Happy New Year! What can we say? What a year 2013 was!

Of course, that is how bubbles work and this my friends is a bubble. Maybe even the bubble to end all bubbles!

Now does this market move higher? So far, I see no reason it does not at least through May and probably overall for 2014.

However, all bubble eventually pop and this one will be no different. This bubble may go much farther and longer than anyone (including yours truly) might imagine, but eventually when hardly no bears are left, it will pop and it will be a blood bath.

So enjoy the bubble! It's hard not to like positive returns (even as our models continue to get punk'd by the Central Bankers of the world on occasion).

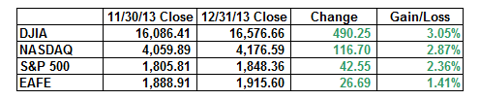

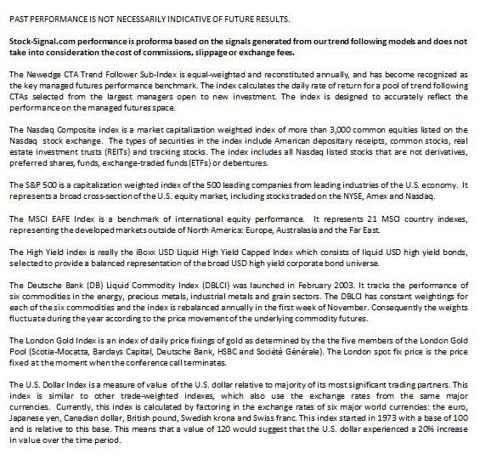

You can see that despite a tough start, December was another positive month for market returns:

The Q4 and 2013 annual returns are even more impressive:

The most impressive performance number to me is the little number the Central Bankers did on the gold bugs. What a hit?

Thankfully, our signals had us short (or inverse) gold all year!

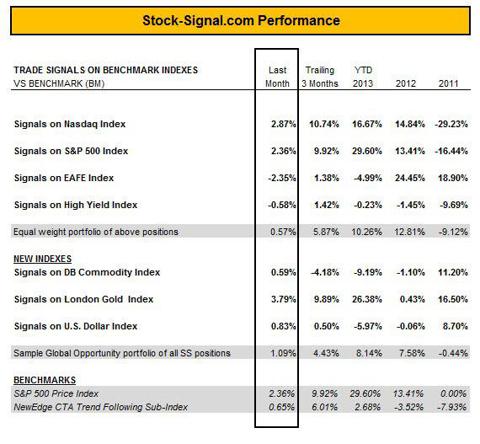

Stock-Signal.com PerformanceOur models and trade signals kept us on the right side of the market in December as you can see below.

The lone exception was, of course, our EAFE index trade signals for December which weighted on monthly performance.

It's funny that these signals actually had us outperforming on a relative basis early in the month, but the Federal Reserve's surprise taper announcement, positive seasonality later in the month and further ECB liquidity provision, quickly reversed weak foreign markets and of course "saved the day." It seems that even a normal healthy correction is now a thing of the past!

Also of note the high yield index has been struggling of late. This index many times is the preverbal "Canary in the coal mine" for short-term market tops so keep an eye on this index. We are well overdue for some kind of corrective action on this recent run up.

Market Forecast - 2014So what happens next? As I alluded to above, this bubble could very well continue. There is still a lot of retail money on the sidelines and the guys on Wall Street will not rest until those investors are sucked in and then allowed to paint the top of the market.

Obviously, the U.S. Federal Reserve is continuing its Quantitative Easing (QE) program at a reduced rate, but $75 billion a month is still a lot of liquidity. It has to go somewhere and the markets have been the beneficiaries. I see no change here.

We are in month 58 of this bull market cycle. The mean bull cycle is 50 months. The average is 67 months. (See our past post- This Bull is Now 55 Months Old!)

However, these numbers are really meaningless until the Fed stops priming the pump with liquidity or some kind of dollar crisis happens that causes investors to turn and run. My best guess is that we follow historical mid-term trends as outlined by Stock Traders Almanac and have a positive year in 2014 with a summer dip. I believe the actual bear market will be pushed off into 2015 (or later).

I will say this, the longer the next recession and bear market are forestalled, the more significant they will likely be!

As a trend follower, this just makes my juices flow. That blood bath will be an amazing market for us, assuming the bloodbath happens over time and not in just a few days.

Don't you miss the party! Why not get a free 30 day trial and be in position to win no matter which direction the market moves?