Dear followers and readers:

In this blog, we provide an update of our SWP portfolio, in case you are holding similar securities. This is our real portfolio that we use to manage our long-term growth needs. In this article, we also think it is a good time to share our thoughts on the overall market and the possibilities of a recession.

As usual, please accept our apologies if you receive duplicative copies, and do not hesitate to reach out with questions or comments. Besides the SA messages and chatroom, you can also Directly email ustoo if that works easier for you.

Best,

Grace and Lucas

Founders of Envision Early Retirement

____________________________________________________________

June 15 SWP update

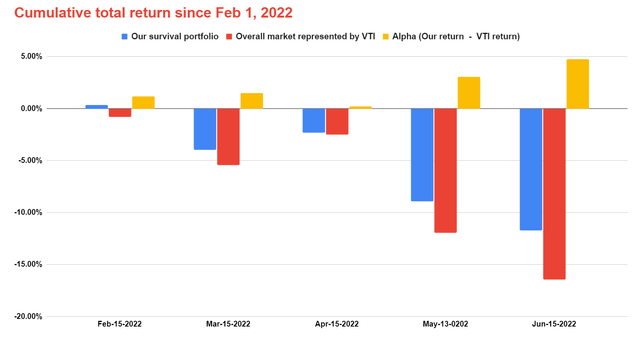

It has been a tough year so far for investors. There is no place to hide. The equity market is down by about 16.5% since Feb 1. Bonds are down. How much depends on the maturity.

This is the time when our SWP really helps us both financially and emotionally. By having enough survival cash, we do not have to participate in the short-term bloodbath. By having a balanced portfolio with high-quality securities, our portfolio falls less during bad times and is well-positioned to rebound more during good times.

Finally, as we kept reminding our readers - do not overlook the outperformance even when it is relative and small. Compounding is inherently asymmetric so a 10% loss hurts you more than a 10% gain helps you.

The following are some of the highlights and specific changes we’ve made to our SWP portfolio this month:

- As usual, chart 1 below provides a snapshot of the portfolio before the maintenance, chart 2 a snapshot of the portfolio adjustment that we made, and chart 3 the portfolio for the incoming month.

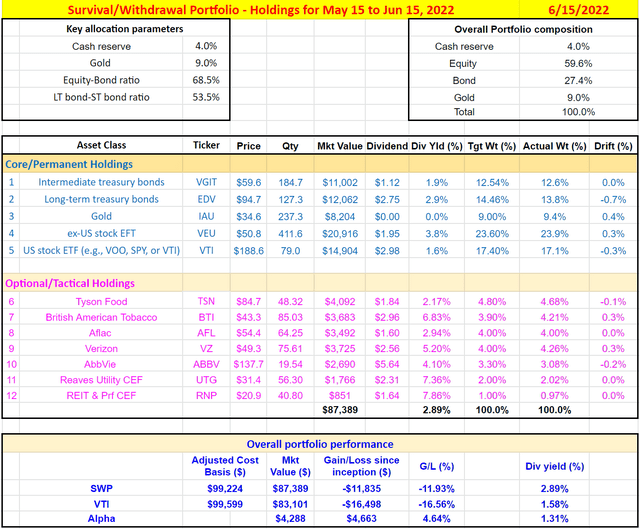

- We performed our maintenance on June 15 around 11:30 am Eastern Time (we live in Richmond, Virginia). And all the price information was taken around that time.

- Cash holding. For this month, the exposure index has become more attractive by a good margin compared to the last month because both bonds and equity have become cheaper. 10-year treasury rose from 3.0% to 3.4%, and the overall equity market lost more than 6%. However, we are keeping our cash reserve at 4%... because we ran out of dry powder last month already. Our own guideline of holding 6 months of living expenses when combining cash, dividends from the SWP, and VGIT. And the current 4% cash reserve is close to this guideline now. So, we are sticking to our own rule, and keeping our cash reserve maintained at 4%. We urge you to stay disciplined too. It is true that there are many attractive opportunities now. But do not chase these opportunities unless your short-term survival is guaranteed first.

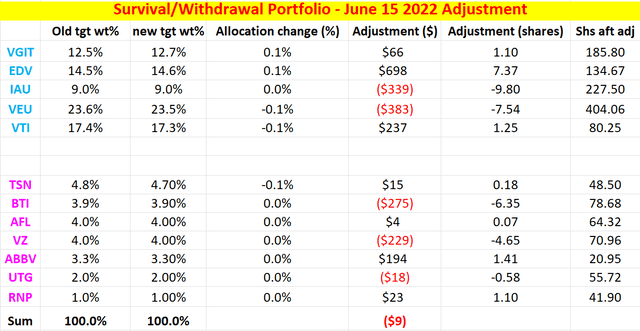

- Adjustment. Overall, the adjustments are relatively minor. We decreased the equity-to-bonds ratio from 68.5% to 68.2%. Bonds have actually become a bit more attractive than equity (but not that much). We sold some gold and our tactical holdings (VEU, BTI, and VZ in particular) to buy bonds and VTI.

- Recession? You have good reasons to be concerned about the possibility of a recession. We are seeing some of the textbook earlier warning signs (yield curve inversion, bellwether stocks reporting profitability pressures, et al). The high inflation and global supply chain issues further compound such possibilities. However, we are not activating our “recession allocation model” yet. As you can already tell, we are still only making gradual adjustments based on our “business-as-usual model”. Our overall thoughts on the recession are provided in our following article if you are interested. We are closing monitoring the parameters and you will be the first to know if we see any meaningful change in the signal.

SPY And Recession: Early Warnings Signs

The remainder of this article is on the mechanics of our maintenance (how we adjust cost basis, et al). We’ve explained these before, and are including them here for easy reference, especially for new members.

Chart 1 – the SWP portfolio before the maintenance

Chart 2 - the portfolio adjustment that we made

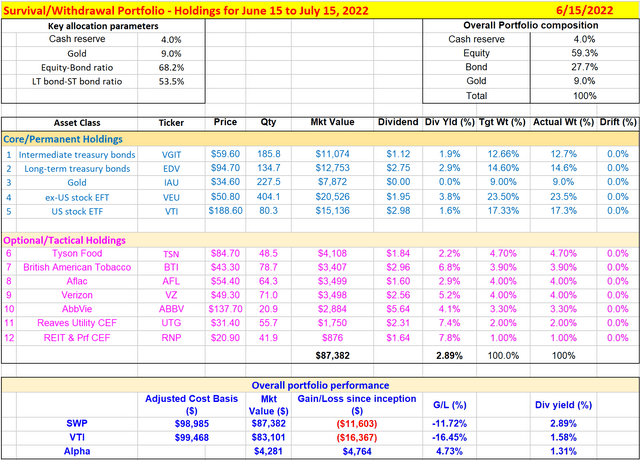

Chart 3 - the portfolio for the incoming month

Mechanics of the Model portfolio and Cost basis adjustment

- For those of you who have been rebalancing your portfolio using a similar calculator as shown in chart 2, you know that a final check is always to see whether all the adjustments dollar amounts add up to 0. Because your money has to be conserved. And in this case, the adjustment amounts added up to a small amount due to rounding off errors (buy-sell spread, et al). This is completely negligible and will even out for any sizable portfolio.

- In case you have not noticed, each of our model portfolios have THREE tabs. The first tab shows the portfolio itself, the second tab shows the return tracking since February 1st (the launching date of our service), and finally, the third tab shows the performance of the portfolio since May 2021 (when we started writing and publishing our portfolio strategy on seeking alpha).

- You do not have to exactly match our allocations to the second digits. We do not do that ourselves. We set a minimum $ amount threshold and only execute adjustments above that amount. These small issues even out in the long run and won’t hurt your performance.

- Cost basis adjustment. We adjust the cost basis due to dividends on a monthly basis (i.e., every time we maintain our portfolio) – regardless of whether the dividends are actually paid or not. We adjust them by the amount ACCRUED. For example, if our SWP had an average dividend yield of 2.4% in the past month, then this month we will adjust the cost basis by 1/12 of 2.4% (i.e., 0.2%) because we have been holding the portfolio for a month and so we’ve accrued 1/12 of the potential dividends. This is mostly for the sake of bookkeeping simplicity – so we do not have to keep track of the dividend dates of all the securities. At the same time, it also makes good sense for a few reasons:

1. We do not do automatic DIRP. We collect our dividends and reinvest them manually or spend them.

2. We are long-term holders to that the dividends can indeed be understood as accrued income even if we have not received them yet. Every additional day that we hold onto our securities, more income has been accumulated and our next payday also becomes closer.

3. Lastly, when you hold a dozen or so holdings (like our SWP) that pay regular dividends, you pretty much constantly receive dividend payments every month (or even multiple payments every month), which again makes the monthly adjustment a sensible idea.