Biodel (BIOD) gets another chance to be in the spotlight. On January 13th, 2011 at 9:30 a.m. Pacific Time (12:30 p.m. Eastern Time) Dr. Errol De Souza, President and CEO of Biodel, will present a corporate update, including information about the development of new follow-on formulations of its lead product, Linjeta™, and any milestones and timelines, at the 29th Annual JPMorgan Healthcare Conference. The meeting will be held January 9-13, 2011 at the Westin St. Francis Hotel in San Francisco, California. To tune in, investors can access the presentation at http://investor.biodel.com/events.cfm. Chances are that it may be good. This is a do or die event for BIOD, but I am betting on a positive call. After all, why else would the company issue a call?

It was not long ago that BIOD received a FDA complete response letter on October 30th asking for more information about Linjeta™. Subsequently the stock price plunged from $3.63 to $1.90. The studies conducted on Type I and Type II diabetes patients in the U.S., Europe, and India. The U.S. and European data showed positive results, but the Indian data showed negative results. Explanations have included mishandling of the blood samples in which samples were not kept at sufficient temperatures and a poorly controlled patient population. Regardless of the reason, the FDA will need more data to approve it. This will probably take another 6 months.

Why this drug is so important is that, as shown in the table below, the company’s next product in their pipeline is still in Phase I trials, meaning its next product is still a long way before getting to approval. This puts the question that if the company can survive without Linjeta™ approval.

Linjeta™ | Phase III |

VIAtab™ | Phase I |

BIOD-Adjustable Basal | Phase I |

BIOD-Smart Basal | Pre-Clinical |

BIOD-Stable Glucagon | Pre-Clinical |

On face, this doesn’t look good. But Dr. Souza sounds confident that the company will eventually get the drug approval. Linjeta™, a fast acting insulin, serves a niche market unmet by current drugs, so approval will have a drastic affect on the stock. Short interest is high at 30.90% according to Yahoo Finance, so any good news from the conference call may cause a short squeeze, boosting the stock price.

On the cash side, the company has $28.92 million in cash and no debt. They received a $1.2 million research grant from the IRS to help fund drug studies in its pipeline on November 2. This is a lot of cash for a $50.22 million company. Thus, it seems to have plenty of cash for at least 6 months.

For the fourth quarter ended September 30, the company reported a narrower loss of $8.1 million, or 31 cents a share, from $10.5 million, or 44 cents a share, a year earlier. So they are somehow cutting their losses, even without approval. Investors seem very willing to give them cash for operations, having gone through multiple public offerings in the past year. And I highly doubt investors will stop giving the company cash.

The chance of the company partnering with another company is also very possible, especially considering the positive U.S. and European results. If mishandling affected the Indian data, it should be relatively easy to redo the data. But more importantly, one of the large drug makers may want to license Biodel's advanced drug-delivery technology. All this gives value to the tiny company.

And certainly, investor sentiment seems positive.

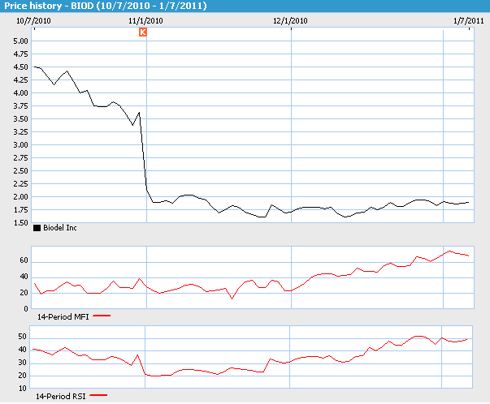

From the graph, the stock’s price has stayed about the same since the FDA rejection, but the 14-Period MFI (money flow index) and 14-Period RSI (relative strength index) went up.

Thus, positive money flow must be increasing, negative money flow must be decreasing, or both. And the increasing RSI correlated with a somewhat stagnant stock price gives a somewhat bullish signal.

Although there is a risk that they report negative news on the 13th, that risk might be well worth it.

Disclosure: I do not own BIOD. Article written for http://momentumoptionstrading.com/