whatever I forgot to make it a round number below: $29K

------------------------------------------

= $250K after taxes minimum initially

I read a series of articles like this one:

New Math for Retirees and the 4% Withdrawal Rule

and

Baby Boomers: Face it. If You're Not Rich Now, You'll Never Be

and played with a bunch of calculators like this one:

How Long Will My Money Last With Systematic Withdrawals?

and talked to a bunch of "2 & 20" type guys in nice suits...

I found out that I could not make ends meet with the amount of assets I had accumulated so far using conventional wisdom investment allocations like a 50/50 stock/fixed income split or an aggressive DGI mix without significant alterations to our lifestyle as the total asset base needed to generate that 'nut' at the meager level of yield either strategy was capable of generating was $6,250,000.00! All we could "safely" count on (>30 years income) from our investments was ~$78,000.00/yr inflation adjusted each year @ 3%.

Based on our current burn rate this is how long we'd last:

"Your money will last approximately 7.0 years with systematic inflation adjusted withdrawals totaling $2,036,402."

Based on $7,000.00/month initially this is how long we'd last:

"Your money will last approximately 29.8 years with systematic inflation adjusted withdrawals totaling $4,032,564."

And of course that's not enough coming in to cover the going out.

Even though the grad school expense would be gone in 1.5 years and the car loans in 5, neither of those withdrawal options were going to fly for obvious reasons, so a better performing alternative was needed. Several pots of Starbucks later I arrived at the concept for "The Frankenstein Fund" initially discussed at the links to my Instablog posts in paragraph 1 above.

Assets initially selected for The Frankenstein Fund:

MORL, CEFL, BDCL, OXLC, WMC, LNCO, SLVO

MORL, CEFL, & BDCL have been discussed and debated at length on SA in a series of articles by Prof. Lance Brofman, James Bjorkman as well as others. If you have not read any or all of them yet you might do so now. The comments sections are almost as good as the original articles!

OXLC (Oxford Lane Capital Corp) is a business development company with investments similar to those in BDCL, however I can lever it 3 to 1 and it pays quarterly on a different month than WMC, BDCL and the "big month" of MORL smoothing out my income stream.

WMC (Western Asset Mortgage Capital Corporation) is an mREIT with investments similar to those in MORL, (but it is not in MORL) and I can lever it 3 to 1, and it has Calls to hedge with and Puts to get additional shares/income with.

LNCO (LinnCo LLC) is a way to own Linn Energy (LINE) at a cheaper price (= a higher dividend yield as they pay the same cash dividend) and I can lever it 3 to 1, and it has Calls to hedge with and Puts to get additional shares/income with. The entire position is hedged with 2 year in the money calls.

SLVO (Credit Suisse X-Links Silver Shares Covered Call ETN) is a way to own silver in a way that pays a "dividend" and I can lever it 3 to 1.

Some might ask why I'd ever want to lever a 2X ETN to 4X or a single stock to 3X. Besides the obvious potential for dramatically increased income generation, due to the "The Fed" money is basically free, and since I have portfolio margin3 the 30% margin requirement stocks (WMC, LNCO, OXLC, SLVO) and the 50% margin requirement stocks (MORL, CEFL, BDCL) are added together to "wrap" into a 40% maintenance margin requirement whole as long as the proportions are selected to add up that way. If I keep the total dollar amount margined at 50% of the floating market stock value then I have a 10% equity buffer (or a -20% drop in value) against the market price action moving against me temporarily. That allows for less to really become more, and fast. More on this later.

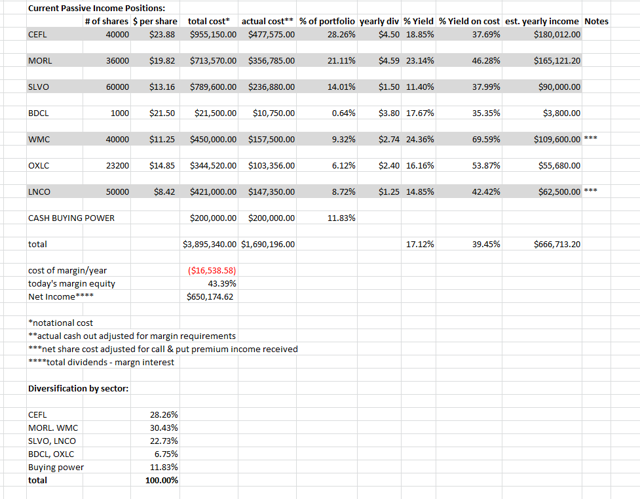

Current positions add up to the following:

Diversification by sector*:

| *see previous Instablogs for sector definitions | ||

| CEFL | 28.26% | |

| MORL, WMC | 30.43% | |

| SLVO, LNCO | 22.73% | |

| BDCL, OXLC | 6.75% | |

| Buying Power | 11.83% | |

| total | 100.00% | |

the goal by the end of the first year is to be roughly:

| CEFL | 22.50% | |

| MORL, WMC | 22.50% | |

| SLVO, LNCO | 22.50% | |

| BDCL, OXLC | 22.50% | |

| Buying Power | 10.00% | |

| total | 100.00% | |

How will I get there? BUY! BUY! BUY! :) Obviously I'm a little overweight in MORL and CEFL to start - but I wanted to capture the June dividends and they were both "on sale" this week.

Notes to the portfolio snapshot above:

*was original cost - will be market price in future rebalancing

**actual cash out of pocket adjusted for margin requirements

***net share cost adjusted for call & put premium income received

****total dividends - margin interest = net income

-shaded cells indicate initial goal allocations reached or exceeded at the time of publication.

"Retail" Cost to build portfolio over the past year:

| $3,850,340.00 |

Current NAV at today's (6/5/2015) closing:

| $3,718,938.00 |

net paper loss: -$131,402.00 (-3.41%)

Net interest/dividend income trailing 12 months:

July-December 2014: $144,768

Jan-June 2015: $198,357.00

July 2015 - June 2016: (projected from spread without further reinvestment) $666,713.00

So things seem to be moving in the right direction.

Discussion:

My previous Instablog posts explain the sector selection and the degree of correlation (or not) of the asset mix so I will not repeat myself, but you can refresh your memory here.

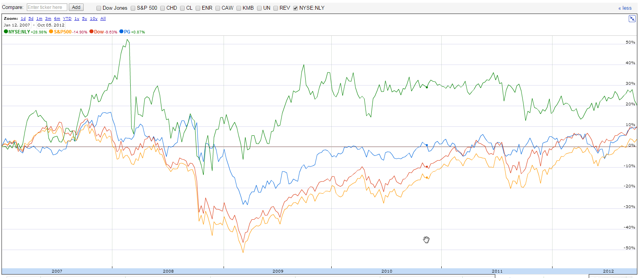

Here's a chart showing the price movements of all of them since the start date for CEFL as that is the youngest member of the pack

A note about apparent congruence in price moves from an article by Professor Brofman:

"Author's reply » That is the statistical phenomena known as Multicollinearity. In textbooks it is often illustrated by pointing out that teachers salaries and sales of alcoholic beverages track each other over a 50 year period while there is little correlation between them. The reason being they both track inflation."

Again, these assets were selected for

- maximum CURRENT SPENDABLE INCOME, and

- dividend reinvestment efficiency through dollar cost averaging to buy more shares every quarter to generate more income.

not the potential for price appreciation with the intent to sell (aka Flipping Mr. Market) to a greater fool later, as when the someone at The Fed unplugs the jukebox and the music stops all the fools tend to disappear in a big hurry.

Risk:

Market Risks

A lot of the comments in the threads on these ETN's focus on "risk". Besides all the everyday risks associated with merely getting out of bed, there is investment risk all around us no matter what you are in. In MORL, CEFL & BDCL's case there's the additional risk that UBS might go down the tube and the ETN's with it, (see Prof B and J.B. articles for some discussion of UBS risk) or that any of the single issue stocks management will take the money and run, or that the market as a whole will tank due to a black swan or The Feds ineptitude and take them with it. Like back in 2008-9 for instance. Here's what happened to blue chip dividend champion PG vs the 2 major components of MORL:

The DOW + S&P500 + PG

and here's what happened to 30% of what's in MORL:

The DOW + S&P500 + PG + NLY:

The DOW + S&P500 + PG + AGNC:

Which asset class might you want to own a chunk of during the next recession that's already overdue? I know what my answer is.

"But MORL has to be more risky than NLY or AGNC because it's not even real and it's 2X leveraged too!"

Hardly. MORL is as real as any "financial asset" is and gains more and "loses" less on a "paper" market price basis and still delivers ~2X on the yield than owning the 2 largest underlying stock positions in MORL individually:

Symbol: current yield

MORL: 22.08% (UBS)

AGNC: 11.70% (Yahoo)

NLY: 11.90% (Yahoo)

MORL vs AGNC & NLY (price)

Total Return October 17, 2012 to date:

MORL: 10.47%

AGNC: -2.06%

NLY: -5.25%

Total income per share: October 17, 2012 to date:

MORL: $11.9758 or $0.46/$1 invested

AGNC: $8.49 or $0.26/$1 invested

NLY: $3.45 or $0.21/$1 invested

Still think MORL is a dog?*

*PG by the way generated income per share of $0.09 for each dollar invested during that time window. Bummer if you are basing your retirement food budget on that..

All portfolios run the risk that there will be global or systemic "black swans", like wars, wandering asteroids, EMP attacks on Wall Street, etc - on a more local level, elections of anti business demagogues, or changes in government rules and regulations that affect your investments or your tax rates or you might even get hit by a bus while looking at your smartphone to check your stock prices when crossing the street.

The "Doing Nothing" or "Not Enough" Risk

However, in my view the greatest risks most people will face are:

a) the risk that you will end up at retirement with basically no money = working forever

b) the risk that the money you do manage to save will not last as long as you do

We've all seen those commercials on TV where people are sitting there in the back of a taxi with a deer in the headlights look wondering if they will outlive their savings - well DUH, if you didn't or couldn't save adequately and the investments you do have do not pay you very much to hold them what else could happen?

According to every article I've read on retirement that was not put out by The Ministry of Truth, the majority of Americans end up facing retirement with too little money, almost 50% of them with nothing but Social Insecurity, the greatest Ponzi Scheme ever invented - but that's a subject for a different post..

"Nearly half (45%) of Americans have no retirement savings, and those least likely to own a retirement account are lower-income households. Although nearly 90% of households in the highest income quartile own retirement accounts, only about a quarter of households in the lowest income quartile have such accounts."

"Overall, the average working household has little to nothing saved for retirement. The median retirement-account balance is only $3,000 for working-age households and only $12,000 for households approaching retirement. In two-thirds of working households with earners between ages 55 and 64 years, at least one earner has saved less than one year's income for retirement. Such savings fall far below what they will need to maintain their present standard of living."

and

and

More than Half of Americans Have Less than $25K for Retirement-What Should they Do?

and (DVL pay attention)

For Retirees, a Million-Dollar Illusion

Even the lefties are concerned:

America's retirement system is breaking down

and

Unfortunately for the people that have no savings reaching retirement age, at this late stage their situation is basically hopeless. For those hard working & thrifty souls that have put something away, like Mr. Average here:

"For those near retirement who have savings, the average balance is $100,000 - still not much money to finance the next 20 to 30 years."

The outlook is marginally better IF you can add in SS and any other side income. However, will a DGI mix yielding 3-4% or bond ladder yielding even less really do much in the grand scheme of things?

Plus, looking at the "average" skews things towards a higher number than what most people actually have due to the Fat Cats:

".. Clearly, such flexibility depends on individual circumstances. Billionaires can afford to be very flexible: just 2 percent of a $1 billion portfolio is still $20 million. With economizing, even a big spender should be able to scrape by on that. But $20,000 - the cash flow from a $1 million portfolio at 2 percent - won't take you very far in the United States today."

"And if you're not close to being a millionaire - if you're starting, say, with $10,000 in financial assets - you've got very little flexibility indeed."

"Yet $10,890 is the median financial net worth of an American household today, according to calculations by Edward N. Wolff, an economics professor at New York University. (He bases this estimate on 2010 Federal Reserve data, which he has updated for Sunday Business (June 2013) according to changes in relevant market indexes.)"

So, the obvious answer is no, the typical yield on a DGI or DGI/Bond mix portfolio is not going to cut it for the majority even if you live in a low cost of living state. And don't plan on moving in with your kids,they are probably already living in your basement.

One way to improve the situation is to get more out of the $ you do have. More on that later when we revisit Al and Sam.

Leverage Risk

As mentioned above, I have chosen to invest in assets that employ internal leverage to generate higher returns. How they do that has been explained 25 times by Prof. B and JB, so I'll not rehash that here. What I will do is explain why I choose to further lever the leverage using margin in the account that I hold these in.

What's leverage?

As KRT_investor mentioned:

"The ultimate leveraging... What could go wrong?"

Lots; AND lots can go right too.

Lets look at that.

Here's a common definition of leverage from Investopedia:

"The use of various financial instruments or borrowed capital, such as margin, to increase the potential return of an investment."

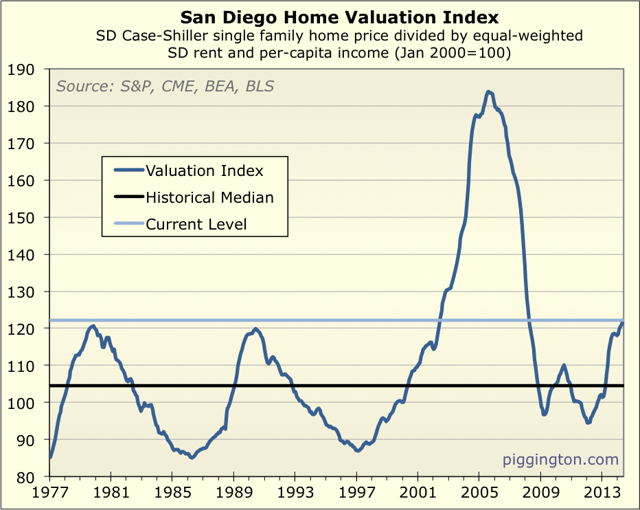

Most people these days use at least 4 to 1 "leverage" to buy a house and think nothing of it. That's the classic 80/20 conventional financing 30 year deal. It's just how its done - but they freak out if you say you use 2 to 1 leverage to buy a stock, huh? In case you have forgotten, housing is just another asset - one that happens to keep the rain off your head - but one that still fluctuates significantly in "Market Value2". Since I have lived in So Cal since 1978, lets look at what's happened to housing prices - aka the market value of a home - in San Diego:

Back in the glory days of the housing financing bubble you could get 105% financing. That's like having Fidelity pay you 5% commission now to promise to pay for the stock in the future. Where do I sign up??

If you don't pay your mortgage you get foreclosed on, if you don't pay a margin call you get closed out of a portion of your positions, but just enough to cover the call - kinda like your mortgage company taking the porch if you don't pay this months payment.

If your only plan to cover a temporary market move against you is to sell something, usually at a depressed price, then max leverage is not for you. Moderate leverage - lets say 20% (or 80% equity) can help boost returns with lots of equity cushion. That can be effective depending on the cost of that money. In my case, I pay 0.75%/year, so the money is even better than free after inflation. Load me up.

Getting back to the KRT_investor comment. Lots of things could go wrong in the world - I don't pretend to have thought of them all. From one of my all time favorite press conferences:

"There are known knowns. These are things we know that we know. There are known unknowns. That is to say, there are things that we know we don't know. But there are also unknown unknowns. There are things we don't know we don't know."

I figure I've got about 1.5 more years of an almost free lunch from the Fed, and have hedges using covered calls and the "buying power" reserve that cover a -20% correction in my net account value (Plan A) - but that's why I also have a $250K HELOC standing by as a Plan B - after that? it might be entertaining. Plan C is doing what typically happens in a crash, i.e. everyone is "selling what you can sell". Not the best plan, and if that's all you got as a Plan A, stick to a cash account.

That said, 3-4 years at +45% realized yield (vs the 18% I'd get in a "cash" account) = 80+ years of a 2% PG Dividend special - Given the potential rewards, and the fact that I have a backup plan to the backup plan I'll take my chances.

Yes, it's "riskier" than some other strategies out there but I'm a "my glass is always half full" kinda guy even though I think we are already back in/never left recession as a nation so we'll see what happens.

Income

Enough of the bad stuff - So what kind of income can my strategy generate in my account?

When calculating the dividend income I used trailing 12 month dividends for each position except LNCO when I used the last 3 months X 4 as a guide.

The starting positions are projected to throw off $650,000/year or so after margin expenses for year 1 before I buy any more stock in the next 3 quarters of rebalancing, so for the purposes of this article I'll pretend I don't buy much, divs are not increased, etc, and I end up with $670.000.00 net for the year after margin interest is deducted.

Since that's more than I "need" - although I think I'm worth it

- I have several options:

- pay down the margin ASAP as the sky will fall any day now

- buy more shares of the stocks I have for even more income

- further diversify

- pay off all my other loans

The least expensive money in my overall loan mix is the margin cost, (remember you are just buying money when you borrow) so this is probably what will happen:

- buy more shares of the stocks I have until I hit my numbers

- further diversify after being fully allocated

- pay off all my other loans with the income stream from #1 & #2

- let the excess dividends pay down the margin

Although Dave Ramsey thinks the paid off home is the new status symbol, I think having your investments pay it off for you is even more clever. But he has a radio show and makes millions telling people to do things they already know they ought to do and I don't so each to their own.

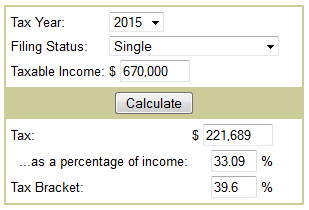

So how much of that take do I actually get to keep?

The Feds had this to say about that:

Depressing.

The boys in Sacramento will have their hands out too for roughly 10% or ~$67,000, so without some fancy footwork worst case:

| $670,000.00 |

| ($221,689.00) |

| ($67,000.00) |

| =$381,311.00 |

less $250,000.00 for me = ~$130,000.00 to reinvest each year.

SHIT, that's it?

Maybe I ought to take everyone's advice and pay off everything and move to Georgia. Hmmm. Too many bugs bigger than I am and no McLaren dealer.

Still, putting an extra $130K to work every year does add up eventually.

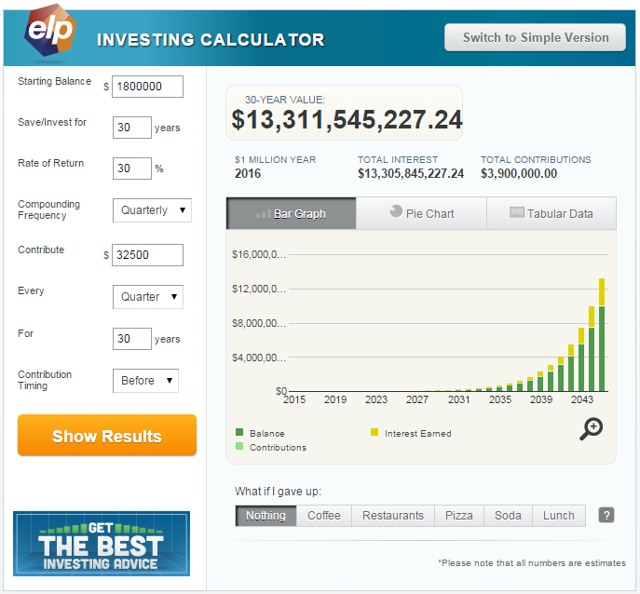

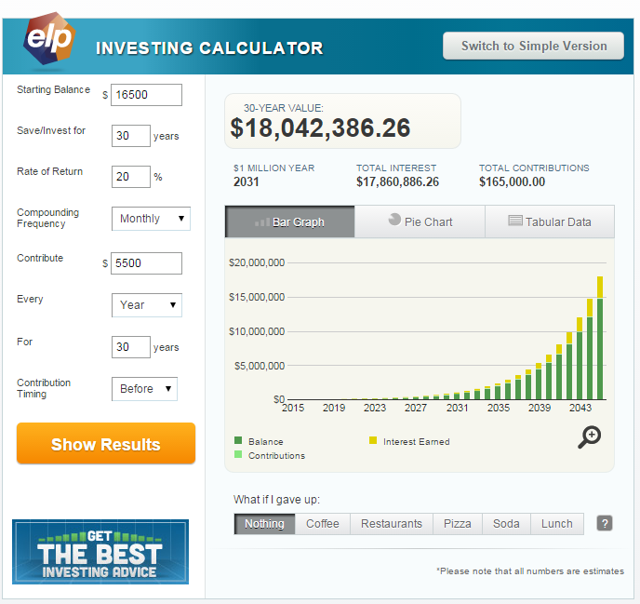

Here's what Dave Ramsey's calculator has to say:

Hmmm, that looks like a possible $13 X-illion with a "B". I used an average of 30% return based on the margin gradually being paid off over time (i.e. year 1 @ 45% return, year 30 @18% return with zero margin) and no increase in the amount invested even though that would also increase each year as the number of shares owned increases, plus no share price appreciation or realized capital gains needed. I wish I could find that calculator that adds up the shares purchased.

Not to shabby even for me, although at 92 those billions might not be as fun to spend as it would be now. sigh. Some Q&A:

Q: How come that Dave Ramsey calculation portfolio starts with $1.8M and your spreadsheet has a cost of $1.67M?

A: I have some other stuff that will get dumped into it later in the year I hope and even though it's current yield is a joke (6.25%) it makes it total 1.8M or so net. If you are more impressed by the retail number ($3.7M) you could use that instead.

Q: How come not all the numbers match exactly everywhere?

A: I wrote parts of this on different days, and so as the yield is recalulated as the stock price changes it's not the same every day. Besides, a few 0.01% moves in $1.8M of stock spread over 10 positions changes things. Today I had an intraday drop of -1.49%.

Q: How come this is not a real article on SA?

A: It was deemed to far ranging and not professional enough by the review people, plus they wanted me to publish under my own name. Like I would be interested in that BS.

------------------------

OK, I can hear it already;

"these stocks are unproven"

If "Past performance is not indicative of future results" then why do DGI advocates use that as their main argument to justify their strategy so often?

"you are taking too much risk"

no risk, no reward.

"But it's just a return of capital"

If the divs are $4/year and the stock price is basically flat or "stuck" in a trading range, how is that return of capital? Will you still be saying that in 10 years when the stocks have paid out ~$40/share and the stock price is still the same?? Probably.

"I couldn't sleep at night"

Whatever. I can't sleep anyway even with a Prostate Plus™ I.V.

"but this would only work (if it did) if you are rich"

Hardly. This is the #1 daughters ROTH; currently split 33% in each. (MORL, BDCL, CEFL)

There could be worse situations I suppose than to have $18M and be only 55. Too bad I didn't do the same thing when I was 19.

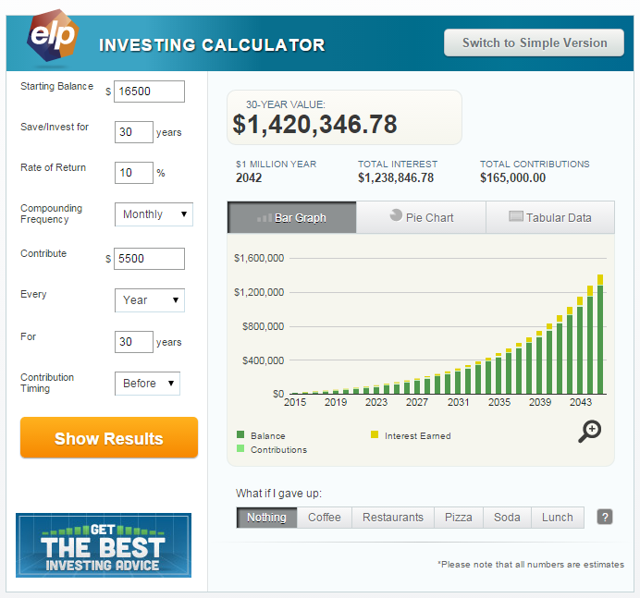

Of course it might not happen, or she could play it safe instead and make 10% "total return" yearly with the best of the best DGI Darlings because her crystal ball works better than anyone else's at picking the winners and dropping the losers over time - how well might that plan work?

OK, well $1,420,349.78 in today's dollars sounds pretty good for 30 years of diligent saving & investing, but what will that $1.4M actually be worth in today's dollars in 30 years with only 3% annual inflation? Why just:

$585,164.98 (vs $7,433,085.30 for the inflation adjusted buying power of the high yield portfolio)

And as we know from all those scholarly articles cited above, and from playing with the "How long will my $ last" calculators, that $585,164.98 in inflation adjusted spending power will not last that long in So Cal.

And of course - it might not actually work the way you think it might:

The Market Has Generated 10% Annual Returns

or maybe not? either way it's great chart porn!

OK, enough about the future, let's remember our two surfers Al and Sam with $100K in retirement savings that needed current income. (I looked for that original post but could not track it down)

As I remember, Al and Sam retired to their nice little beach casitas in Baja each with $100K to invest for current income. Since the rest of their life was paid off (paid off car, paid off casita, paid off surfboards, no alimony, etc) all they need is a few bucks a month for utilities, beans and tortillas, a little beer to watch the sunset with and some cash to pay a little protection money vig for the local cartel in lieu of the federal, state and local USA income taxes they left behind.

Let's pretend for the sake of this math exercise that their average weekly budget adds up to about $800/month or $9,600/year. Al, having read one book on dividend growth investing he found in a used bookstore - maybe this one written in 1990, and stopped thinking immediately afterwards - puts his $100K in the cream of the crop top 50 Golden Globe Award Time Tested Dividend Growth Stocks - aka the "Nifty 50". Conveniently put together for him by Vanguard and bundled in [VDIGX] so he does not even have to do any work to put a portfolio together himself.

Lets look at how that might work out for him. Hmm, just 1.83% current yield = $1,830 in income. Where is the other $7,770 going to come from? Well from selling some shares each year of course. Let's look at the long term return of VDIGX since 1992. Hmm, total return is 8.28%/year. Our handy-dandy "How Long Will My $ last in Retirement Calculator" says:

"Your money will last approximately 15.3 years with systematic inflation adjusted withdrawals starting @ $800.00/month totaling $184,508."

Let's see what Sam does with his $100K. Since Sam keeps up with the latest investing ideas on SA he reads about the UBS High Yield Funds BDCL, MORL and CEFL. Yikes! such a deal. Splitting his $ three ways, he averages (data from UBS 6/04/2015)

BDCL: 15.54%

MORL: 22.84%

CEFL: 17.79%

------------

Average yield = 18.72% or $18,720/year income. Since his expenses are the same as Al's he reinvests $9,120.00 a year back into those same 3 stocks buying more of those shares every year rather than have to sell any. How many years will his income continue?

"This calculation could not be completed. The number of payments is too large to compute using this calculator."

Now that's the kind of performance that makes you want to get out of your hammock in the morning! (and be one of Sam's heirs too) - maybe he will take pity on his pal Al and hire him to wax his board for him when he runs out of $.

YRMV

Final Thoughts

I think I've found my solution to the current and future income challenge, and since I'm posting the results here, we'll all find out over time.

This is just my opinion, and everyone has one as they say, so yours may differ. Hopefully your solution will be adequate for your needs too. Just make sure that you actually do the forward math and not just the rear view mirror math and don't drink too much of the CNBC CW Kool-Aid while you are tapping the keys..

Whatever you choose to do or not do with your investments, remember that no matter what you have been told by the talking head of the hour or read on SA or anywhere else, written by me or your favorite guru, no investment is worth more to someone else than the bid price on the last trade, and tomorrow there could be no bid.

HAPPY TRADING!

Cliff Notes

1tip of the hat to DVL for inadvertently naming the concept.

2Market Value is just what someone else will pay you today to take whatever you are selling off your hands aka the price at whichbuyers and sellers agree to trade in an open market at a particular time.

3From Fidelity: Portfolio margin is another method of calculating margin requirements. Unlike the traditional Initial/Regulation T (Reg T) margin calculation method, portfolio margin measures the risk in your overall portfolio and uses that to determine your margin requirement. As a result of these calculations, margin requirements may be as low as 15% for a well-diversified account with long and short market exposure. Since portfolio margin measures overall portfolio risk, it is best suited for a well-diversified portfolio. If a portfolio is heavily invested in an individual stock or sector, higher margin requirements may be placed on the account in question. An account that uses portfolio margin is not subject to Initial/Reg T margin requirements.

Helpful Links: