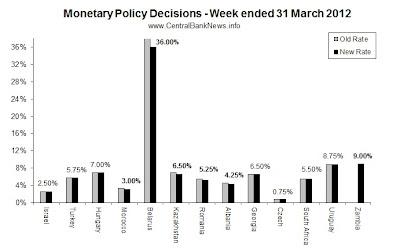

The past week in monetary policy saw 5 banks announcing reductions to their official interest rates: Morocco -25bps to 3.00%, Belarus -200bps to 36.00%, Romania -25bps to 5.25%, Albania -25bps to 4.25%, and Kazakhstan -50bps to 6.50%. The Bank of Zambia also announced its new benchmark interest rate would be set at 9.00%. Those that held monetary policy settings unchanged were: Israel 2.50%, Turkey 5.75%, Hungary 7.00%, Georgia 6.50%, the Czech Republic 0.75%, South Africa 5.50%, and Uruguay 8.75%.

Looking at the central bank calendar, the week ahead sees the central banks of Uganda, Australia, Kenya, Poland, the EU, and UK meeting to review monetary policy settings. The main market moving banks will be the RBA, ECB, and BoE, though none are likely to make any major moves. Elsewhere the US Federal Reserve's FOMC releases its March meeting minutes on Tuesday, and the Swiss National Bank puts out its annual report on Thursday.

| Apr-02 | UGX | Uganda | Bank of Uganda |

| Apr-03 | AUD | Australia | Reserve Bank of Australia |

| Apr-04 | KES | Kenya | Central Bank of Kenya |

| Apr-04 | PLN | Poland | National Bank of Poland |

| Apr-04 | EUR | Eurozone | European Central Bank |

| Apr-05 | GBP | United Kingdom | Bank of England |

Source: www.CentralBankNews.info

Article source: http://www.centralbanknews.info/2012/03/past-week-in-monetary-policy-saw-5.html

IMPORTANT NOTICE: The Central Bank News website is presently for sale, if you are interested please click through for more details.