Today's pick is TATAMOTORS (TTM). The stock began 2012 with an uptrend that took it all the way to its 52-week high of Rs. 320 in April. This was then followed by a correction to Rs. 200 levels which was seen in August. The stock has since been on an up-trend and looks poised to test Rs. 320 levels again. In the last three months, the stock has moved +15% vs. +5% of the Nifty's.

Oscillators RSI and CMO are flashing a bright red over-bought signal. Also, the stock is trading close to the upper Bollinger band which is short-term bearish.

The MACD line that just started moving down towards the signal line, along with the fall in histogram levels, is suggesting an imminent bearish move. However, long-term and short-term GMMA lines are experiencing an expansion giving out a bullish signal for the scrip.

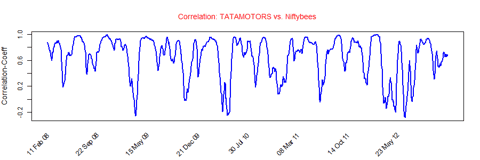

TATAMOTORS's average correlation with the Nifty is 0.64 is positive and strong. The scrip will be replicating the movement of Nifty.

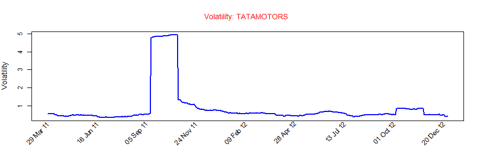

TATAMOTORS has a historical volatility in the range of 1 to 5. The scrip's volatility currently is in the lower end of the range. The high volatility could be attributed to the face value split from Rs. 10 to Rs. 2 last year (September 2011.)

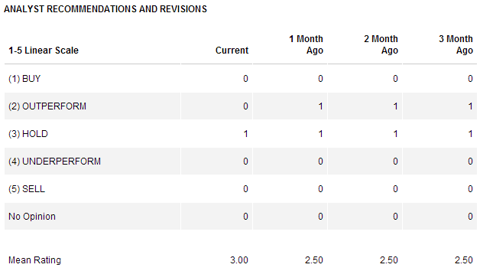

Analysts have mixed expectations with the scrip. Better than expected earnings for the current quarter can help bring some consensus to the table.

Dividend investors should also have a look at the DVR (Differential Voting Rights) version of the stock: TATAMTRDVR that is trading at almost half the valuation of the regular equity version.

To conclude, given these technicals, the stock is a short-term SELL. For the long-term we suggest a HOLD because of the strong underlying trend with a keen eye around Rs. 320 levels.

The article first appeared on Your Money@stockviz.biz.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.