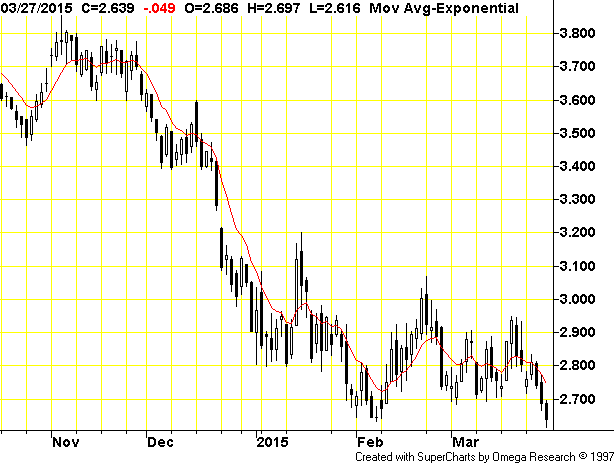

Natural Gas

In my last article, click here, I was looking for a short-term top in natural gas around March 19th and it came in on March 18th and then began falling hard on March 19th and has continued to slowly weaken as time goes on. I had previously looked for an April bottom in natural gas and found an article by Main Street Trading that agreed with my analysis, but added the March 19th top to the scenario. Well, Main Street Trading has now posted an article giving there latest thoughts found here. In the article, Main Street Trading first covers Crude Oil and then gives their latest thoughts on Natural Gas. They indicate that unless natural gas can move back above the March 18th high of $2.949, then it will continue to weaken and the bottom is not in. Here is a daily chart of May Natural Gas:

On Friday May Natural Gas finally took out the February low by a couple cents. This projects a move to lower levels. However, just as natural gas tried to bottom in January around the $2.80 level and finally fell to the mid $2.60s before finding support (a drop of 15 cents), May Natural Gas could now drop a similar amount and find support at $2.50. Into that support area I plan to be slowly buying some futures contracts but will buy the June contract to that I have plenty of time to allow natural gas to find its Spring bottom. When I get some indication that we have reached a temporary bottom, which I project should come in around $2.50, I will likely buy some shares in the triple leveraged natural gas ETN (UGAZ).

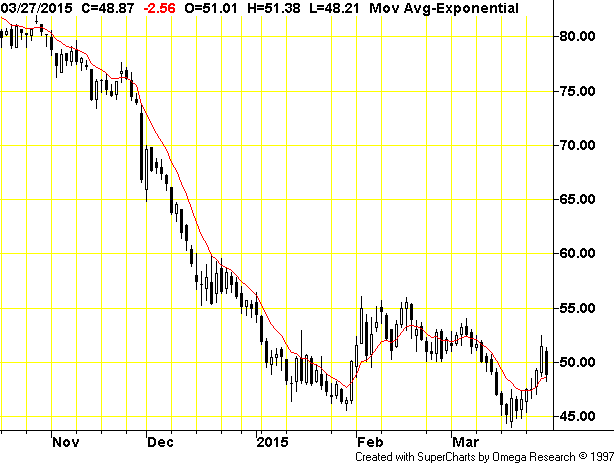

Crude Oil

In my last article, I also called for a temporary bottom in crude oil, which I was lucky enough to hit right on the money. Crude Oil has since rallied an impressive $8 off the bottom, however, it is has significant resistance at the 55 day moving average of $52.25 as indicated in the Main Street Trading article, and again at $55. Here is a look at the daily chart of May Crude Oil:

On Friday, there was significant profit-taking on the recent May Crude Oil longs and also traders who had covered their short positions decided to get short again above $50. However, I prefer scalping from the long side of Crude Oil right now and prefer buying the energy ETFs on further weakness. I anticipate $47 in May Crude should now provide significant support and will look to begin buying some futures contracts in that area. I will gradually scale in my buys. For those who don't trade futures, the energy ETFs should provide excellent value on any further weakness. I agree with Main Street Trading that one needs to buy into the current dip. I expect to be buying some May Crude by Tuesday.

Disclaimer:

The thoughts and opinions in this article, along with all Stocktalk posts made by Robert Edwards, are my own. I am merely giving my interpretation of market moves as I see them. I am sharing what I am doing in my own trading. Sometimes I am correct, while other times I am wrong. They are not trading recommendations, but just another opinion that one may consider as one does their own due diligence.