This is a follow up to an earlier post. I have changed the basket a bit to minimize the number of ETFs that cannot be traded without commission at Fidelity. The performance of this basket is slightly better.

The strategy is derived from a synthesis of various ideas: relative strength and persistence of momentum, polygamous paired switching, and averaging over multiple time scales. The last one is just the antithesis of any strategy that optimizes with respect to the holding and evaluation periods. My view is that any such optimization would lead to a method that works very well in back testing but is quite fragile/brittle for the future. Averaging over multiple pairs of holding and evaluation periods provides the possibility of robustness with respect to future market movements whose time scales are generally unpredictable.

Although this strategy can be easily implemented without too many complex calculations, it seems to provide a very attractive method to adaptively change not only the weights of various components of the basket but also the number of ETFs that are invested in at any given time.

This quarterly rebalancing strategy works well to minimize portfolio volatility without any significant deleterious effect on the returns.

- The basket consists of two parts (a) a set of assets nominally correlated with the market, typically equity ETFs and (b) a set of assets which have low or negative correlation with the market, typically fixed income ETFs. The number of fixed income assets should be as many or preferably more than the number of equity assets.

- The rebalancing schedule consists of three tranches:

(a)at the beginning of every quarter choose a set of assets that performed the best during the immediately preceding month,

(b) at the beginning of every half-year choose a set of assets that performed the best during the immediately preceding month, and

(c) at the beginning of every year choose a set of assets that performed the best during the immediately preceding quarter.

Obviously the assets from the three tranches can be commingled at the beginning of each quarter to be equally divided in the three tranches. Further the number of selected assets should be close to the number of equity ETFs in the basket (as in 1(a)).

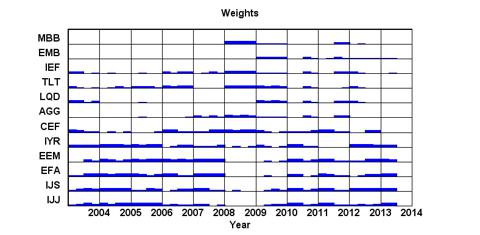

Note that each of the three tranches specifies a set of weights for each of the components of the basket, with the weights for the first one changing every quarter, for the second one every six-months and for the third one only once a year. At the beginning of each quarter, these three sets of weights are averaged to construct the portfolio.

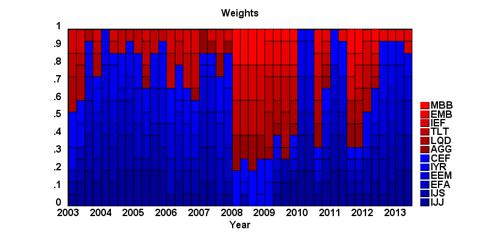

The basket consists of the following:

IJJ IJS EFA EEM IYR CEF AGG LQD TLT IEF EMB MBB

Apart from EFA, EEM, CEF, all these ETFs can be traded commission free at Fidelity. Commission free versions of EFA and EEM are available, but not much historical data exist for those ones, and so we have used EFA and EEM for back testing.

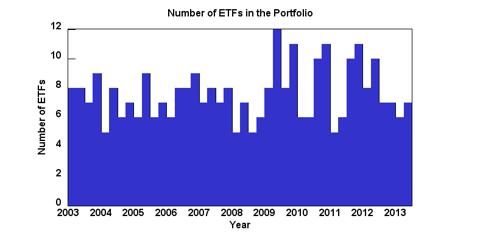

At each update for each tranch, five assets were chosen. However, since three different set of weights are averaged, the actual number of ETFs in the portfolio at any given time may range from five to fifteen. The following figure shows the number of ETFs that were in the portfolio during 2003-2013.

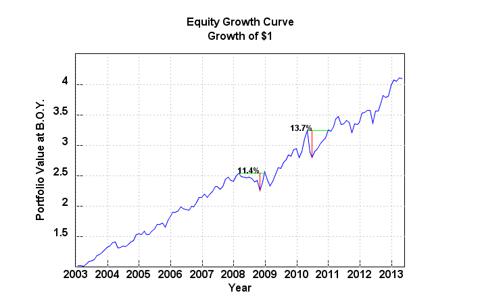

Here are the detailed results for 2003:2013

CAGR 14.6%

Sharpe Ratio .99

Kelly Fraction .42

Maximum Monthly Drawdown 13.7%

Monthly One Factor Alpha .70%

Monthly One Factor Beta .48

Monthly One Factor R^2 .42

The equity curve, the Manhattan asset allocation diagram and the basic asset allocation diagram are shown below.