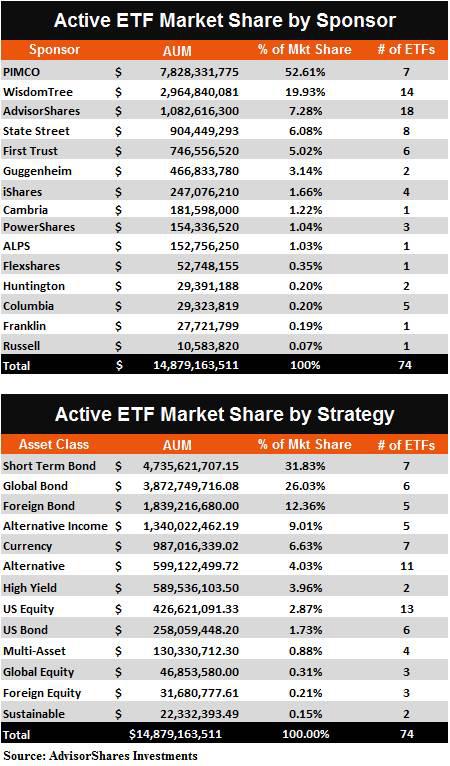

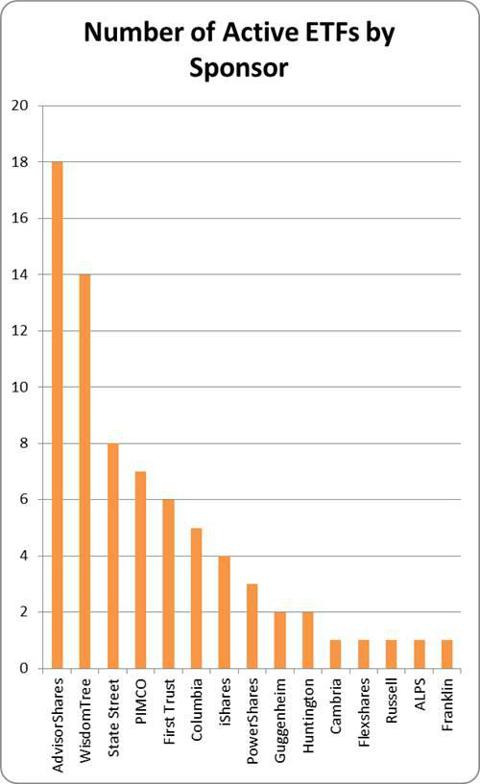

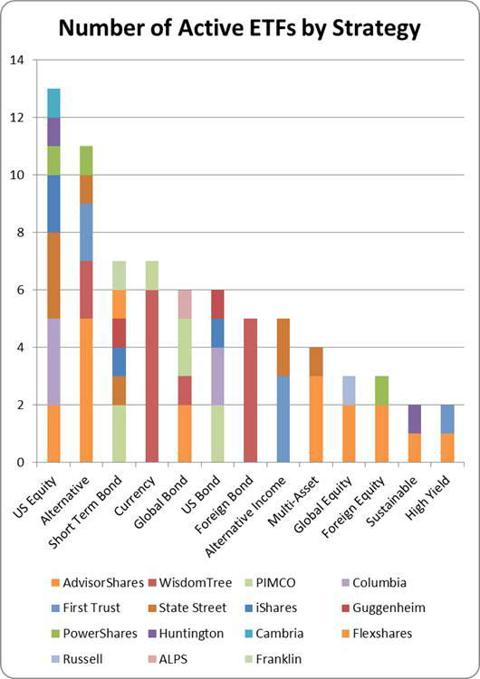

The active ETF market experienced a sizable increase, with total net assets exceeding $14.8 billion. The total number of active ETFs rose to 74 with State Street launching three equity products: SPDR MFS Systematic Core Equity ETF, SPDR MFS Systematic Growth Equity ETF and SPDR MFS Systematic Value Equity ETF last week. The Short Term Bond category, highlighted by PIMCO's Enhanced Short Duration ETF and iShares Short Maturity Bond ETF, had the highest weekly increase in net assets by about $54 million. Net assets in the High Yield category gained over $31 million led by AdvisorShares Peritus High Yield ETF.

To subscribe to our full monthly report, please register at www.advisorshares.com (note the full report is only available to financial professionals).

There are risks involved with investing in ETFs including possible loss of money. Shares are actively managed and are subject to risk similar to stocks, including those related to short selling and margin maintenance. Ordinary brokerage commissions apply.

There are risks involved with investing in ETFs including possible loss of money. Shares are actively managed and are subject to risk similar to stocks, including those related to short selling and margin maintenance. Ordinary brokerage commissions apply.Shares are not individually redeemable and owners of the shares may acquire those shares from the Funds and tender those shares for redemption to the Funds in Creation Unit aggregations only, typically consisting of 50,000 shares.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.