This recent tweet summed up the events and endless talking head discussion roundtables (grasping for immediate explanations) nicely:

This is where everyone who didn't call for this knows exactly what's going on and why

I would just like to add three points to this tweet summary about the situation in Chinese and other stock markets:

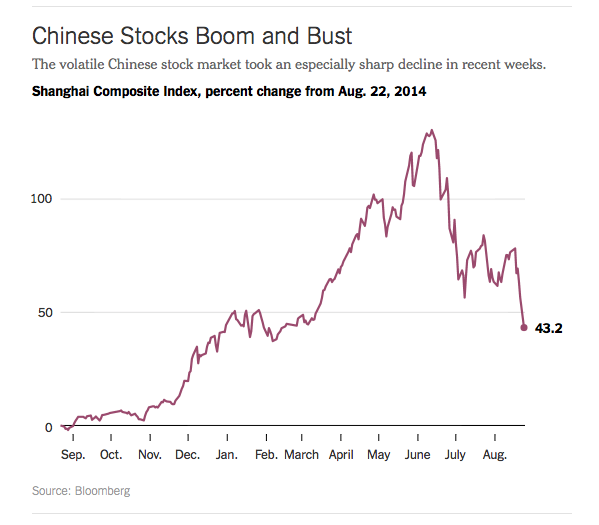

1. This (Friday, August 21 and Monday, August 24) was and is not a (mini-)crash in my opinion, rather a Chinese bubble finally deflating.

The Shanghai Index still is way above its August 2014 levels:

When (almost) everybody was looking at Greece earlier this year, the China stock market bubble was in full swing in April - July 2015. We are only back at January - March 2015 levels at the moment.

2. China devalued the Yuan back on August 11, 2015 already. 14 days is quite a long period for a stock market reaction in the age of algos and HFT. China then kept trying to extend this "one-time" fix with various patches and placatory announcements to calm down domestic investors. It didn't work and the market finally sold off.

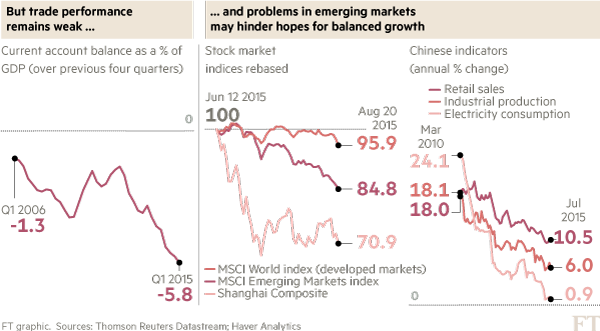

But let's keep in mind that Chinese economic numbers in general have been worsening for quite a while:

:

:

Since China is a big importer and user of commodities, commodity prices have been following the same price trends.

(Trusting the official numbers in China is another thing, I won't go into further details here. The actual numbers may be worse...Exporting numbers from other countries - such as Australia - into China are harder to fake and better canaries in the coal mine).

3. Numerous sources (including myself) have warned about elevated stock market valuations worldwide for 1-2 years. One of the last good articles summing up various risks can be found here:

Doomsday clock for global market crash strikes one minute to midnight as central banks lose control-

China currency devaluation signals endgame leaving equity markets free to collapse under the weight of impossible expectations

Forget about the flashy title, the entire article is well worth reading.

I have written about reasons 7 and 8 (namely 7: "Bull market third longest on record" and 8: "Historically high CAPE number - Shiller's cyclically adjusted price earnings ratio") before in this Instablog.

I also discussed currency wars and artificially low interest rates (ZIRP) as a major theme many times. China is just one the latest major entrants into this dangerous game (following the FED, Japan and the ECB).

Finally, the FED moves (raising rates starting later in 2015) have been known and anticipated for months - if anything, the latest market turmoil may present the FED and other central banks with a good excuse to once again postpone raising rates into 2016 or later.

Some even argued this correction might turn into a QE4 operation soon:

Forget Rate Hikes: Bridgewater Says QE4 Is Next; Warns World Is Approaching End Of Debt Supercycle

We will see. In any case, there have prominent warning signs for months now - but nothing that called for a sell-off on exactly Monday, August 24.

Summary: Anyone who claims to have seen the exact timing of the mini-market crash yesterday with the appetizer on Friday is full of it. The exact same slide could have happened days earlier based on the Yuan devaluation timing and other jitters.

It also makes no sense that volatile, high-beta stocks with little to no exposure to China were taken down 10 to 20% within two days.

Most stock markets worldwide have been richly valued or overvalued for 1-2 years already. Market participants are looking for short-term excuses and reasons in any sell-off when the writing is on the wall...continue to watch central bank actions, forex and commodity prices closely to get a gauge where the markets are headed over the next months.