At the end of March the median home price in Maricopa County was 19% higher than ten months ago. That is huge. This is not another bubble; it's what's happens when a large inventory of distressed property finally approaches depletion. Sometimes careful observation and theory work. What's happening in Phoenix and the reasons why were explained ten months ago in the article Signs of a Phoenix Housing Recovery Good for Homebuilders.

This rise in home prices in Phoenix should persist; we think gains of another 15% are possible over the next twelve months. And the volume of new home sales should increase too, perhaps doubling. Why? Once the distressed inventory is gone, the limited amount of normal sales will not meet demand, so new homes sales will have to fill the void. Homebuilders in Phoenix (DHI, TOL, KBH and XHB) should continue to see earnings from their Phoenix operations grow, first from expanding profit margins due to higher prices, then from increased sales volume.

Price increases like this go a long way toward "fixing" the housing market. Further price increases should help more and more homeowners buried under negative home equity. We think 30%-50% of homeowners who were under water a year ago will soon be positive again. This should help reduce the number of homeowner "walk always" further stabilizing prices.

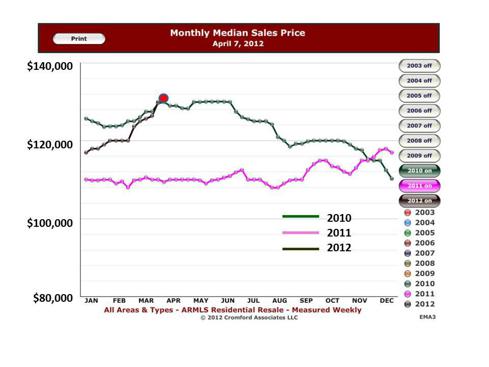

The chart below shows the 19% median price gain. The median home price for Phoenix was around $110,000 last May and is now about $131,000 at the end of March (red dot).

Many thanks to Mike Orr - owner of the Cromford Report and the Director of Real Estate Research at Arizona State University's W. P. Carey School of Business - for all the analysis and necessary data.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.