Financial market report for November 16, 2010 documents that a global competitive deflationary currency war is underway at the hands of the bond traders and currency traders.

I … Introduction

The currency traders continued with their global currency war on the world’s central bankers, which they commenced November 5, 2010, when the bond vigilantes called the Interest Rate on the US 30 Year Government Bond, $TYX, higher above 4.0%, on concern that the US Federal Reserve’s Quantitative Easing constitutes monetization of debt.

II … The currency traders sold the commodity currencies today.

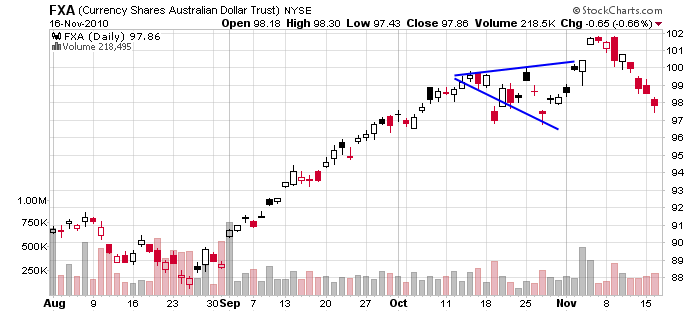

The commodity currencies were sold heavily today; these included the Australian Dollar, FXA, and the South African Rand, SZR, and the Canadian Dollar, FXC, causing the Australia, EWA, South Africa, EZA, and the Canadian Small Caps, CNDA, to fall lower.

Chart of the Australian Dollar, FXA.

The Swedish Krona, FXS, was sold, causing Sweden shares, EWD, to fall lower.

The Brazilian Real, BZF, was sold, causing Brazil Small Caps, BRF, to fall lower.

The Russian Rubble, XRU, was sold, causing Russian shares, RSX, to fall lower.

The British Pound Sterling, FXB, was sold, causing UK Shares, EWU to fall lower.

The India Rupe, ICN, was sold, causing the Indian Small Caps, SCIF, to fall lower.

The Mexico Peso, FXM, was sold, causing the Mexico Shares, EWW, to fall lower.

III … The sell off in the commodity currencies caused a sell off in commodities, especially the base metals, which induced a sell off in the basic material stocks.

Base metals, DBB, Tin, JJT, Copper, JJC, Nickle, JJN, and Lead, LD. fell lower.

Food Commodities, FUD, and Agriculture Commodities, RJA, fell lower.

Oil, USO, and UCO, fell lower.

The commodity currency sell off caused International Basic Materials, DBN, China Materials, CHIM, Copper Miners, COPX, Metal Manufacturers, XME, Steel Manufacturers, SLX and coal producers, KOL, to all fall lower.

At one time the financial stocks had great value and paid good dividends, and this formerly protected them from falling lower. Currently many of the coal stocks, pay good dividends. Will a good dividend rate, protect them from a fast fall lower?

The 4.4% fall seen China Materials, CHIM, suggests that the China basic material stocks have seen a lot of dollar carry trade and yen carry trade investment that came with the onset of the anticipation of Quantative Easing 2. Now that QE 2 is in, the investment is starting to flow out. Also, China announced that it will take action to curb inflation in the cost of basic materials, this gave emphasis to the sell off in China Materials, CHIM.

Chart of International Basic Materials, DBN,

Chart of Commodities, DBC,

One of the most carry trade invested commodities has been Timber, CUT. Its fall today signals the end of an era in speculative carry trade investing in commodities. While Oil, $WTIC, will rise and fall in the future, Timber will continually be going lower, that is being driven lower by falling currencies. The spread between Timber and Oil will be interesting to observe over the years. I expect Timber to fall quite rapidly compared to Oil.

One could see the fall coming in base metals, DBB; these first popped higher from a consolidation triangle, on QE 2 Anticipation, and now have collapsed lower as the QE 2 cool aid has worn off.

The fall in Oil, $WTIC, caused Exxon Mobil, XOM, to fall parabolically lower.

The sell off in commodities, DBC, stimulated a sell off in the agricultural stocks, MOO.

IV … A sell off of emerging market currencies, CEW, unwound carry trade investment in emerging market countries.

The emerging markets, EEM, fell lower: Columbia, GXG, Thailand, THD, Turkey, TUR, Brazil, EWZ, India, INP, and the small cap shares, Brazil Small Caps, BRF, Australia Small Caps, KROO, South Korea Small Caps, SKOR, India Small Caps, SCIF, and the earnings shares, India Earnings, EPI, the Emerging Market Small Cap Dividend Shares, DGS, and the Emerging Market Financial shares, EMFN, such as Credicorp, BAP.

The sell off of currencies caused a strong sell off in emerging Europe countries, ESR, such as Poland, EPOL.

V … European stocks fell lower on sovereign debt worries

A falling Euro, FXE, took European shares, VGK, European Financials, EUFN, Ireland, EIRL, Spain, EWP, and Italy, EWI, Europe Small Cap Dividends, DFE, lower.

VI … Asia currencies were sold, resulting in a strong sell off in Asia, China, and Japan Shares.

China, FXI, and China Small Caps, HAO, fell strongly.

Formerly hot South Korea, EWY, and Singapore, EWS, fell strongly

Japan, EWJ, and Hedged Japan, DXJ, turned lower today.

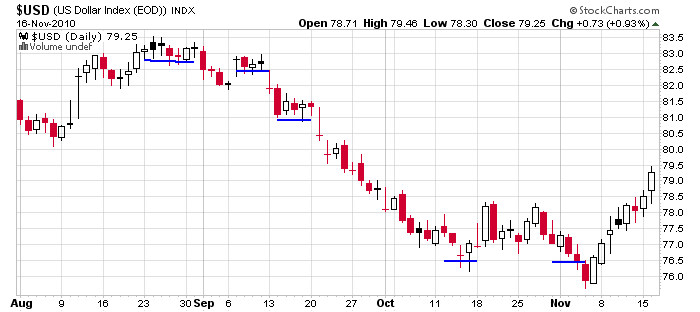

VII … The sell off in currencies, buoyed the US Dollar, $USD, again today.

VIII … The ongoing sell off in the worlds currencies, DBV, strengthened the world-wide stock sell off that commenced on November 5, 2010.

Debt deflation is well under way in the traditional deflationary stocks: Airlines, FAA, Nuclear Energy, NLR, Solar, TAN, Home Builders, ITB, Nanotechnology, PXN, Clean Energy, ICLN, and Wind Energy, FAN.

Speculators sold out of gaming stocks, BJK, such as Las Vegas Sands, LVS.

Real estate, IYR, and banking stocks, KBE, fell on fears that Quantitative Easing will not sustain bonds, BND. Shares falling strongly in this group included Blackstone Group, BX, Stanwood Property Trust, STWD, Blackrock, BLK, Brookfield Properties, BPO.

Office REIT, Capital Lease, LSE, fell lower.

Residential Real Estate, REZ, fell lower.

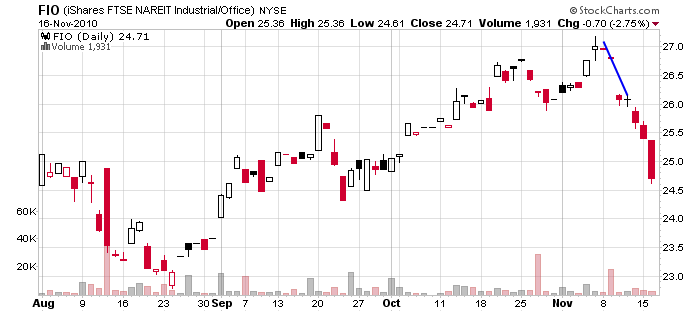

A waterfall loss of value continued in the Industrial and Office REITS, FIO, today.

Mortgage Finance, iStar Financial, SFI, fell lower.

Semiconductors, SMH, fell lower.

Investors turned away from the Internet stocks, HHH, the NASDAQ Internet, PNQI, and the Dow Internet, FDN again today.

The Russell 2000, IWM, fell lower on the lower bank, KBE, shares.

Carry trade disinvestment came out of International Consumer Discretionary, IPD.

International Dividend Payers, DOO, fell strongly.

Utility Leader, CenterPoint Energy, CNP, fell strongly, leading the International Utilities, IPU, lower.

Credit Services, such as Master Card, MA, Nelnet, NNI, and EZCorp, EZPW, American Express, AXP, fell strongly.

Capitol Market Providers, KCE, fell lower.

Insurance, KCE, fell lower.

Those who were wise to invest short the Leveraged S&P ETN, BXUB, were well rewarded; as were those short the Tax Managed Buy Write ETN, ETW.

IX … Debt deflation continued in sovereign debt

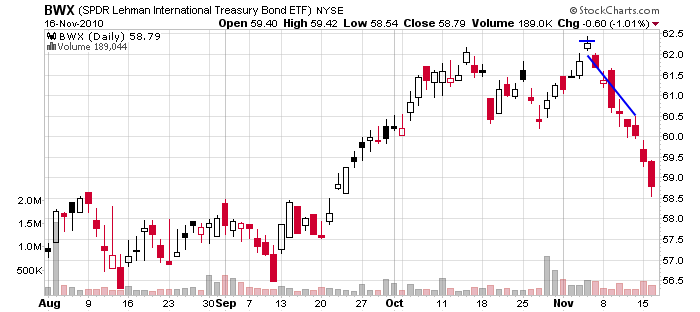

Bond vigilantes continued calling interest rates higher globally. And as currency traders sold the world’s currencies, International Government Bonds, BWX, and Emerging Market Bonds, EMB, fell sharply lower.

Risk appetite has turned to risk aversion causing carry trade investment disinvestment in Junk bonds, JNK

An unwinding of carry trade investment globally is documented by the developed market currencies, DBV, and the emerging market currencies, CEW, falling more than the Yen, FXY.

With World Government Debt, BWX, and World Stocks, ACWI, falling lower, carry trade investment is starting to come out of the HUI Precious Metal Stocks, ^HUI, traded by the ETF, GDX, and the junior gold mining shares, GDXJ.

Gold mining stocks are not the same things as physical gold; gold stocks are bought and sold as a speculative investment; this is readily seen in the chart of the junior gold mining shares, GDXJ, relative to gold, GLD, GDXJ:GLD, turning lower.

Research documents that CONSISTENTLY the precious metal mining shares turn down, when the US sovereign debt turns lower. US Government debt and the precious metal mining shares ALWAYS turn lower together. This is seen in today’s fall in the HUI relative to US 30 Year bonds in the futures market, $HUI:$USB.

Stocks in the precious metal mining category include, Keegan Resources, KGN,

Great Basin Gold, GBG,

Nevsun Resources, NSU,

Allied Nevada Goldfield, ANV,

Golden Star Resources, GSS,

Aurizon Mines, AZK,

ASA, ASA

XI … Volatility rose

Inverse Volatility, XXV, has now fallen lower. S&P Volatility, VXZ, has turned up withe the US Dollar, $USD, suggesting that an unwinding of Dollar carry trades is underway.

The 2% fall seen in the chart of the New York composite, NYC, communicates that a bear market is well underway in the stock markets. The 1.5% fall in the S&P, communicates also tht a bear market is underway.

XII … Currency traders are conducting an international currency war to enrich themselves and reward those who will serve them.

The bond traders have seized control of both long-term interest rates, such as the Interest Rate on The US 30 Year Government Bond, $TYX, and short term rates that were formerly under the control of the central bankers. Joe Weisenthal reports Mortgage Rates Just Hit A Four-Month High; his chart shows an explosive jump in mortgage rates in just the last few days.

The currency traders have established themselves as the world’s sovereign governing power; they rule supreme over world governments. Mike Mish Shedlock reports EU President Proclaims “Survival Crisis”; Everyone Wants A Bailout of Ireland Except Ireland; Austria tells Greece to Get Stuffed; Currency Ping-Pong

XIII … In Today’s News

The Gazette: Euro under siege as now Portugal hits panic button

The Guardian: Ireland told: Take EU bailout or trigger crisis

Bloomberg: Ireland’s Cowen to weigh EU steps for banking system

Bloomberg: Greece Leads Jump in Sovereign Debt Swaps After Austria Says Aid Withheld. Greece led a surge in the cost of insuring European government debt after Austria threatened to block its next transfer of European Union funds because the nation isn’t meeting tax revenue and deficit-cutting targets.

CNBC China Behind Chilling Drop in Commodity Prices: ”It’s been the rising economic growth story in China and the belief that quantitative easing would make the dollar weak that boosted the attractiveness of oil and commodities to two-year highs,” says Gene McGillian, an analyst and broker at Tradition Energy. “Now that it appears China is trying to put a brake on its economic growth and European problems are resurfacing. It’s boosting the dollar and forcing liquidation in commodities.”

Disclosure: I am invested in gold bullion

I … Introduction

The currency traders continued with their global currency war on the world’s central bankers, which they commenced November 5, 2010, when the bond vigilantes called the Interest Rate on the US 30 Year Government Bond, $TYX, higher above 4.0%, on concern that the US Federal Reserve’s Quantitative Easing constitutes monetization of debt.

II … The currency traders sold the commodity currencies today.

The commodity currencies were sold heavily today; these included the Australian Dollar, FXA, and the South African Rand, SZR, and the Canadian Dollar, FXC, causing the Australia, EWA, South Africa, EZA, and the Canadian Small Caps, CNDA, to fall lower.

Chart of the Australian Dollar, FXA.

The Swedish Krona, FXS, was sold, causing Sweden shares, EWD, to fall lower.

The Brazilian Real, BZF, was sold, causing Brazil Small Caps, BRF, to fall lower.

The Russian Rubble, XRU, was sold, causing Russian shares, RSX, to fall lower.

The British Pound Sterling, FXB, was sold, causing UK Shares, EWU to fall lower.

The India Rupe, ICN, was sold, causing the Indian Small Caps, SCIF, to fall lower.

The Mexico Peso, FXM, was sold, causing the Mexico Shares, EWW, to fall lower.

III … The sell off in the commodity currencies caused a sell off in commodities, especially the base metals, which induced a sell off in the basic material stocks.

Base metals, DBB, Tin, JJT, Copper, JJC, Nickle, JJN, and Lead, LD. fell lower.

Food Commodities, FUD, and Agriculture Commodities, RJA, fell lower.

Oil, USO, and UCO, fell lower.

The commodity currency sell off caused International Basic Materials, DBN, China Materials, CHIM, Copper Miners, COPX, Metal Manufacturers, XME, Steel Manufacturers, SLX and coal producers, KOL, to all fall lower.

At one time the financial stocks had great value and paid good dividends, and this formerly protected them from falling lower. Currently many of the coal stocks, pay good dividends. Will a good dividend rate, protect them from a fast fall lower?

The 4.4% fall seen China Materials, CHIM, suggests that the China basic material stocks have seen a lot of dollar carry trade and yen carry trade investment that came with the onset of the anticipation of Quantative Easing 2. Now that QE 2 is in, the investment is starting to flow out. Also, China announced that it will take action to curb inflation in the cost of basic materials, this gave emphasis to the sell off in China Materials, CHIM.

Chart of International Basic Materials, DBN,

Chart of Commodities, DBC,

One of the most carry trade invested commodities has been Timber, CUT. Its fall today signals the end of an era in speculative carry trade investing in commodities. While Oil, $WTIC, will rise and fall in the future, Timber will continually be going lower, that is being driven lower by falling currencies. The spread between Timber and Oil will be interesting to observe over the years. I expect Timber to fall quite rapidly compared to Oil.

One could see the fall coming in base metals, DBB; these first popped higher from a consolidation triangle, on QE 2 Anticipation, and now have collapsed lower as the QE 2 cool aid has worn off.

The fall in Oil, $WTIC, caused Exxon Mobil, XOM, to fall parabolically lower.

The sell off in commodities, DBC, stimulated a sell off in the agricultural stocks, MOO.

IV … A sell off of emerging market currencies, CEW, unwound carry trade investment in emerging market countries.

The emerging markets, EEM, fell lower: Columbia, GXG, Thailand, THD, Turkey, TUR, Brazil, EWZ, India, INP, and the small cap shares, Brazil Small Caps, BRF, Australia Small Caps, KROO, South Korea Small Caps, SKOR, India Small Caps, SCIF, and the earnings shares, India Earnings, EPI, the Emerging Market Small Cap Dividend Shares, DGS, and the Emerging Market Financial shares, EMFN, such as Credicorp, BAP.

The sell off of currencies caused a strong sell off in emerging Europe countries, ESR, such as Poland, EPOL.

V … European stocks fell lower on sovereign debt worries

A falling Euro, FXE, took European shares, VGK, European Financials, EUFN, Ireland, EIRL, Spain, EWP, and Italy, EWI, Europe Small Cap Dividends, DFE, lower.

VI … Asia currencies were sold, resulting in a strong sell off in Asia, China, and Japan Shares.

China, FXI, and China Small Caps, HAO, fell strongly.

Formerly hot South Korea, EWY, and Singapore, EWS, fell strongly

Japan, EWJ, and Hedged Japan, DXJ, turned lower today.

VII … The sell off in currencies, buoyed the US Dollar, $USD, again today.

VIII … The ongoing sell off in the worlds currencies, DBV, strengthened the world-wide stock sell off that commenced on November 5, 2010.

Debt deflation is well under way in the traditional deflationary stocks: Airlines, FAA, Nuclear Energy, NLR, Solar, TAN, Home Builders, ITB, Nanotechnology, PXN, Clean Energy, ICLN, and Wind Energy, FAN.

Speculators sold out of gaming stocks, BJK, such as Las Vegas Sands, LVS.

Real estate, IYR, and banking stocks, KBE, fell on fears that Quantitative Easing will not sustain bonds, BND. Shares falling strongly in this group included Blackstone Group, BX, Stanwood Property Trust, STWD, Blackrock, BLK, Brookfield Properties, BPO.

Office REIT, Capital Lease, LSE, fell lower.

Residential Real Estate, REZ, fell lower.

A waterfall loss of value continued in the Industrial and Office REITS, FIO, today.

Mortgage Finance, iStar Financial, SFI, fell lower.

Semiconductors, SMH, fell lower.

Investors turned away from the Internet stocks, HHH, the NASDAQ Internet, PNQI, and the Dow Internet, FDN again today.

The Russell 2000, IWM, fell lower on the lower bank, KBE, shares.

Carry trade disinvestment came out of International Consumer Discretionary, IPD.

International Dividend Payers, DOO, fell strongly.

Utility Leader, CenterPoint Energy, CNP, fell strongly, leading the International Utilities, IPU, lower.

Credit Services, such as Master Card, MA, Nelnet, NNI, and EZCorp, EZPW, American Express, AXP, fell strongly.

Capitol Market Providers, KCE, fell lower.

Insurance, KCE, fell lower.

Those who were wise to invest short the Leveraged S&P ETN, BXUB, were well rewarded; as were those short the Tax Managed Buy Write ETN, ETW.

IX … Debt deflation continued in sovereign debt

Bond vigilantes continued calling interest rates higher globally. And as currency traders sold the world’s currencies, International Government Bonds, BWX, and Emerging Market Bonds, EMB, fell sharply lower.

Risk appetite has turned to risk aversion causing carry trade investment disinvestment in Junk bonds, JNK

An unwinding of carry trade investment globally is documented by the developed market currencies, DBV, and the emerging market currencies, CEW, falling more than the Yen, FXY.

With World Government Debt, BWX, and World Stocks, ACWI, falling lower, carry trade investment is starting to come out of the HUI Precious Metal Stocks, ^HUI, traded by the ETF, GDX, and the junior gold mining shares, GDXJ.

Gold mining stocks are not the same things as physical gold; gold stocks are bought and sold as a speculative investment; this is readily seen in the chart of the junior gold mining shares, GDXJ, relative to gold, GLD, GDXJ:GLD, turning lower.

Research documents that CONSISTENTLY the precious metal mining shares turn down, when the US sovereign debt turns lower. US Government debt and the precious metal mining shares ALWAYS turn lower together. This is seen in today’s fall in the HUI relative to US 30 Year bonds in the futures market, $HUI:$USB.

Stocks in the precious metal mining category include, Keegan Resources, KGN,

Great Basin Gold, GBG,

Nevsun Resources, NSU,

Allied Nevada Goldfield, ANV,

Golden Star Resources, GSS,

Aurizon Mines, AZK,

ASA, ASA

XI … Volatility rose

Inverse Volatility, XXV, has now fallen lower. S&P Volatility, VXZ, has turned up withe the US Dollar, $USD, suggesting that an unwinding of Dollar carry trades is underway.

The 2% fall seen in the chart of the New York composite, NYC, communicates that a bear market is well underway in the stock markets. The 1.5% fall in the S&P, communicates also tht a bear market is underway.

XII … Currency traders are conducting an international currency war to enrich themselves and reward those who will serve them.

The bond traders have seized control of both long-term interest rates, such as the Interest Rate on The US 30 Year Government Bond, $TYX, and short term rates that were formerly under the control of the central bankers. Joe Weisenthal reports Mortgage Rates Just Hit A Four-Month High; his chart shows an explosive jump in mortgage rates in just the last few days.

The currency traders have established themselves as the world’s sovereign governing power; they rule supreme over world governments. Mike Mish Shedlock reports EU President Proclaims “Survival Crisis”; Everyone Wants A Bailout of Ireland Except Ireland; Austria tells Greece to Get Stuffed; Currency Ping-Pong

XIII … In Today’s News

The Gazette: Euro under siege as now Portugal hits panic button

The Guardian: Ireland told: Take EU bailout or trigger crisis

Bloomberg: Ireland’s Cowen to weigh EU steps for banking system

Bloomberg: Greece Leads Jump in Sovereign Debt Swaps After Austria Says Aid Withheld. Greece led a surge in the cost of insuring European government debt after Austria threatened to block its next transfer of European Union funds because the nation isn’t meeting tax revenue and deficit-cutting targets.

CNBC China Behind Chilling Drop in Commodity Prices: ”It’s been the rising economic growth story in China and the belief that quantitative easing would make the dollar weak that boosted the attractiveness of oil and commodities to two-year highs,” says Gene McGillian, an analyst and broker at Tradition Energy. “Now that it appears China is trying to put a brake on its economic growth and European problems are resurfacing. It’s boosting the dollar and forcing liquidation in commodities.”

Disclosure: I am invested in gold bullion