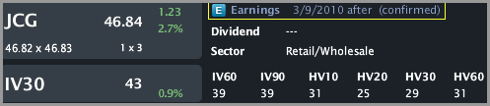

ANN is trading 18.60 with IV30TM up 5%. JCG is trading 46.84. Note that they both have earnings coming this week. The LIVEVOLTM Pro Summaries are below.

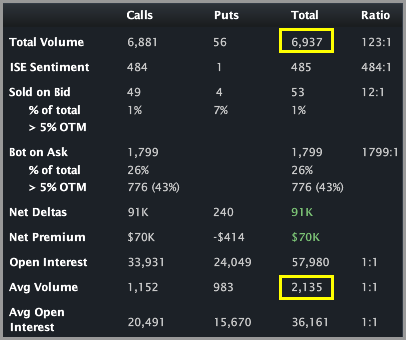

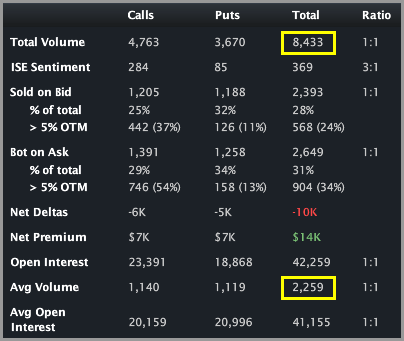

ANN has traded ~7,000 options today on total daily average option volume of 2,135 with March call purchases the largest trades. JCG has traded ~8,500 options today on total daily average option volume of 2,259 with March put sales the largest trades. The Stats Tab and Day's biggest trades snapshots are included (click either image to enlarge).

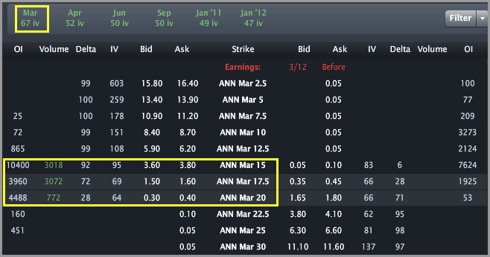

The Options Tab for ANN (click to enlarge) illustrates that the calls have traded less than OI. A little digging has convinced me that the Mar 15, 17.5 and 20 calls are the same side as the OI (they are opening). Also, the Mar 20 calls OI has jumped from ~200 to ~5000 in less than a week. You can also see that Mar vol is the highest of all months with earnings (a vol event).

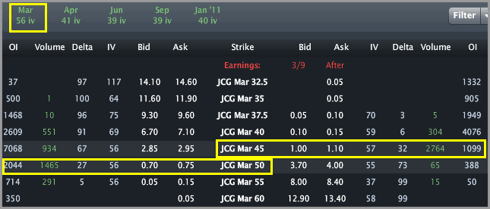

The Options Tab for JCG (click to enlarge) illustrates that the Mar 45 put sales are at least mostly opening (volume > OI). Like ANN, you can also see that Mar vol is the highest of all months with earnings (a vol event).

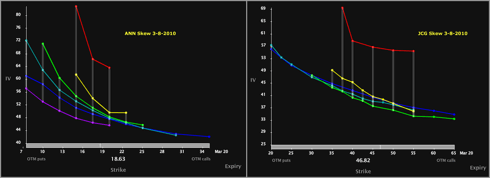

The Skew Charts for each are provided (click to enlarge). Note the similar shapes and in particular how high the front month vol is relative to the back months.

Skew Legend:

Red - Front month

Yellow - Second month

Green - Third month

Blue - Fourth month

Finally, the Charts Tab (6 months) for each is included (click to enlarge). The bottom portion is the vol - IV30TM (red line) vs. HV20TM (blue line). The yellow shaded area at the very bottom is the IV30TM vs. the HV20TM vol difference.

Note the similarities - recent stock run ups with short term vol well above HV20TM.

Conclusion:

The order flow is heavy in both relative to average and is getting long deltas. JCG trades are selling the high vol, ANN trades are getting long the vol. Based on the earnings vol levels and the bullish sentiment, I probably like JCG approach (selling the vol to get long) rather than ANN.

This is trade analysis, not a recommendation.

Disclosure: No positions