Here's Phil's plan for lowering oil prices. What do you think - agree, disagree, agree there's a problem, have a better solution? - Ilene

Don't Tax Oil Companies - Nationalize Them!

Courtesy of Phil of Phil's Stock World

I would like to report a crime.

I would like to report a crime.

Yesterday, $112M was stolen from US consumers. It will happen again today and probably tomorrow and that is on top of the $800 Million PER DAY that is being overcharged by oil companies in America alone, ACCORDING TO EXXON'S CEO.

That's right, Rex Tillerson himself just testified to Congressthat "based purely on supply and demand- should be in the $60 to $70 a barrel range." The reason it’s above $100 a barrel, Tillerson explained, is due to the oil majors using futures contracts to lock in current high prices, and speculation that is engineered by the high-frequency trading of quantitative hedge funds.

Other disclosures were made in last week's testimony that may interest you:

- The average cost of producing 1 barrel of oil was $11 (THAT IS ELEVEN, NOT A TYPO!); the average price of the oil in the marketplace–$92– some 8.5 times the cost of getting the oil out of the ground.

- The profits for the big 6 oil companies was $36 billion in the year’s first quarter. A large part of the $36 billion was used to buyback shares or pay dividends to shareholders.

- The deduction for intangible drilling expenses was given to the oil industry in 1960 when a barrel was worth about $15-17. So, why do they need this favor when oil is $100 a barrel?

Clearly there is no shortage of oil, the US has 1.75Bn barrels of oil in storage, enough to offset 186 days of imports (9.4Mbd) and 60% of those imports come from Canada and Mexico, not OPEC so our 1,750 MILLION barrels of storage would offset over 500 days worth of imports from the Middle East and Africa - even if it was TOTALLY cut off.

Nonetheless, oil shot up from $95 on Tuesday to $101 this morning, costing US consumers an additional $112M per day but that's an UNDERSTATEMENT - when we buy gasoline at $4, we are paying $168 for a 42-gallon barrel and, of course, rising oil prices also impact our home energy bills and even our food. The cost, in fact is more like $250M PER DAY per $5 increase in oil - and that is just for the US. Globally we're over $1 Billion per day that is removed from consumer's pockets for each $5 over that $60-70 range that the CEO of Exxon says (under oath) is the correct price of oil.

Nonetheless, oil shot up from $95 on Tuesday to $101 this morning, costing US consumers an additional $112M per day but that's an UNDERSTATEMENT - when we buy gasoline at $4, we are paying $168 for a 42-gallon barrel and, of course, rising oil prices also impact our home energy bills and even our food. The cost, in fact is more like $250M PER DAY per $5 increase in oil - and that is just for the US. Globally we're over $1 Billion per day that is removed from consumer's pockets for each $5 over that $60-70 range that the CEO of Exxon says (under oath) is the correct price of oil.

Fortunately for Mr. Tillerson, I wasn't a US Senator because I might have said "Gee Rex, you own the reserves, you build the wells, you own the refineries and you own the gas stations - it's nice to blame HFT Bots and Hedge Funds but have you looked in the gold-plated mirror of your 1,500 square foot bathroom lately?" There used to be such a concept, under Capitalism, of an excess profits tax as well as awindfall profits tax - Big Oil's situation is a little of both but it's also something far more sinister - it's market manipulation!

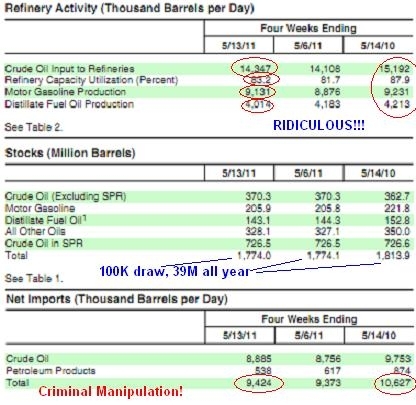

Oil jumped yesterday, as it often does, on a draw-down in oil inventories which Criminal Narrators Boosting Crude play off as an indication that demand is picking up. This could not be further from truth! What CNBC, the WSJ or any kind of real journalist COULD do, in roughly 30 seconds, is LOOK at the ACTUAL EIA Report. Doing that, they would see that the net drawdown of 100,000 barrels (yes, really, 100,000 barrels is what's now causing us to pay another $112M a day, which happens to be enough money to buy another 1.1M barrels PER DAY - are you not outraged by this?) was caused by Net Imports of crude dropping from 10.62Mbd last year to 9.42Mbd this year.

Perhaps it would take more than 30 seconds to have teams from MIT and Harvard pour over this data but, if they did, they would eventually discover that the reason our inventories are down 100,000 barrels in a week is not because demand increased but because they are shipping us 1.2 Million barrels per day LESS than last year EACH DAY or (and here's where the MIT guys really come in handy) 8.4 MILLION barrels a week less oil.

That is (and I cannot emphasize this point enough) 8.4 Million barrels LESS oil PER WEEK (11.3%) being imported than this time last year, WHEN OIL WAS $67.15. $67.15 is, of course, right in Mr. Tillerson's sweet spot, the other $34 a barrel IS YOU BEING RIPPED OFF. When I say you - I mean you, me and every other US and Global citizen who consume 88 Million barrels of oil per day. That is an overcharge of $3Bn PER DAY or over $1Tn per year - JUST FOR THE OIL. Add in refining costs, home energy costs, food costs and other items and we are talking about a $2.5Tn global rip-off (See "Goldman's Global Oil Scam Passes the 50 Madoff Mark!," Fake-Out Thursday - Oil Scam Continues Unabated," and "The scam behind the rise in oil, food prices.")

While the top 10% may not care much whether a gallon of gasoline is $2 or $4 or whether our home electric bill is $300 or $500 or whether a bag of groceries is $100 or $200 - those of us in the business of selling something to consumers other than oil should be outraged! Those are OUR customers that are being robbed! That is $2.5Tn of precious discretionary spending money that they could be giving to US instead of burning it up in our customers' gas tanks.

What we need to do is organize EVERY OTHER business into a lobby to put a stop to this outrage. We are being impacted by this every day - not just in what we pay for oil-related products in our business and personal lives, but the energy sector is sucking $2.5 TRILLION dollars out of our customer's pockets every year.

That would be as much money as ALL US Corporations reported in profits last year and, if you take out the $1Tn of profits in the energy sector and $800Bn of profits in the financial sector (their partners in crime) - that leaves only $700Bn in profits for the rest of us. So, to be clear - that money is being stolen from every business owner in America because if they steal it from our clients at the gas station - they don't have it to spend when they walk into our stores!

The effect on GDP is worse because that money is being removed from the bottom of the chain and being spent on a consumable item of no lasting value (we literally buy it and burn it up). Had my customer not spent $60 for a tank of gas, they might have spent $49 for my newsletter (you can subscribe here) and then I might have taken that $49 and gone out for pizza and Kim, my waitress would have had $5 more to spend tomorrow, and Mina, the owner, would have had $30 to buy some more bread, and the baker would have had $20 to buy some wheat and flower and maybe go out for some pizza himself. OR - my customer could have burned that $45 driving back and forth to work. What do you think is better for our economy?

High oil prices give us trade imbalances, they weaken the dollar by flooding the World with them as we exchange them for oil at the rate of $1.8Bn per day or $657Bn per year. That is the ENTIRE GDP of Turkey, the 17th largest economy in the World and, keep in mind, that is just 40% of what the oil ultimately costs us as it pushes through to other items we use every day. Now my business is global so I look at the US consuming just 1/5th of the World's total and I want to cry. $3.2 Trillion a year spent on oil alone! That's 65 Million newsletter subscriptions! That's right, I'm a Capitalist so I worry about how things affect me - even when they are global tragedies that are causing hundreds millions of people to live in poverty so one man can have a 1,500 square-foot bathroom (allegedly).

And, if you think giving $45 to the gas station puts money into the economy, you are wrong. The local gas station makes very little on each transaction (it's a volume business, that's why they sell food) and half of that money goes directly overseas to pay for our imports and the other half goes to Exxon or whatever big oil company owns your gas station or supplies it.

Now, if you have a business that makes gold-plated mirrors for executive bathrooms (with the cool TV screens behind the glass) - you will be thrilled or, if you are Exxon stock you will be thrilled because XOM bought $19Bn of their own stock back in 2009 (it was a rough year for all of us) and paid out $8Bn in dividends but what they didn't pay was one penny of US taxes on $310Bn in sales.

That's right, although XOM paid $34.7Bn in taxes in 2009, that was only paid to foreign governments who know how to collect money from Big Corporations - the United States Government is either too stupid or too corrupt to tax corporations properly so a company like Exxon can do 65% of their business in the US and make 70% of their profits in the US but pay no taxes in the US. Oh, sorry, I forgot to mention - AND WE PAY THEM SUBSIDIES - so they can pollute our air and our water (anyone in Alaska or the Gulf may know what that means) and use our roads and our electrical grid and our police protection locally and our military protection globally ($1Tn a year for US to keep that up to protect Exxon's interests overseas) and we educate their employees and we fund their retirement, so Exxon doesn't have to and XOM gives us - NOTHING. Sorry, not nothing, they give us a $300Bn bill for their service.

Although I encourage you to send this post (and "like it" in Facebook and Twitter it, and whatever) - to people to make them aware of this scam - including Congresspeople and especially those turncoat Democrats who refused to vote against oil subsidies on Tuesday - I am not saying that any change in policy is going to help. This situation is too far gone, the energy industry has it's hooks too deeply in our politicians and they have WAY too much control over our daily lives. That means the logical thing to do, when faced with an out-of-control vital service that is gouging consumers and damaging our economy, our environment and working against our national interests - is to NATIONALIZE THEM.

Although I encourage you to send this post (and "like it" in Facebook and Twitter it, and whatever) - to people to make them aware of this scam - including Congresspeople and especially those turncoat Democrats who refused to vote against oil subsidies on Tuesday - I am not saying that any change in policy is going to help. This situation is too far gone, the energy industry has it's hooks too deeply in our politicians and they have WAY too much control over our daily lives. That means the logical thing to do, when faced with an out-of-control vital service that is gouging consumers and damaging our economy, our environment and working against our national interests - is to NATIONALIZE THEM.

That's right, we HAVE TO Nationalize the energy industry. Oil should no more be a profit center than water (and they are trying to privatize water, so soon you will know what a gallon of that costs too!) or air. It is necessary (some form of energy) for life in the modern World and that is why these greedy, bloated, corrupt organizations are able to hijack our economy and siphon of 50% of the planet's disposable income in order to mark up a barrel of oil (according to Exxon's own CEO) 850% and that ends up being 1,360% at the pump.

Clearly the current situation does not lead to oil companies developing safer, cleaner, renewable means of energy - they've had 100 years to do it and we're still using oil. In fact, their massive profits lead them to undermine those developments when they occur and to lobby against sensible measures like conservation or pollution controls. The oil scam is just too damned profitable and the money is too corrupting so, if the American people want to stop losing this game day in and day out - WE HAVE TO END THE GAME!

While the Big 6 oil companies may claim not to have a monopoly, they clearly have an oligopoly and prevention of a monopoly is the strongest argument in favor of nationalization of an industry. Clearly there is no price competition when Tillerson admits he can pull a barrel of oil out of the ground for an average of $11 but, by the time it gets to the refiner's door - it costs $101! Sure, you have to put it in the barrel and you have to drive the barrel to the refiner (or ship it from overseas) but that's about it. To claim that "speculators" are entirelyresponsible for the $90 mark-up is obvious BS.

Meanwhile, back to business. We are, of course, speculators (indirectly) in the energy market. I called a top yesterday at $99 and, so far, so wrong, but we are just making short-term covers on our long bets because - until someone does put a stop to these criminals - the scam WILL continue.

Back in December, I wrote a post (available to all subscribers on Christmas Day) called "Secret Santa's Inflation Hedges for 2011" and, in that post I said:

Gasoline prices are once again creeping up and, if you are the average family, you buy about 1,000 gallons of gas per year ($2,500) and spend another $1,500 heating your home. That’s $4,000 a year spent on energy and it’s already up over $1,000 from last year – pretty annoying, right?

XLE is the ETF for the energy market and it’s currently trading at $67.41. If you want to guard against another $1,000 increase in the price of fuel next year, buy 2 Jan 2012 $55/60 bull call spreads for $2.60 ($520) and offset that cost with the sale of 1 2013 $50 put for $4 ($400) for a total outlay of $120. If XLE simply maintains $60 for the year (11% lower), you make $880 (733%).

We're only in May but XLE is already at $74, and the Jan $55/60 bull call spread is now $4.40 ($880) and the 2013 $50 put is down to $2.60 ($260) for net $620 - up 416% and up $500 on the $120 investment so far, with another $380 expected if this trade plays out. These ridiculous, out-sized returns on speculation are why the investing class does not give a crap about the suffering inflicted on the bottom 90% by higher energy prices. We don't just buy 2 contracts, we buy 200, and we make enough money to buy a yacht and put 1,000 gallons into it for a weekend cruise. That increases demand and makes the little people pay even more for fuel, and WE MAKE EVEN MORE MONEY -Muhahaha!

If this seems fair to you - then congratulations, you are "one of us" but, if you have no way of taking an XLE bull call spread offset by selling 2013 puts short - then you are the guy whose pockets XOM is reaching into and stealing the money from on our behalf. Where do you think that $500 profit came from - it came right out of your wallet at the pump! It came out of mine too and, since you are reading this, then you are either a customer or a potential customer, so I will either teach you how to play so you can profit from the oil scam or tell you what needs to be done to put a stop to this obscenity.

Don't worry about us, we'll make money whether oil goes up or down, but let's all worry about our country and our planet, which has been taken over by bankers and commodity pushers, who have organized against us to take every penny out they can get their hands on. If all you do is read this and feel mildly upset - then you are just a mark - the kind who comes back to the con again and again until you have nothing left to lose. It's high time we stood up as a country and said - NO MORE!

Please - send this around - let's get a conversation going and make this an election-year issue. It has to stop....

Try out Phil's Stock World here >