The Truth About Taxes and Why You Have to Verified Everything a Politician Says

(originally published ![]() Friday, March 27, 2009)

Friday, March 27, 2009)

Here is a quote from President Obama's town hall speech at the Orange County Fair and Event Center in Costa Mesa, California (March 2009):

"…Let's talk tax policy for a second, because, again, some on the other side have said, oh, Obama, he's a tax-and-spend Democrat - tax and spend. Well, it turns out, yes. You know, what I've said is we should return to the tax rates that we had under Bill Clinton, which means - which means this: which means that for people who are making more than $250,000 a year, they would pay instead of 36 percent, they'd pay 39 percent. Like, a 3 percent increase on their tax rate."-President Barack H. Obama

So President Obama had a little mathematical error in this speech. He said that raising the taxes on the rich from 36% to 39% is only a 3% increase. Actually, it is an 8.3% increase (please see math example at the end of this article for more clarity). This has always rubbed me the wrong way and politicians do it all the time. During the campaign, President Obama made several mentions of the Bush tax cuts only benefiting the rich. Let's look at some numbers and see who got what tax cuts.

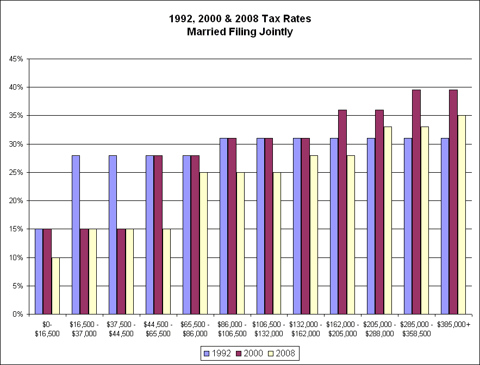

All numbers are for a married couple filing jointly.

Starting with 1992-2000 with President Clinton.

Q: Whom did President Clinton cut taxes for?

A: If we look at only married couples filing jointly, he cut taxes for couples making between $16,500 and $44,500 (under $16,500 DID NOT get a tax cut).

Q: Whom did President Clinton raise taxes on?

A: Couples making $162,000 or more.

Percentage increases/(decreases):

$0 - $16,500:……………………………….0% [stays at 15%]

$16,500 - $37,000:……………………….(46.4%) [28% to 15%]

$37,000 - $44,500:……………………….(46.4%) [28% to 15%]

$44,500 - $65,500:……………………….0% [stays at 28%]

$65,500 - $86,000:……………………….0% [stays at 28%]

$86,000 - $106,500:……………………..0% [stays at 31%]

$106,500 - $132,000:……………………0% [stays at 31%]

$132,000 - $162,000:……………………0% [stays at 31%]

$162,000 - $205,000:……………………16.1% [31% to 36%]

$205,000 - $288,000:……………………16.1% [31% to 36%]

$288,000 - $358,500:……………………27.4% [31% to 39.5%] {Oops, President Obama forgot the 0.5%}

$385,000+:………………………………….27.4% [31% to 39.5%]

2000 - 2008 with President Bush.

Q: Whom did President Bush cut taxes for?

A: Everyone except couples making between $16,500 and $44,500.

Q: Whom did President Bush raise taxes on?

A: No one.

$0 - $16,500:……………………………….(33%) [15% to 10%]

$16,500 - $37,000:……………………….0% [stays at 15%]

$37,000 - $44,500:……………………….0% [stays at 15%]

$44,500 - $65,500:……………………….(46.4%) [28% to 15%]

$65,500 - $86,000:……………………….(10.7%) [28% to 25%]

$86,000 - $106,500:……………………..(19.4%) [31% to 25%]

$106,500 - $132,000:……………………(19.4%) [31% to 25%]

$132,000 - $162,000:……………………(9.7%) [31% to 28%]

$162,000 - $205,000:……………………(22.2%) [36% to 28%]

$205,000 - $288,000:……………………(8.3%) [36% to 33%] {Oops, married couples making $250k are at 33%, not 36%.}

$288,000 - $358,500:……………………(16.5%) [39.5% to 33%] $385,000+:………………………………….(11.4%) [39.5% to 35%]

What did we learn?

1.President Obama is misleading the public with his current stump speech on taxes, which is a shame. I find it hard to believe he does not know what the current rate actually is or what the real rate was under President Clinton. Also, I am pretty sure President Obama knows how to use percentages, so it is disheartening to see him misrepresent the actual percentages.

2.If President Obama changes the tax rate for married couples making over $250,000 back to the rate during the 1990's (39.5% since $250,000 is not the start or end of an actual tax bracket currently), then the rate would change from 33% to 39.5%, a 19.7% increase.

3.Even after President Bush cut the taxes on the rich, his tax rates were still higher than the tax rate when President Clinton took office in 1992, so the tax cut was not that deep.

4. Under President Clinton, if you had two teachers making $45,000 each, they did not get any tax cuts. Under President Bush, they got a 24% tax cut.

5.Just about everyone got tax cuts under President Bush. Couples making less than $16,500 were essentially removed from the tax rolls (after standard deductions, their taxes essentially go to zero percent).

6.Under President Bush, the 4 largest percent tax cuts were all under $205,000.

Math Example

Let's use the raise in the tax rate from 33% to 39.5% as an example. Going from 33% to 39.5% is a 6.5 percentage point change. This is not the percent increase. 6.5% is 19.7% of 33%. Another way of thinking about it. Lets say you make $100,000 and your tax rate is 33%. Your taxes would be $33,000. If your tax rate was raised to 39.5%, then your taxes would be $39,500. Your taxes increased by $6,500 ($39,5000 - $33,000). $6,5000 is 19.7% of $33,000. Therefore, you are paying 19.7% more.

1992, 2000 & 2008 Tax Rates

Link to President Obama's speech: http://latimesblogs.latimes.com/washington/2009/03/obama-text.html

Historical Tax Rates: http://www.taxfoundation.org/files/federalindividualratehistory-20090102.swf