Today's pick is TATACOMM [stockquote]TATACOMM[/stockquote]. The stock has been range-bound between Rs. 220 and Rs. 260 for most part of the year. There is a secondary support at Rs. 200 levels. The stock is again headed towards the lower end of the range. In the last three months, the stock has moved -4.1% vs. a flat Nifty.

Oscillator RSI and CMO are in no man's land. The stock is trading in the middle of Bollinger band not giving any short-term directional bias. Short-term technicals saw a 9x18 bullish cross-over.

The MACD line and signal line are moving very close to each other without giving any directional bias. Also, Long-term and short-term GMMA lines can be seen contracting, unable to give any direction to the stock.

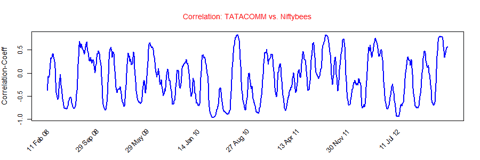

TATACOMM's average correlation with the Nifty is -0.11 which is negative. The scrip will not be replicating movement of Nifty.

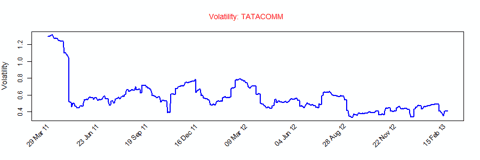

TATACOMM has a historical volatility in the range of 0.4 to 1.2. The scrip's volatility is currently in the lower end of the range.

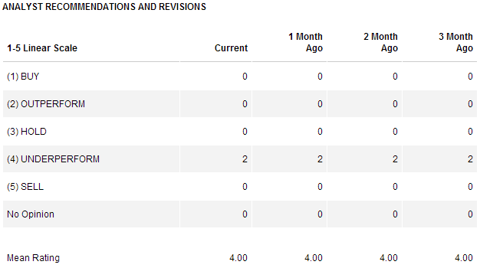

Analysts continue to have an underperform rating for the stock.

Given these technicals, we suggest a short-term hold. For the long-term a call can be taken once this Rs. 220 - Rs. 260 range is broken in either direction. However trailing stop-losses will be of help in case sudden trend-reversal were to take place.

The article first appeared on Your Money@StockViz.biz.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.