IBM (IBM) is a story of a company that is "doing more with less". They are shedding low-profit hardware (thus Revenue suffers) to focus on the higher margin consulting business (thus the increasing margins you have noticed). The investor ends up with more cash (Buffett's 'Owner Earnings').

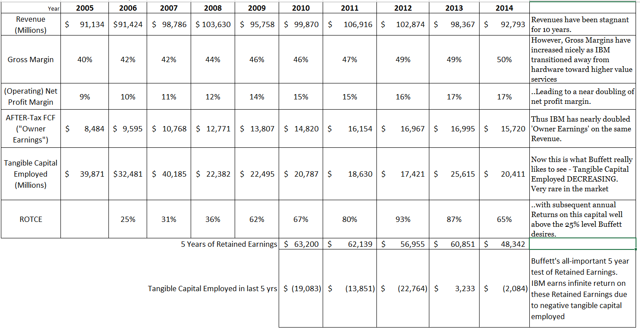

One Chart..IBM revenues have been stagnant for 10 years. However, Gross Margins have increased nicely as IBM transitioned away from hardware toward higher value services. This has lead to a near doubling of net profit margin. Likewise, IBM has nearly doubled 'Owner Earnings' on the same revenue. IBM also has something Buffett really likes to see - Tangible Capital Employed DECREASING. Very rare in the market. Subsequent annual returns on this capital are well above the 25% level Buffett desires. And in Buffett's all-important 5 year test of Retained Earnings, IBM earns infinite return on these retained earnings due to tangible capital employed decreasing over time.

One Video..In the CNBC interview below, from May 2015, Buffett gives away a key metric. Just watch the last 30 seconds, where you'll hear him say:

One of the interesting things about IBM - and its true about other tech companies - IBM earns infinite returns on tangible common equity. ….These are very good businesses. ….There is no net tangible investment.

Link to Video:

The Equity-Coupon..

I estimate normalized earnings at $19.69 per share. At current prices IBM is offering nearly 15% pre-tax on your money. You won't find that return on many stocks in today's market.