Berkshire Put Option Opportunity

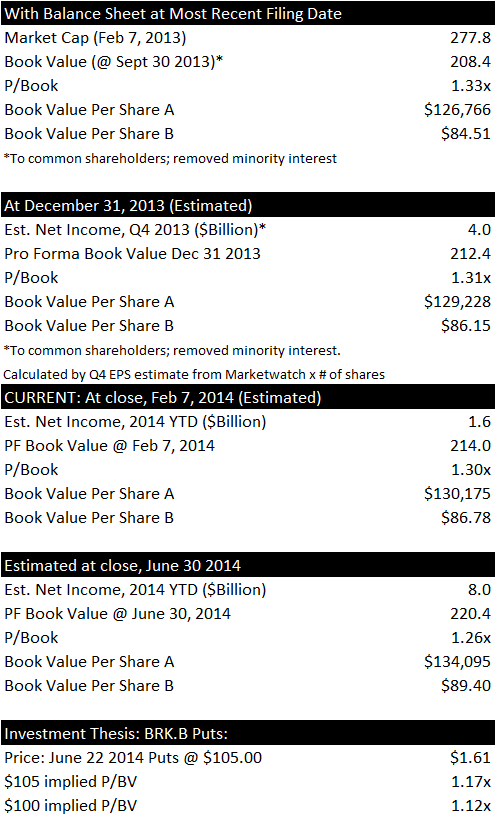

As of the close of trading on February 7, 2014, Berkshire Hathaway is trading for $112.61 (for [BRK.B]) and $169,010.00 (for [BRK.A]). We are already long Berkshire Hathaway. But we believe we can prudently boost our returns by writing put options on the company.

We wish to point out an interesting opportunity to profit by leveraging Berkshire Hathaway's unique corporate attributes of steadily building book value. We believe that the recent pullback in Berkshire Hathaway's share price represents a particularly opportune time at which to write out-of-the-money puts on the stock. However, a more interesting phenomenon is also at play regarding the writing of Berkshire puts, which is unique to this company.

In fact, we believe that Berkshire Hathaway represents an excellent opportunity to 'game' or arbitrage the options market on account of a somewhat unique combination of factors which are relatively specific to the company:

We believe that when writing put options on Berkshire Hathaway, the 'time value' of the option should operate in a reverse fashion to the conventional manner (or at least neutral fashion): there is an argument that puts expiring in the more distant future should not cost more, and should potentially cost less.

Options are normally valued based on the time to expiry and volatility (as well as proximity to being in-the-money). But Berkshire builds book value consistently and never pays a dividend, so a more distant time horizon means Berkshire stock will more likely have risen simply based on increase in book value alone. Volatility is assumed to be directionless, but with Berkshire, we know the long-term trend is up via net income which converts to retained earnings.

Note: As an aside, we believe Berkshire call options should operate in the conventional manner, where options with longer expiry times should indeed cost more. BRK shares probably won't trade for less than book value, but the euphoria of the market, they may trade for a huge premium.

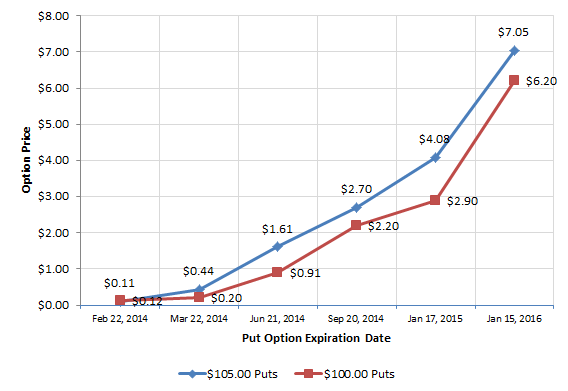

In reality, examining the actual pricing of Berkshire put options, we see that they operate in the conventional manner: Options with more distant expiry dates cost more. We believe this provides investors with the ability to generate a superior risk-adjusted return by writing puts with distant expiry dates, as it is very likely that the presently out-of-the-money puts on Berkshire stock will remain out-of-the-money by the time the put expires due to the steady profits generated by the company and the fact that it retains all capital and already trades at a low price to book multiple.

The Hypothesis:

Although minor price declines occur frequently, and even large declines are possible (such as in 2008/2009), Berkshire has a number of attributes which cause significant long-term price declines to be relatively unlikely:

- Never distributes capital to shareholders: Berkshire does not pay a dividend, meaning it either (1) retains all income it generates, (2) re-deploys it into other income-generating assets, or (3) buys back shares, which it only does when such a mechanism is not particularly dilutive. In some respects, money never leaves the company; even when cash is re-deployed, the book value does not decrease significantly*

- *Or rather at least the book value per share doesn't decrease materially. Technically BVPS will decline slightly if BRK buys shares back at over 1.0x book, and it will do so up to 1.2x book value.

- Consistently generates profit/diverse income streams:Berkshire has a stellar record of consistently generating net income. Its diversified portfolio of income generating assets makes the income stream more resilient than other companies.

- This means the book value is constantly increasing

- The only worrisome issue that is likely to materially affect book value to the downside is if Berkshire's equity portfolio experiences large declines

- Trades at a low multiple of book value: Berkshire presently trades at about 1.3x book value. Historically its price to book value has been higher than this, but even in times of crisis the P/BV has remained above 1. While it is not foolproof, we believe we can treat a book value of 1 as the likely floor price for Berkshire stock.

- Buys back stock under 1.2x Book Value: Warren Buffett has articulated in the past that he is comfortable buying back Berkshire stock up to 1.2x book value. While this does not mean that Berkshire will at all times buy anytime the price drops below this level, it is an encouraging signal.

Investment Thesis Summarized:

Essentially, as a result Berkshire's profitability and retention of capital, when writing puts on Berkshire, the longer the time until the option expires, the less risky it is that Berkshire will fall to that extent, assuming that such a put it is sufficiently out-of-the-money.

Normally the longer until an option expires, the more expensive it is: There is more time in which unexpected 'stuff can happen' which would move the security into a price range in which the option is in the money. This is what option holders pay for when buying the option.

If this sounds like a veiled attempt to make the case for investors to go long Berkshire, it's not. While we believe that Berkshire indeed has a number of positive qualities which make it a good long investment, here we are highlighting the reasons why it's not likely to decline significantly as opposed to the reason that it is likely toincrease significantly.

Using our earnings estimates, by December 31 2015 (the date closest the options with the most distant expiry date), Berkshire's book value will be about $100 per BRK.B share. So even at 1.0x Book value, the $100 puts would expire worthless.

Of course, this relies on us being correct with our earnings assumptions in terms of building book value.

This is admittedly a big if, but we've left ourselves a very large buffer by assuming Berkshire shares will trade as low as 1.0x Book Value. In reality, given Buffet's buyback propensity under 1.2x book value, we find this unlikely.

We would be comfortable writing January 2016 puts for $6.20 on BRK.B. We feel it is very likely that these puts will expire worthless. We are not suggesting that this is a risk-free transaction - there is always a risk, and a very large and asymmetric one when writing put options. However, we feel that despite this, Berkshire represents a good opportunity to write puts with less risk than one would experience with comparable companies due to the growing Book Value. We feel that (contrary to conventional option pricing logic for most companies) the more distant the expiry date of the put, the higher Berkshire stock price is likely to be at that time. The greater the time to expiry, the smaller the risk of the puts ending in the money due to BRK's natural price appreciation.

Disclosure: I am long BRK.B.

Additional disclosure: I may write covered or uncovered puts on BRK.