The Setup

I have always been quite impressed with articles that I read from Main Street Trading as they almost always align with the way I see the markets. However when they wrote Friday's Natural Gas article, click here, they really outdid themselves. I judge the article as the best written, most insightful article I have seen in a long time. Before continuing, please stop now and read the article.

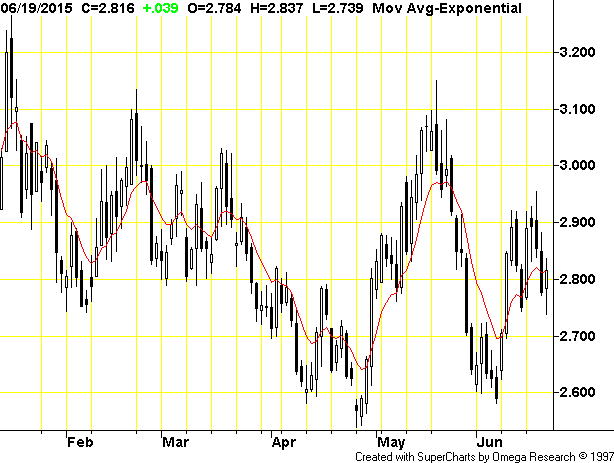

In 2009, 2012 and 2015, natural gas bottomed in April, and then rallied. In all three years the bottom was retested and was followed by another rally. We have completed 3 weeks of the second rally and are now approaching the critical 4th and 5th weeks of this second rally off the lows. To see where we are, take a look at the daily chart of July Natural Gas:

On Friday, July Natural Gas broke below the low scored on the previous Friday, by just 4 ticks, and then reversed to close strongly, back above $2.800. This sets us up for a further rally this coming week, to continue the patterns of 2009 and 2012. However, the following week, week 5, there was a divergence, as pointed out by Main Street Trading. In 2012, we kept rallying but in 2009 we rolled over and eventually made a new low of the year.

My Best Guess

My best estimate right now, is that we roll over and make a new low for the year, similar to 2009. In 2012, natural gas traded above the March high in both weeks 3 and in weeks 4. In 2009, like 2015, we failed to take out the March high in week 3, just completed, missing the high by 19 1/2 cents. If we fail to trade above $3.15 this coming week, which is quite doubtful since it would require a rally of over 34 cents, then we are more aligned to the 2009 pattern and could move lower and make a new yearly low in August and September. I suspect that natural gas may struggle to trade above the high made this past week at $2.955 and likely will stop short of $3.00 as well as the critical $3.15 point.

Summary:

In my last natural gas article, click here, I cautioned about a bearish hanging man pattern which ultimately was confirmed. I warned traders to take profits and most did. However, on the late week dip, traders have since aggressively accumulated shares in UGAZ again. With Friday's reversal, that strategy looks quite promising for next week. However, be prepared to completely liquidate all UGAZ shares on further strength, especially if we cannot take out the March high of $3.15. If we fail on the retest of the highs this coming week, it will be time to stop trading UGAZ and move into DGAZ. You won't want to favor UGAZ again unless we fall back towards the April lows. Again, this coming week could be your last best chance to sell your UGAZ shares at a nice profit. You have been warned!

Disclaimer:

The thoughts and opinions in this article, along with all STOCKTALK posts made by Robert Edwards, are my own. I am merely giving my interpretation of market moves as I see them. I am sharing what I am doing in my own trading. Sometimes I am correct, while other times I am wrong. They are not trading recommendations, but just another opinion that one may consider as one does their own due diligence.