When you look at the numbers, it's fair to say that the typical American family is in dire financial straits. They're leaving no room for error in their budget, with no allowance for financial problems and incorporating little planning for their future financial needs. Meet your neighbor, the average American family:

When you look at the numbers, it's fair to say that the typical American family is in dire financial straits. They're leaving no room for error in their budget, with no allowance for financial problems and incorporating little planning for their future financial needs. Meet your neighbor, the average American family:Some of the scariest stats, according to Visual Economics:

- $117,951: The average American household's debt

- 40% of Americans are not saving for retirement

- 25% have no savings at all - retirement or otherwise

- 7.7% of Americans don't have a bank account

- The average American household has to pay off a $2,200 credit card balance

Some would argue that the middle class is absolutely vital to having a sustainable and flourishing economy. "The middle class dream is at risk," writes the MyBudget360 blog. "This is a question of what we want out of our country. Are we simply obsessed on keeping home values inflated so banking giants could keep gaming accounting rules and claim billion dollar profits? If we want to prosper in the next decade, there will need to be a radical change to preserve what once was envied by the world."

To access this infographic (via Visual Economics), click here.

Here are some investing ideas with exposure to the stats discussed above.

Medicaid Stocks

If the average American family isn't saving for their retirement, should we expect higher Medicaid enrollment over the coming years? How stable is the Medicaid program? Here are a few Medicaid managed-care companies to watch:

- Amerigroup (AGP): A multistate managed healthcare company, serving those who receive healthcare benefits through publicly sponsored programs such as Medicaid. Sales have grown by 23.26% over the last 5 years, and Wall Street analysts expect the company's earnings to grow by 4.69% over the next year.

- Molina Healthcare (MOH): Delivers health care services to persons eligible for Medicaid, Medicare, and other government-sponsored programs for low-income families and individuals. The stock has gained 13.64% over the last year, despite earnings growth dropping by 10.25% over the last 5 years.

- Centene (CNC): Operates as a multiline healthcare company in the United States. It operates through two segments, Medicaid Managed Care and Specialty Services. The company's current liabilities are larger than their current assets, which may signal short term liquidity problems. Investors don't appear to be too concerned though, given the stock's gain of 26.37% over the last year.

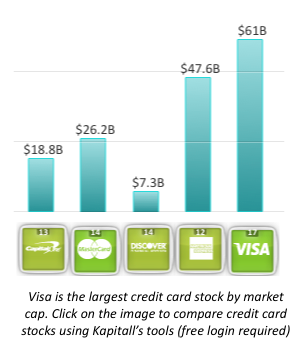

Credit Card Companies

The average American household has to pay off a $2,200 credit card balance, but doesn't have an emergency fund. How will the stocks of credit card companies react if America can't pay off their credit cards anymore? Or are these fears overblown? A few credit card companies to have a look at:

The average American household has to pay off a $2,200 credit card balance, but doesn't have an emergency fund. How will the stocks of credit card companies react if America can't pay off their credit cards anymore? Or are these fears overblown? A few credit card companies to have a look at:- Capital One Financial (COF): Provides various financial products and services to consumers, small businesses, and commercial clients in the United States, Canada, and the United Kingdom. Even though earnings growth has declined by 30.87% over the last 5 years, the stock still managed to gain 58.13% over the last year.

- American Express (AXP): American Express Company provides charge and credit payment card products. The stock currently offers a dividend yield of 1.87%. Over the last three months, insiders (management and directors) have been selling off the stock, reducing their holdings by more than 28%.

- Discover Financial (DFS): Operates as a credit card issuer and electronic payment services company. Wall Street analysts expect the company's earnings to grow by 7.00% over the next 5 years. The stock has already lost 12.46% so far in 2010.

- Visa (V): Operates retail electronic payments network worldwide. The company has no debt, and offers a dividend yield of 0.69%. The stock has so far lost more than 17% during 2010.

- Mastercard (MA): Provides transaction processing and related services. A large block of investors expect the stock to decline, with more than 10% of the company's shares currently being sold short by speculators (i.e. betting on a decline). The company has virtually no debt, and earnings are expected to grow by 19.39% over the next year.

Pawn Lending

Less than four out of ten American families have an emergency fund to cover unexpected financial costs. When you consider that these families are already knee-deep in debt, it may be very hard for them to get a loan through traditional channels. How will this affect non-traditional providers of credit like pawn stores? Here are a few pawn store stocks:

- First Cash Financial Services (FCFS): Primarily operates pawn stores that lend money on the collateral of pledged personal property in the United States and Mexico. The company's annual sales have grown by 15.27% over the last 5 years, with the stock gaining more than 24% over the last year.

- EZCORP (EZPW): The company lends or provides credit services to individuals to meet their short-term cash needs. Annual sales gave grown by 21.27% over the last 5 years, with the stock gaining more than 36% over the last year.

- Cash America International (CSH): Provides specialty financial services to individuals primarily in the United States and Mexico. The company operates in three segments: Pawn Lending, Cash Advance, and Check Cashing. The company's debt, as a percentage of shareholder equity, equals 47%. A large block of investors expect the share price to decline, with more than 15% of the company's shares being sold short (i.e. investors betting on a price drop).

Disclosure: No positions in any of the stocks mentioned above.