Oil price has returned to $40 level after touched a multiple-year low in middle of February. Although it is difficult to predict if the upwards trend is sustainable this year, I expect the oil price will be back to $60 level by end of 2017 for the following reasons:

- The current oil price is far below the full-cycle cost for most of the oil producers especially the shale oil companies in US. Thanks to the existing production hedge and requirements of creditors, the shale oil production did not drop too much so far. However, most of the companies greatly reduce the capital budget in 2015 and even more in 2016. The number of oil rigs operating in U.S. oil fields fell sharply to reach a multi-decade low to 443, 55% drop from one year ago. This will greatly reduce the oil and gas production in the future when the current developed reservation is depleted.

- Saudi Arab is going to sell Aramco to diversify away from oil. The IPO is planned at end of 2017 or early 2018. This IPO size is in trillion dollars which is critical to solve the current fiscal deficit of Saudi Arab. In order to sell the shares at good price, the sentiment of oil investment needs to be greatly improved which requires much higher oil price next year. So Saudi's strategy is likely to change to boost oil price to ensure the success of IPO.

However, oil price in the future can be affected by other unexpected factors such as the economy slow down or new supply from Iran. So this investment is a kind of speculative, which requires the following criteria to select the potential investment candidate:

- The current price has not picked up with the recent price rebound yet;

- It has high leverage to the upside of oil price with limited loss;

- Near term oil price fluctuation has less impact on the business;

- There is some good hedge instrument in the market.

After some research with the above criteria, I found the unsecured senior bond of Breitburn was the ideal candidate. Breitburn has two senior unsecured bond outstanding as shown the following table:

Although the 2022 bond has better liquidity, the 2020 bond offers better yield with similar risk. As shown in the following chart, the bond price went down along the oil price but did not bound back with the oil price rally. The recent low price is mainly to the delay of the redetermination of the credit line. The current credit line is $1.8 billion with $1.23 billion outstanding usage. The lender seemed not accept the voluntary reduction of $0.4 billion offered by Breitburn and postponed the final decision till early May to wait for the result of the Russia/OPEC meeting on April 17th. The current price implies a substantial credit line reduction which may force Breitburn to default or debt restructuring immediately.

However, I think the credit lender is unlikely to force Breitburn to default for the following reasons:

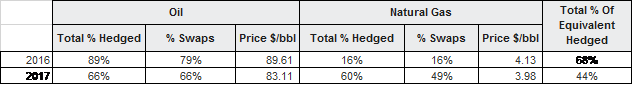

- Breitburn has hedged out 68% and 44% of equivalent production for 2016 and 2017 respectively, which ensures positive cashflow till 2017. The current value of hedge is around $720 million at today's oil price of $40. Moreover, the hedge instruments are mainly swaps which are even more valuable for even lower oil price.

- Bank is reluctant to hold the oil assets in the current market condition since it is very time consuming to sell it at a fair price. Bank may leave reasonable credit line to Breitburn and wait for the oil price recovery next year. Recently some similar company like WPX got good credit line adjustment.

If any meaningful oil production freezing or reduction is reached at the Russia/OPEC meeting, Breitburn should get a reasonable credit line to survive at least for another one year with the valuable hedge. The bond price is easily to jump back to $20 to $30 range and pay the accrued coupon $4.31. This will lead to a 2 to 3 times profit. If oil price goes back $60 level in 2017, the bond price may jump above at least $50 with $8.625 paid coupon.

For conservative investor who does not want to lose the $11 if Breitburn goes default, there is an ideal hedge instrument in the market with limited cost and liquidity. It is the preferred A share of Breitburn(BBEPP) which is closed at $5.79 on April 10th. We can short 200 shares of BBEPP for every 10 bonds. As shown in the following table, the carry is positive even with a 40% fee to borrow the preferred shares. Similar to the bond, BBEPP has a par value at $25. So if both bond and BBEPP reach their par value, the value of the portfolio is $10000-200*$25=$5000. If bond defaults, given its seniority is higher than preferred share, at least $158 is left assuming zero recovery of bond. So it is win-win case. Of course, this strategy is upon your broker which can lend the BBEPP shares at reasonable borrow fee.

In summary, it is a good speculative bet on recovery of oil price in 2017 with the 2020 senior unsecured bond of Breitburn. Investors can hedge their investment of bond with the preferred A share if they can borrow the share at reasonable cost.