--Overvaluation Drops To Lowest Levels Since May, 2013

ValuEngine tracks more than 7000 US equities, ADRs, and foreign stock which trade on US exchanges as well as @1000 Canadian equities. When EPS estimates are available for a given equity, our model calculates a level of mispricing or valuation percentage for that equity based on earnings estimates and what the stock should be worth if the market were totally rational and efficient--an academic exercise to be sure, but one which allows for useful comparisons between equities, sectors, and industries. Using our Valuation Model, we can currently assign a VE valuation calculation to more than 2800 stocks in our US Universe.

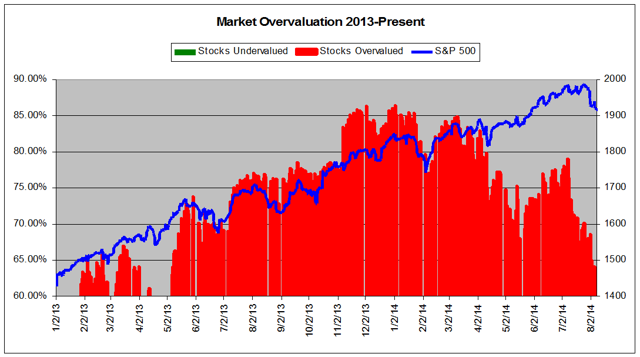

We combine all of the equities with a valuation calculation to track market valuation figures and use them as a metric for making calls about the overall state of the market. Two factors can lower these figures-- a market pullback, or a significant rise in EPS estimates. Whenever we see overvaluation levels in excess of @ 65% for the overall universe and/or 27% for the overvalued by 20% or more categories, we issue a valuation warning. We issued our latest valuation warning on May 8th, 2013. At that time, the S&P was at 1625.

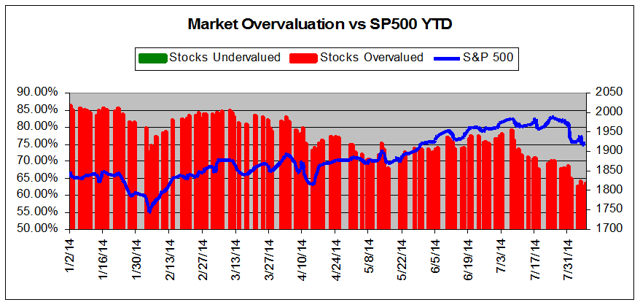

We now calculate that 64.13% of stocks are overvalued and 21.27% of those stocks are overvalued by 20% or more. The recent market pull back-- combined with changes in earnings and stock prices-- have resulted in figures that are now the lowest recorded since our current Valuation Warning began.

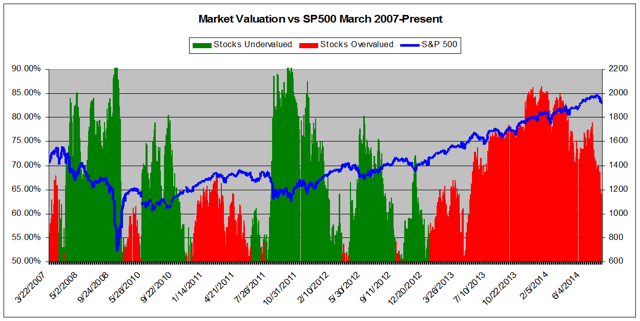

With these sorts of numbers, we no longer have a "Valuation Warning." We now operate under a "Valuation Watch." If the figures continue the decline, we will remove find ourselves back in "normal" range from a valuation perspective. This does not mean we have a "buy" signal yet, just that valuations have declined into a more "normal" range. We remain bullish overall for equities and the US economy. Overall news has been good, and we believe that the long Great Recession is finally behind us. We have seen a remarkable rally for equities since the early days of the Obama Administration. Think about that SP500 inter-day low of 666 on March 9, 2009! The market has tripled!

But, once again economic events are eclipsed by foreign issues as the destabilization of the Middle East-- fostered in large part by the disastrous US invasion of Iraq-- continues to provide new challenges with few easy (or even apparent) solutions. Events in the Ukraine also provide a problematic scenario for investors. Underneath this global unrest we still find strong fundamentals, but every good rally comes to an end and investors remain skittish. We remain convinced that the US economy will get stronger, not weaker, but along with that conviction comes the uncertainty of how markets will react to Fed tapering.

In any case, we now have a Valuation Watch.

Subscribers Get FULL ACCESS to our Market and Sector Overviews

The chart below tracks the valuation metrics from January 2014.

This chart shows overall universe over valuation in excess of 65% vs the S&P 500 from January 2013

This chart shows overall universe under and over valuation in excess of 50% vs the S&P 500 from March 2007*

*NOTE: Time Scale Compressed Prior to 2011.

In addition to the overall valuation metrics, we see that on a sector basis the declines in overvaluation have also relived some pressure. While ALL sectors remain overvalued according to our Valuation Model, only two of them--barely-- remain calculated to be overvalued by double digits.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.