Summary:

•US listed leading mining companies are mostly overpriced

•Smallest companies are worth to be followed more closely

•Vale SA is the only major mining company offering quality for cheap (just don't invest yet)

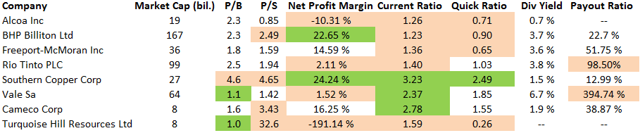

Earlier I looked at the valuation of Vale SA due to its long period of declining stock value. It was clear that Vale is getting interesting by value investing terms as it now has a P/B of 1.11. But this number alone does not tell us much, so to understand the industry a bit better I am now comparing Vale SA with other major mining companies that are listed in the US (Stock prices I used are from 18th of September). List also includes next two largest mining companies from the under 10 billion side for comparison. Of all ratios P/B and S/P are the interesting part with other ratios being there for support.

All numbers are provided by ft.com except P/B that I counted based on the financial information listed in ft.com ((Total assets - intangibles - goodwill - total liabilities)/shares outstanding).

By P/B Vale and Turquoise Hill Resources Ltd are clearly cheaper than their peers, which are greatly overpriced. But what do other ratios say about these companies? Comparing sales and stock price shows that Turquoise Hill Resources is at the moment grossly over priced. Looking at net profit margin shows why this is. Turquoise also has horrible quick ratio, but does at least have a decent current ratio. So Turquoise is a company that might be worth following. If their profit levels improve this stock could be very valuable. At the moment it is already decently priced for an investor who believed there will be future improvements.

By P/S Vale is also cheap compared to its peers. Here could be seen a large change if iron ore prices started climbing up (This would of course apply to rest of the companies that deal with iron ore). By net profit margins BHP Billiton and Southern Copper Corp stand out from the rest. Here Vale is barely positive. Only major mining company with worst net profit margin being Alcoa which also shows overvaluation. Second interesting group is formed by Cameco and Freeport-McMoran that are also under 2 in terms of P/B. Out of these two Cameco seems the more interesting one. With only 8 billion in market capitalization it possesses plenty of room to grow.

Cameco is also one of the most financially strong companies with a current ratio of 2.78. Current and quick ratio show us that Vale, Cameco and Southern Copper are financially very strong as rest of the industry leaders are on even dangerous levels if market turns bad for them.

Dividend is not important for a value investor, but it can contain information that is valuable. But it isn't the dividend that is actually interesting, it is the dividend payout ratio in this case. It is stated that payout ratios of over 60 % are usually not sustainable for companies. Out of these we see Rio Tinto and Vale having much, much higher percentages than sixty percent. For Vale it could have been an attempt to raise their stock price and get it to an upwards track (this wouldn't be unusual). Due to Vale's financial strength it might just be that they haven't found a better use for their cash (And due to weaker revenues their dividend payout ratio seems so absurd this year).

Other end of the stick are companies with low payout ratio but good yield. BHP Billiton, Southern Copper Corp and Cameco come out as profit making companies that are paying an ok dividend already, but also have room for dividend increases.

So is there value to be found? Today, not really. Two companies are clearly cheaper than the rest (Vale and Turquoise) but are also likely to get a lot cheaper if their net profit margins don't turn around. Turquoise with its weak P/S must be able to improve its sales. Alcoa seems cheapest by P/S so I would follow it incase it actually improves its situation in the future. Cameco is another interesting company. It is not too strongly overpriced. Plus, with its small market cap and decent net profit margin it does have a possibility to be growing in the future. Whereas Vale needs to be followed more. It doesn't show to be ready for a turnaround yet, but is getting cheaper instead. With its strong financials Vale has the strength to survive long periods of bad business cycles. So when Vale's price drops to a more comfortable levels and/or company shows that it is operating strongly on the black again I am very interested to make an investment.

This has been a look at the real value of these companies (not a look on their operations!), any investor is advised to perform his own research of any company before making an investment decision.