I had posted this article on 2/3/15 and then accidently deleted it. I am reposting it now so it does not get lost.

Today on Stocktalk, I was asked about my opinion about the current rally in crude oil. I stated that I felt there was significant resistance at $55 and if that price is reached, it could easily roll over. Looks like I have some company in regards to my prognosis. Bernard Stegmueller Jr of Fusion Trading Zone just published a short article, click here, where he is calling for a short in Crude Oil at $55 or higher. Instead of outright shorting the crude oil futures market, he is suggesting selling an out of the money $60 strike call, or putting on a bear put spread.

The reasons that crude oil is not likely to have bottomed, are many. First of all, you have the bullish momentum in the US Dollar that is not likely to top and roll over without a fight. Also the fundamentals remain quite bearish with a 3.7 million barrel increase in inventories expected when oil inventories are announced at 10:30 a.m. EST on Wednesday, February 4, 2015, click here.

The real reason for the current rally is due to the fact that funds got extremely short the market during January and we were overdue to see a quick and sharp short-covering rally, click here.

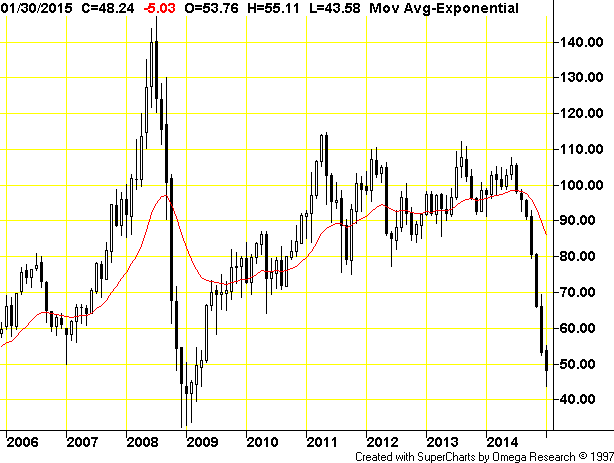

If we just bottomed in Crude Oil, then we will have seen a very sharp "V" bottom. That is not how markets typically bottom. To see what usually happens, take a look at the following monthly chart of crude oil going back several years to 2008:

Back in December 2008, when crude oil bottomed at $32.40, it rebounced to $50.47 in January 2009, only to retest the low at $32.70, but closing out the month at $41.68. In early February 2009, crude oil again retested the bottom, hitting a low of $33.55 before reversing and trading above $45 and finally bottoming for good. The bottoming process took at least a couple months, and I expect that in 2015 crude oil will again take at least two months to bottom out as well, based on the fact we have had a very long and protracted selloff. Thus, the first rally off the bottom should be played from the short side, if at all. No one should get bullish on crude oil unless we retest the bottom and the support holds. If we hold on the retest then maybe then a small long position is justified. However, if the support gives way, which it is apt to do, the short side is still the way to play crude oil.

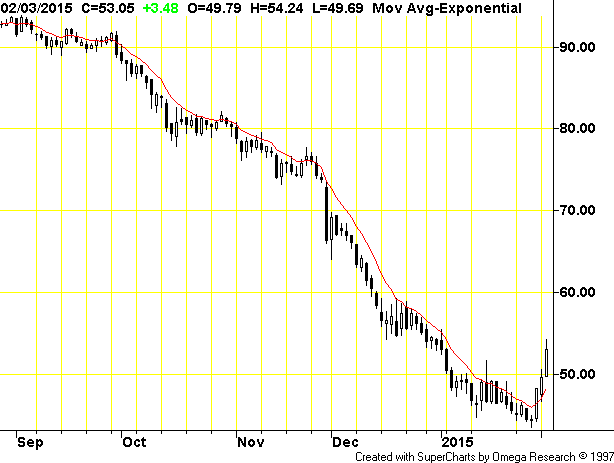

When gold or gold mining stocks bottom, they tend to have similar short-covering rallies lasting a few days, and then tend to make minor new lows. It usually takes 3, 4 or 5 attempts to bottom before the turn is successfully made. We can now take a look at the daily chart of March crude oil:

In three days, crude oil has rallied 20% off the bottom, from a low of $43.58 last Thursday, to today's high of $54.24. Pretty impressive move indeed! What it tells me is that crude oil wants to bottom, and should put in a meaningful bottom between now and early April 2015. Crude oil rallied today to a price level not seen in a month. However, if $55 does not stop the rally, there is significant resistance at $59. In the 3rd week of December 2014, after bouncing off support at $54.33, crude oil tried for several days to get back over $60 and failed. I expect to see a similar failure now if crude oil does get back in the $58s or $59s. More likely it stops somewhere between $55 & $57.50 and then quickly falls back towards $50 or below. If on Wednesday the announced inventory increase of crude oil stocks is greater than expected, this rally could be stopped dead in its tracks. As impressive as crude oil has bounced in the last 3 days, it will be much harder to move above $55 and especially $60, in the immediate future.

This time could be different. We could of course get a very rare "V" bottom and the bottom could already be in for the year. But even if true (which I don't believe), odds favor at least one retest of the lows if not 2 or 3, before one can really call for a bottom!

Disclaimer:

The thoughts and opinions in this article, along with all Stocktalk posts made by Robert Edwards, are my own. I am merely giving my interpretation of market moves as I see them. I am sharing what I am doing in my own trading. Sometimes I am correct, while other times I am wrong. They are not trading recommendations, but just another opinion that one may consider as one does their own due diligence.