In the world of hedge funds, it is standard practice to list a ‘volatility target’ within a presentation to potential investors. You never see this listed in any mutual fund or investment advisor type of presentation. The reason for this is that hedge fund presentations are geared to a different kind of investor. Nevertheless, whether it’s in the presentation or not, it’s a topic that is important to post about as often as possible.

First, volatility is a good way to think about ‘drawdown potential.’ High volatility means that the high to low intermediate moves are likely to be large – and since you can never be quite sure what the future will bring, you should generally avoid the highest volatility ETFs unless you feel especially confident in very high return expectation. The relationship between your general return expectation and the underlying volatility of the ETF is an important one.

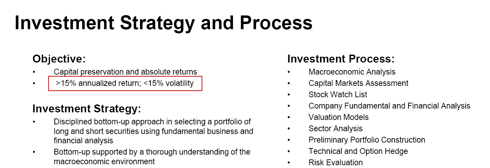

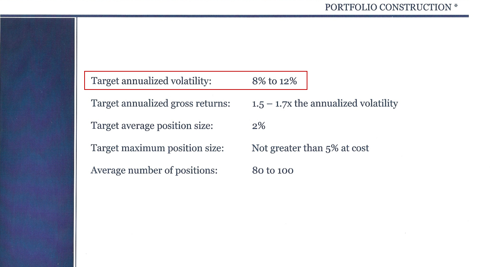

What hedge funds state in their presentations is a ‘volatility range’ to expect – that is, what the hedge fund manager believes their strategy equates to in a bottom-line percentage, always stated as an annual figure. Many presentations then try to target a ratio of returns relative to that volatility figure. Two such examples are listed here:

Target: <15% Volatility with >15% Return

Target: 8-12% Volatility with 1.5x+ Return

Both of the above examples from actual hedge-fund marketing books are stated within the same structure: namely, the Sharpe Ratio. Return and volatility of return are both used as quantitative targets.

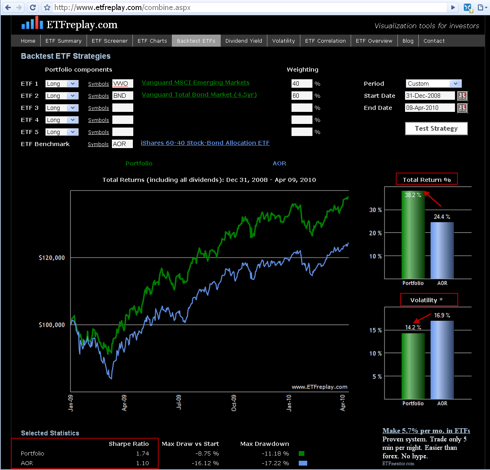

How does this apply to ETF’s? Each ETF has its own same characteristics. Viewing total return and annualized volatility for each ETF is a nice breakdown of the major components of the Sharpe Ratio. Moreover, you can COMBINE ETF's into portfolios that suit your own risk tolerance.

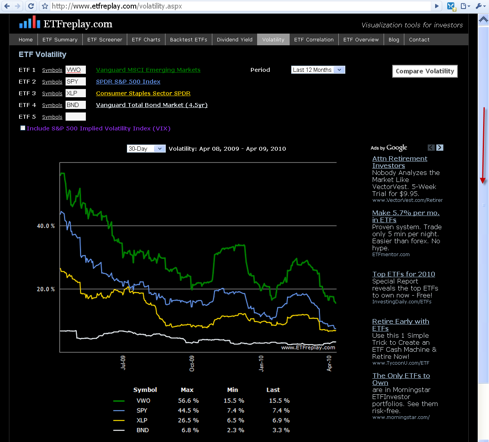

One major issue for all investors is that volatility is not static. Large changes in market volatility complicate the discussion of absolute targets of volatility. But what we can observe from actual experience is that RELATIVE volatility across different types of ETFs have been quite consistent. Below is an example of a few different types of ETFs. You can see that while the LEVEL has swung around significantly, if we were to rank each of these ETF’s – you would see that each ETF has maintained its exact ranking for every period for the last few years. Emerging markets have maintained high relative volatility vs the S&P 500, which has been more volatile than the defensive Consumer Staples Sector SPDR which in turn has been more volatile than the aggregate bond market.

What this says is that the risk of drawdown among these different ETF’s is skewed. We cannot precisely say what kind of risk there is --- but we can think that if we entered a long position in bonds and mis-timed the entry, the punishment for being wrong would not be as great as if we did the same thing in Emerging Markets.

Summary:

It is professional to think in terms of volatility and risk-adjusted returns. But you do not need to be a ‘long-short’ hedge fund manager to maintain an efficient (risk-adjusted) portfolio. Overall portfolio volatility can be diluted through exposure to shorter-term fixed income. Indeed, rotating between high returning ETF segments (high relative strength) and low-volatility investments is a strategy that generally leads to the same place hedge funds are ultimately targeting: a high Sharpe Ratio.

Note: The Sharpe Ratio measures reward per unit of risk. It is calculated as the annualized average daily excess return divided by the standard deviation of daily excess return.

Disclosure: none