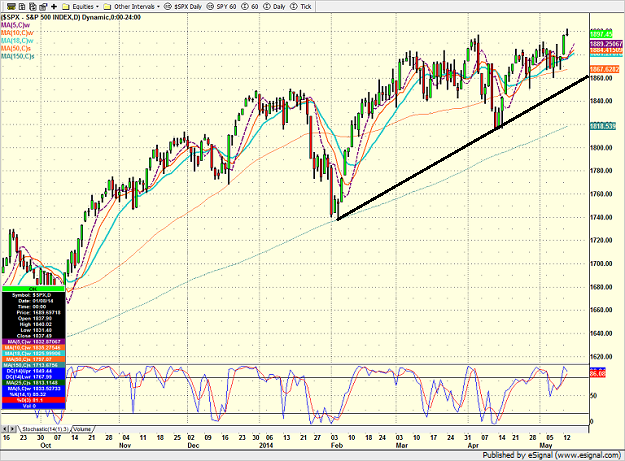

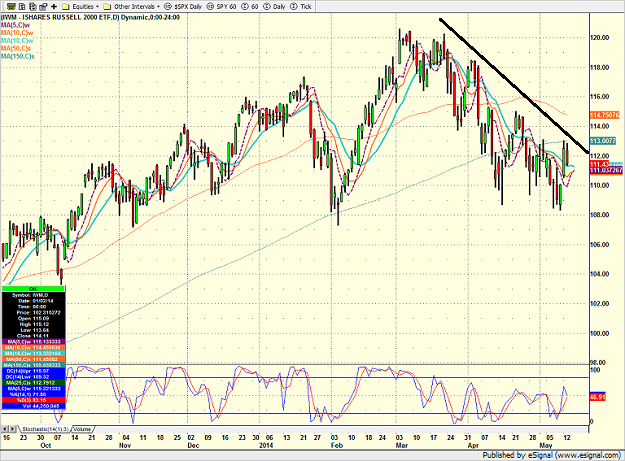

| Daily State of the Markets In yesterday's missive, we talked about the idea that really big, really bad bear markets just don't happen that often. And since investors were treated to two devastating bears within a 9-year stretch, most folks are keeping their eyes wide open and preparing for the next one. The key point is that the type of bear market that wipes out years of gains and puts financial plans of all shapes and sizes at risk by producing losses of 30, 40, and 50 percent don't occur when most people are looking for them. No, the truly gut-wrenching bear markets have historically come out of nowhere. They take investors by surprise. And frankly, most investors don't understand why stocks are crumbling around them until it is too late. Ask yourself, did you know what a CMO was prior to the summer of 2008? How about a sub-prime mortgage? Did you understand the impact of Lehman's fall on the banking system? Were you aware that heavily leveraged hedge funds were hemorrhaging wildly in the fall of 2008? And did the headlines about money market funds "breaking the buck" make you quake in your boots and/or hide under your desk? Before the Credit Crisis and the ensuing alphabet-soup of derivative destruction, there was the Tech Bubble bear. Again, ask yourself - and be honest - were you more worried about missing the next great internet stock in 2000 than the fact that Cisco Systems (NASDAQ: CSCO) was selling at a valuation higher than 20 of the Dow 30 stocks combined? Did you heed Jim Cramer's advice in late 1999 and begin buying "baskets" of internet stocks instead of just one at a time? And did you call your financial advisor during 1999 to demand more exposure to the stock market in general and more specifically the "hot dots" of that era? Believe it or not, a great many did. Make no mistake about it; when the animal spirits are soaring and soccer Mom's are trading stocks in between car pool runs, THIS is when portfolios are at risk of being wiped out. THIS is when the really hot stocks are set up to lose 70-90 percent of their value. And THIS is when it pays to know how to play defense in your portfolio. After two brutal bear markets that, as the joke goes, turned people's 401K's into "201K's" (or worse), everybody now "gets it." Everybody NOW knows that risk management is important. Everybody is prepared for the next big bear. So, what is Ms. Market likely to do to all those investors who are now ready with a plan for the next big, bad bear hits? If history is any guide, she will probably serve up a very long, very strong bull market, with an occasional "baby bear" mixed in just to keep everyone off balance. Remember, frustrating the masses is what Ms. Market does best! Are Those Baby Bear Tracks? While Ms. Market may not serve up a fat, juicy 50 percent decline any time soon, this does not mean that a "mini" or cyclical bear isn't lurking. Lest we forget, just about everybody in the game is looking for a meaningful decline in the stock market to occur this year. As such, it is a probably a good idea for investors to be on the lookout for any signs that the bears might be awaking from a long winter's nap. So, let's scout around the camp site so to speak and see if there are any paw prints to be found. Bear Track #1: Waning Momentum - In case this is your first trip through the market cycles, it is important to recognize that the market's internal momentum tends to peak long before the popular indices do. For example, if one plots the number of technically healthy sub-industry groups (the number above their 200-day moving averages, for example) you will find that the number tends to expand during healthy bull market trends. However, as a bull market ages, the peaks in the number of healthy sub-industries begins to trend lower. This means that fewer and fewer groups are participating in the advance. And in the vast majority of cases, this is a very good sign that the market may be due for a meaningful decline. The same can be said for "net demand volume." In healthy markets, a plot of "demand volume" minus "supply volume" trends upward. But currently, this line has been moving lower for almost a year. And at some point, this will be a problem. In short, these two indicators suggest that the market has lost its upside momentum. Unfortunately for all the card-carrying perma-bulls out there, these indicators have been in decline for some time now. And while a market can, and often does, advance "narrowly" for long periods of time, investors should take note that waning momentum is NOT a good thing. Bear Track #2: Divergences - As they say, a picture is worth a thousand words. Or in this case, two pictures can make the point quite clear that the "troops" (the small caps) are not following the "generals" at this time. S&P 500 Daily While things have been quite choppy, the S&P remains in an uptrend and at all-time highs. However, the Russell 2000 small cap index is clearly in a downtrend. And in short, this is a classic divergence. iShares Russell 2000 (Small Caps) Daily In addition, the number of stocks making new 52-week lows has been expanding lately. The key is that this just doesn't happen in healthy market environments. Bottom Line: Investors Need to Be Ready While investors may not be bloodied to the degree they were in 2000 and in 2008, there are a fair number of indicators that suggest the market may be setting up for a "mini" or cyclical bear period. The good news is that these "baby bears" tend to be brief, lasting about 3 months or so. But the bad news is that a decline greater than -15 percent could be in the cards sometime in the next year - unless, of course, the bulls can recover their lost mojo in the near term, that is. So... the bulls are certainly free to continue to enjoy the bull party. However, note that the punch bowl is running low and the dance floor is looking a little sparse. As such, anyone interested in managing risk may want to know where the exits are at all times. Looking For Investment Management Help? If you are looking for help with money management, check out Heritage Capital Management's Active Risk Manager Service - or call Heritage for more information at (630) 250-4700. ALL NEW: The Next Generation of the Daily Decision system is now available to clients of Heritage Capital. The upgraded system utilizes swing trading and mean reversion strategies during neutral market environments, multiple indices for long positions, incremental moves in and out of the market, multiple managers and multiple strategies - with the overall goal being reduced volatility, fewer and less impactful whipsaws, and a "smoother ride." To learn more about the "Next Generation" system, Read the Research Report Turning to This Morning... The ECB is openly talking about policy measures designed to stimulate the Eurozone economy today while the Bank of England is discussing when the first rate hikes are to be expected. Here at home, investors will be focused on the macro data and the question of whether or not the blue chip indices can push higher in the near term. Currently U.S. futures point to a modest pullback at the open. Pre-Game Indicators Here are the Pre-Market indicators we review each morning before the opening bell... Major Foreign Markets: Crude Oil Futures: +$0.29 to $101.99 Gold: +$10.10 at $1304.90 Dollar: higher against the yen and pound, lower vs. euro 10-Year Bond Yield: Currently trading at 2.576% Stock Futures Ahead of Open in U.S. (relative to fair value): Thought For The Day... "It's a beautiful day, don't let it get away" -BonoPositions in stocks mentioned: none Follow Me on Twitter: @StateDave The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should not be construed as recommendations. The analysis and information in this report and on our website is for informational purposes only. No part of the material presented in this report or on our websites is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed nor any Portfolio constitutes a solicitation to purchase or sell securities or any investment program. The opinions and forecasts expressed are those of the editors of StateoftheMarkets.com and may not actually come to pass. The opinions and viewpoints regarding the future of the markets should not be construed as recommendations of any specific security nor specific investment advice. One should always consult an investment professional before making any investment. Any investment decisions must in all cases be made by the reader or by his or her investment adviser. Do NOT ever purchase any security without doing sufficient research. There is no guarantee that the investment objectives outlined will actually come to pass. All opinions expressed herein are subject to change without notice. Neither the editor, employees, nor any of their affiliates shall have any liability for any loss sustained by anyone who has relied on the information provided. The analysis provided is based on both technical and fundamental research and is provided "as is" without warranty of any kind, either expressed or implied. Although the information contained is derived from sources which are believed to be reliable, they cannot be guaranteed. The information contained in this report is provided by Ridge Publishing Co. Inc. (Ridge). One of the principals of Ridge, Mr. David Moenning, is also President and majority shareholder of Heritage Capital Management, Inc. (HCM) a Chicago-based money management firm. HCM is registered as an investment adviser. HCM also serves as a sub-advisor to other investment advisory firms. Ridge is a publisher and has not registered as an investment adviser. Neither HCM nor Ridge is registered as a broker-dealer. Employees and affiliates of HCM and Ridge may at times have positions in the securities referred to and may make purchases or sales of these securities while publications are in circulation. Editors will indicate whether they or HCM has a position in stocks or other securities mentioned in any publication. The disclosures will be accurate as of the time of publication and may change thereafter without notice. Investments in equities carry an inherent element of risk including the potential for significant loss of principal. Past performance is not an indication of future results. |

Are Those Bear Tracks Important?

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.