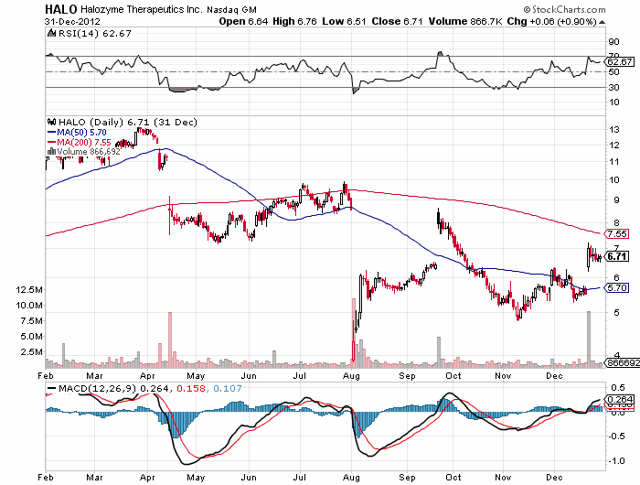

The above daily chart of Halozyme Therapeutics Inc. (HALO) shows how in April 2012 there was a gap down selloff from above $12 to the $8 area. Without trading under $7, the stock eventually traded back to just under $10. Then on August 1, 2012, the stock closed at $8.56, only to open just below $4 the next day and close off the lows of the day. This is similar to the action we had on Friday with HALO hitting the extreme low around the opening and then rallying back a bit for the remainder of the day. In August 2012 the stock would rally back to $6 on the 4th trading day of the smackdown. From there it fell back to the mid $5s and then eventually had good news in September 2012, that caused HALO to hit a high of $8.65 and recover the full loss. I would not be surprised to see a similar pattern now, as what occurred in August and September of 2012.

Friday Is A Great Example Of Why One Must Diversify

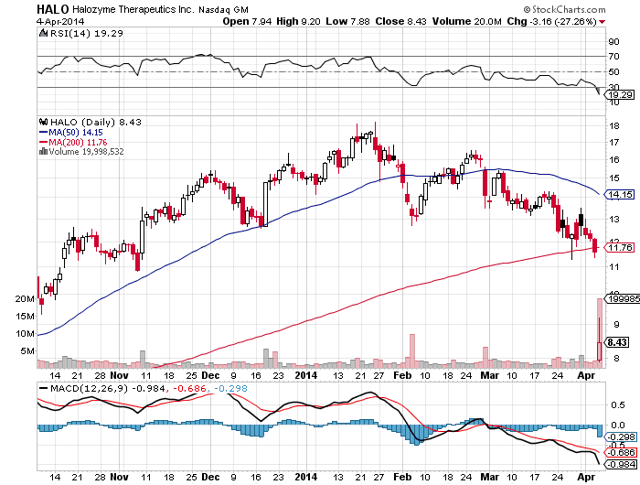

If one was fully invested in HALO, at the low on Friday, one would be down $32%, see above chart. However, if one was only 1/3 invested in HALO, it would only knock your trading account down at a much more manageable 10%. I have HALO in all three of my trading accounts but fortunately I am diversified into several positions so one surprise negative announcement is disappointing but not devastating. If you were too concentrated in this stock, remember this lesson and learn from this experience. In the future stay diversified, especially when playing biotechs that are in the early development stage and have yet to turn a profit. Fortunately the halt in the trial of PEGPH20 is temporary, as pointed out by a couple Motley Fool articles and not yet permanent. With the possibility of the concerns being cleared up in the future, which would cause a tremendous snapback rally, the uncertainty should keep the bears from pushing further to the downside for now. Just like in August 2012, the above chart shows that on Friday, HALO found support at just below $8 and was able to rally back to $9.20 before closing at $8.43. I would anticipate that HALO continues to try to rally closer to $10 and probably hitting somewhere around $9.65 to $9.75 in the next couple days, before falling back towards the $8 support level. If the bottom holds between $8 and $8.50, then HALO might be able to then rally back to $10. If one had bought the stock around $8 on the opening on Friday, one could have made back over $1.00/share and then unloaded their entire position and then bought back in on the rally back towards $8.02 before closing in the mid $8s. Friday had over 3 nice premarket rallies and several more regular trading session rallies that were quite tradable.

This coming week, I will be buying HALO around $8 to $8.50 and lower while selling in the $9 to $9.50 and higher range for now. I will do this to help reposition myself so that it does not require a return to $12 to break even. For anyone who is not invested in HALO, it would appear that HALO would be an excellent scalping vehicle as bargain hunters will be picking up shares on dips, and short-covering rallies should be plentiful to take profits. In the past, I have done fine when I got hurt by a surprise negative announcement such as what occurred Friday in HALO. It just required patience and active management of the position.

One must simply be smart about managing their position. For instance, since more negative news could come out, all added shares should be liquidated and not held overnight. On rallies of $1 to $2 off the lows, it is prudent to sell out of at least half of one's position at a loss, to raise cash to buy back on dips without increasing the level of risk by increasing the number of shares owned. Friday offered a half dozen rallies to sell into, and dips to buy into, that could greatly reduce the average price of ones shares of HALO. I expect for that pattern to continue next week.

If the company overcomes this setback, it could be trading back at $12 as soon as 6 weeks. If not, it should still remain in a $2 to $3 trading range which should offer numerous trading opportunities. If $8 gives way as support, $7.50, $7, $6.50 and $6 should all offer support to bounce a couple dollars off the lows. Since I am caught in the stock, I will continue to trade it while exercising caution. I like the stock better now at $8 than I did at $12 or at the recent high of $18.18. It would appear that the bad news should be pretty well factored in at this point in time, and the stock should be working its way up, off its lows. However, it will probably remain in a $2 to $2.50 trading range for the immediate future until there is more clarity on the future of PEGPH20.

Disclaimer:

The thoughts and opinions in this article, along with all stock talk posts made by Robert Edwards, are my own. I am merely giving my interpretation of market moves as I see them. I am sharing what I am doing in my own trading. Sometimes I am correct, while other times I am wrong. They are not trading recommendations, but just another opinion that one may consider as one does their own due diligence.

Disclosure: I am long HALO.