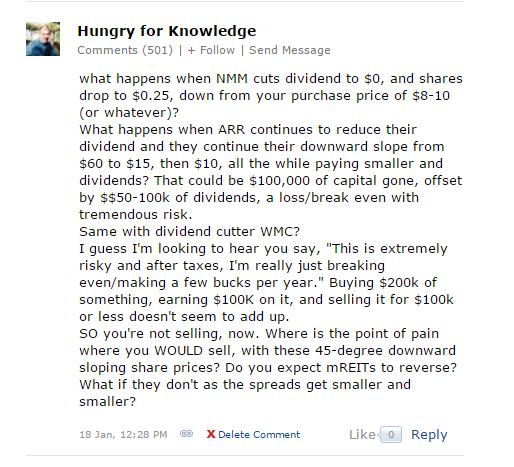

What Happens If? What Happens When? JUST TELL ME WHAT'S GOING TO HAPPEN SO I FEEL SAFE???

1/18/2016

Hungry for Knowledge asked:

Perfectly good questions, and I have no idea what's going to happen tomorrow much less in a month or in 6 months or a year.

No one does. If they did they'd be 'Masters of The Universe.' Oh oops, how much did those smug CB's turn out to know? Not much.

Classic:

"When it becomes serious, you have to lie." -Jean Claude Juncker

That said, the question that's most important to my income is:

What am I going to do if the prices of my ARR, WMC, or NMM shares don't go straight up at a 45 degree angle forever and instead go down at a 45 degree angle or up and down "randomly" for a year or 2 or 3 due to macro economic forces?

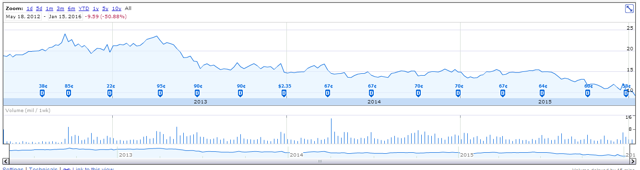

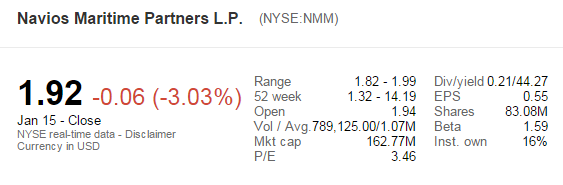

Let's look at NMM first since I've been keeping track of that one.

Fridays close:

So what happens when they cut the div to $0.00? Well If HFK knew when that would happen then he'd be a stud and would short the stock. Somehow I don't think he knows that or he'd not be so hungry...

Last I looked NMM had some decent long term charter bookings that are paying their bills out to about 2018 so I think the current price adjustment is a little overblown, but what do I know? Obviously not everything.

"Navios Maritime Partners L.P. (NYSE:NMM) is an international owner and operator of dry bulk and container vessels formed by Navios Holdings, which is a vertically integrated seaborne shipping company. The Company is engaged in the seaborne transportation services of a range of dry cargo commodities, including iron ore, coal, grain, fertilizer and also containers, chartering its vessels under medium to long-term charters. The operations of Navios Partners are managed by Navios ShipManagement Inc., which is a subsidiary of Navios Holdings (the Manager), from its offices in Piraeus, Greece, Singapore and Monaco. The Company's vessels are chartered-out under medium to long-term time charters with an average remaining term of approximately three years to a group, including Cosco Bulk Carrier Co. Ltd., Mitsui O.S.K. Lines Ltd., Exelon Corporation, Rio Tinto, Hyundai Merchant Marine Co., Ltd and Mediterranean Shipping Co. S.A.

With the world slowing down, it looks like it might take awhile for them to make some decent $ again even with those charters, so I've been working on reducing my cost basis..

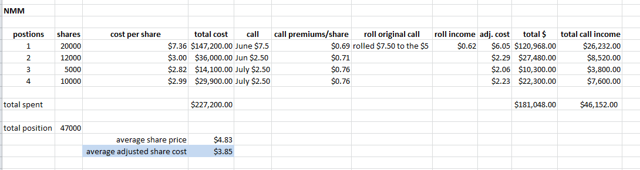

My $3.85/adjusted share cost is still "out of the money" so I'll be selling more calls in June & July. So far I've just received 1 div distribution:

NMM 11/10/2015 $4,250.00 regular dividends

But the next one ought to be coming in next month:

NMM 2/13/2016 $9,987.50 regular dividends

Time will tell how that plays..

***

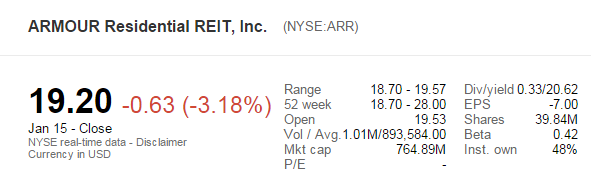

Lets look at ARR second.

I didn't buy it back when it was a split adjusted $60, my unadjusted cost basis is currently $20.95. Geez, looks like I'm -$1.75 at the moment. Time to scream and run for the hills!?

Well so far I've sold calls against the original 1,000 share position:

ARR Jan 2016 $21 calls 9/24/2015 $749.50 call option premium paid in September

and against the 2nd 1,000 share position:

ARR 11/23/2015 $749.56 July 15 2016 $21 call option premium paid in November

and rolled the first position from January to July:

ARR 1/11/2016 $499.14 July 15 2016 $21 call option roll premium paid in January

What's my actual cost per share now?

1,000 @ $20.95 - ($749.50 + $499.14) = $19.70/share actual.

1,000 @ 20.95 - $749.56 = $20.20/share actual

for a adjusted cost basis of $19.95.

In July I'll sell them again. At $-1.50/share/year reduction in cost basis I'll be at $0.00/share in a mere 13.3 years if I do not average down. Which I might.

Of course I originally bought these shares for the income and because they only require a 30% maintenance margin. How's that working out?

- ARR 10/27/2015 $330.00 regular dividends

- ARR 11/27/2015 $660.00 regular dividends

- ARR 12/30/2015 $660.00 regular dividends

- ARR 01/27/2016 $660.00 regular dividends

Dammit, rolling in month after month like waves at the beach. Maybe they will keep going, maybe they will be more or less in the future, I don't know. I think I'll get more with the obscene profits from the BX trade.

***

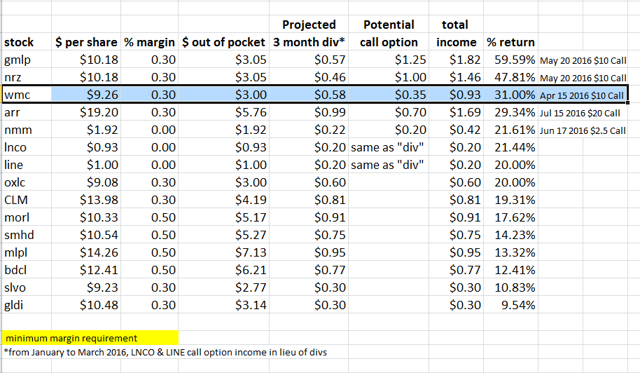

So lets look at that serial dividend cutter WMC last. Fridays quote:

Since inception:

Seems like the divs have gone up and down and up and down. Maybe the divs are related to net profits or something. /sarc

Here's my current position:

There you see some pesky call options again. Current adjusted cost per share is ~$10.31, maybe I'll buy some more for the next div and to average down.. of course at just $3 cash out of pocket on these they rock in real life:

But I'm going to do the BX trade first.

HFK says:

"I guess I'm looking to hear you say, "This is extremely risky and after taxes, I'm really just breaking even/making a few bucks per year."

Of course it's "risky", that's why it generates the big bucks. Perhaps you've heard "Nothing ventured, Nothing gained?" before someplace? - or maybe "Buy low and bank the income?" - OK, I made that last one up.

In 2015 I had a decent year, this year I'm looking for a better than decent year.

We'll have to see what happens of course, I might even surprise myself to the upside. Did I mention the BX trade? Net call option premiums on 20,000 shares of those bad boys could pay off my house in just 50 weeks..

HFK says:

"Do you expect mREITs to reverse? What if they don't as the spreads get smaller and smaller?"

I expect them to do whatever they will do. I'd refer you to this as an example of what they can do. Will ARR or WMC replicate NLY? I have no idea. I can make money in any environment.

YRMV*

*depending on what you do (if anything) and when you do it.