Free and Public Investment Models

Over the coming months I will be adding content to my Instablog section showing investors how they can build their own investment model using the principles that I write about in Seeking Alpha.

The simplest way I know to follow these models is to have a paid account with the same stock screening and backtesting platform which I use, Portfolio123. If you sign up for a trial using the link here, you'll get 30 days of free trial instead of 15 days posted on their site.

I want to be clear that these models are free. The principles will all be laid out for you to do on your own provided that you can find a data source which allows screening and ranking. Or perhaps a community project can be started by someone...I don't know. I will just provide you with the screen and you can go from there.

Steps To Find the Free Screens

Once you sign up for a P123 free trial account (I don't believe you need credit cards or anything), you can click on this link to go directly to the screen I have made public called Free Div Growth Screen 2. Yes, there is also another freebie div growth screen 1.

To find this and many other public screens, click SCREEN and under the drop-down menu select P123 SCREENS. In the menu bar you will see a magnifying glass. Click it.

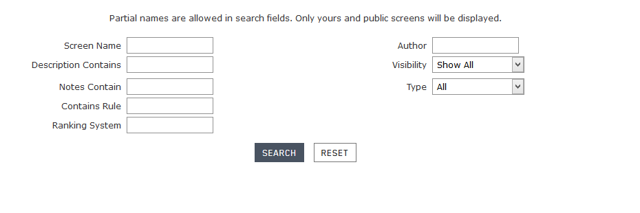

It should take you to a page that looks like this:

From here you can type in "Hemmerling" without the quotes in the Author field, or simply leave everything blank and hit search if you feel inclined to sift through 3,000 stock screens to see what gems might be hidden.

Dividend Growth Safety Screen Holdings

Below are the holdings of the Dividend Growth Safety Model which is submitted for publication as of April 10th, 2015. Before that, here are the steps to build this model yourself:

- Dividend Growth stocks in the Russell 1000 with at least 10 years of dividend growth

- 4 week rebalancing

- Calculation of the 100 day average of daily price beta

- Calculation of the 60 day average of ATRN (Average True Range Normalized)

- The stocks meeting criteria 1 and 2 are given a relative rank between 1 and 100 based on how low the beta is (lower beta gets a better score). Do the same for ATRN. Stocks with the best combined score are purchased and held.

- You only sell a stock if the combined average score is 80 or less (or if total score is 160 or less if you add the two scores together)

Or, just run the screen 'as is' that I have provided. All the steps are done for you. And remember, more will be added later.

As promised, here are the 20 portfolio holdings:

| Ticker | Name | MktCap |

| (SIAL) | Sigma-Aldrich Corp | 16431.52 |

| (FDO) | Family Dollar Stores Inc. | 9014.72 |

| (WM) | Waste Management Inc. | 24600.51 |

| (RSG) | Republic Services Inc. | 14421.9 |

| (CLX) | Clorox Co (The) | 14235.02 |

| (GIS) | General Mills Inc. | 31105.97 |

| (CHD) | Church & Dwight Co. Inc. | 11170.9 |

| (T) | AT&T Inc | 173657.8 |

| (KO) | Coca-Cola Co (The) | 181276.3 |

| (PG) | Procter & Gamble Co (The) | 223224.2 |

| (VZ) | Verizon Communications Inc | 200643.2 |

| (HCC) | HCC Insurance Holdings Inc. | 5536.34 |

| (COST) | Costco Wholesale Corp | 65874.42 |

| (CB) | Chubb Corp | 23215.01 |

| (TRV) | Travelers Companies Inc (The) | 34088.76 |

| (PEP) | PepsiCo Inc | 143101 |

| (BRO) | Brown & Brown Inc | 4568.59 |

| (WPC) | W. P. Carey Inc | 6856.6 |

| (KMB) | Kimberly-Clark Corp | 39025.19 |

| (WMT) | Wal-Mart Stores Inc | 266517.9 |

Stay tuned, more to come.

Kurtis Hemmerling