Please Note: Blog posts are not selected, edited or screened by Seeking Alpha editors.

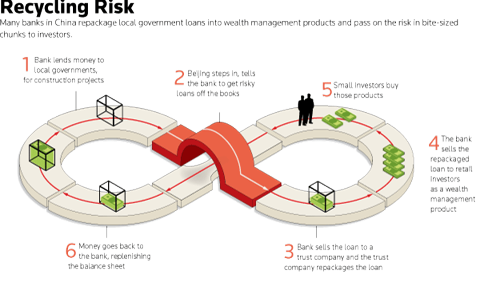

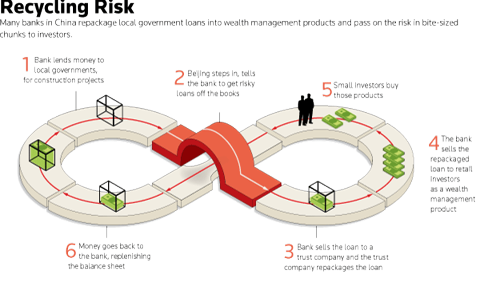

I wrote about shadow banking cracks in China before, so I will keep this entry short.

While Japan (and to a lesser extent the U.S. and Europe) has a giant public debt problem, China has a nasty shadow banking problem that won't go away, expect more bad news in 2014 and beyond on this...

"There is an unresolved self-contradiction in China's current policies: restarting the furnaces also reignites exponential debt growth, which cannot be sustained for much longer than a couple of years."

Source

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.