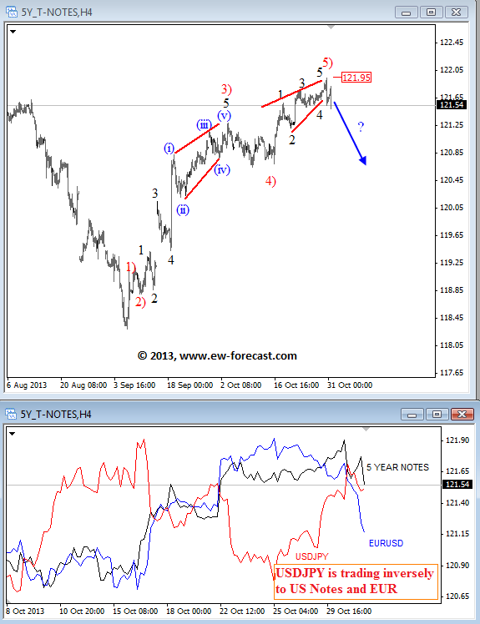

US Treasury notes and bonds turned bearish yesterday after FOMC statement which was just a trigger for a reversal that has been expected already earlier. Notice that from September low, rally on 5 Year notes can be counted in five waves with wedge at the top of the current rally which is a reversal sign. Traders with Elliott Wave approach will also know that after every five waves correction follows back to the area of the former wave 4). If we are correct then US bonds and notes will move lower in the next days, but the question is how it will impact the FX market? Well, we see a positive correlation between the EUR and US notes so if the US notes will fall then the EURUSD will probably follow. At the same time we can see a negative correlation between US notes and USDJPY; that's because rising US yields.

Register For Our Free Webinar On Elliott Wave

Elliott Wave Principle and Live Analysis >>> Click Here