Over the past decade or so, equities have been mired in a vicious bear market. The extent of this bear is not so apparent in nominal terms. After all, major indexes eclipsed their 2000 highs prior to the 2008 liquidation. However, in terms of gold, stocks have suffered a series of crashes, none of which have been recovered:

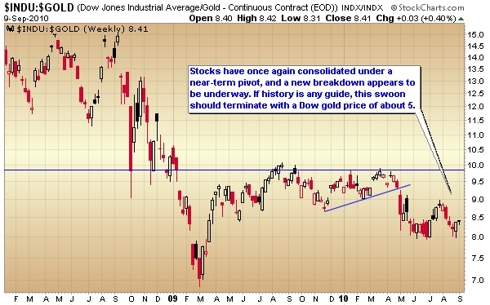

At the 2009 low, stocks had lost 85% of their real-money value in less than a decade... and the wealth destruction does not appear to be quite finished:

The fifth crash of the secular bear market in stocks appears to be underway. Typically, these periods do not finish until the Dow reaches parity with gold, so traders can expect two more crashes over the next several years before this process completes.

Amazingly, the masses continue to wish stocks higher... not wanting to admit their mistakes... while ignoring the sector that can actually return their money. Somehow I suspect they will catch on right about the time the Dow and gold approach parity. At that point, I'll be happy to trade my gold for their equities.

Disclosure: Long precious metals

Stocks Keep Crashing

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.