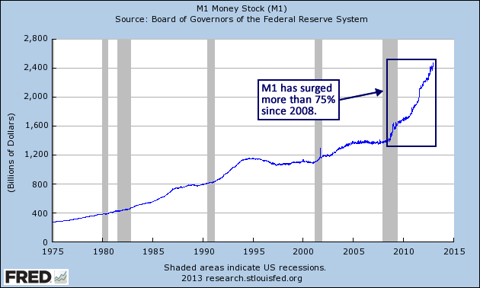

Many mainstream analysts contend that the stock market is reasonably valued, or even undervalued, at current levels. In most cases, this assertion is based on forward earnings estimates, which are in turn based on corporate profit margins that are currently about 70 percent above historical norms. The tacit assumption is that the current situation is sustainable and corporate profits can therefore hold at these historic highs indefinitely. Unfortunately, nothing could be further from the truth. Following the financial crisis in 2008, the US Federal Reserve engaged in a historic liquidity operation intended to support economic recovery that continues today. Since the recession in 2008, M1 money supply has surged an astonishing 75 percent.

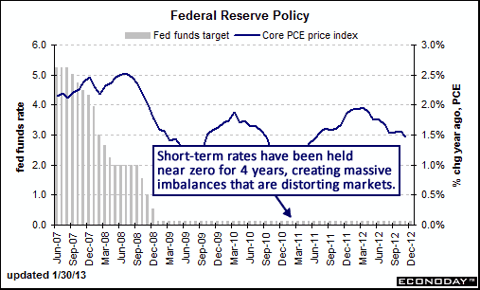

The Federal Reserve has held short-term interest rates artificially low near the zero level for the past four years and plans to continue this measure until at least 2014. This supply of "free" money is creating massive imbalances that are distorting markets.

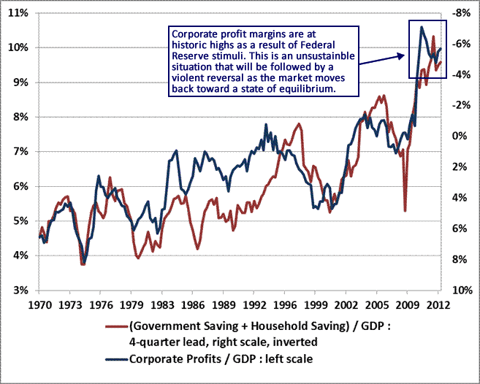

It is the unprecedented injection of stimulus that has driven corporate profit margins to historic extremes, not the healthy, sustainable growth of a structurally sound economy. The following graph from a recent commentary at Hussman Funds displays the relationship between government deficits, household savings rates and corporate profits.

The hope for continued high profit margins really comes down to the hope that government and the household sector will both continue along unsustainable spending trajectories indefinitely. Conversely, any deleveraging of presently debt-heavy government and household balance sheets will predictably create a sustained retreat in corporate profit margins.

Markets, by their nature, gravitate toward states of equilibrium. Whenever markets are driven to unsustainable extremes, they will eventually move to eliminate the imbalance that has been introduced, and the more extreme the imbalance, the more violent the resulting corrective action. Given the historic nature of the recent surge in corporate profit margins and persistent structural economic weakness, it is highly likely that the inevitable decline in profits will be equally extreme in character.