We have seen some positive data over the past few days. I am sure it will confuse quite many analysts and forecasters. However, the truth is that we are in a slowdown mode and will be there for the next 2-3 quarters.

Why am I so sure? Well, I spent quite a lot of time crunching the data in order to find a robust approach to business cycle analysis. Here are the latest results.

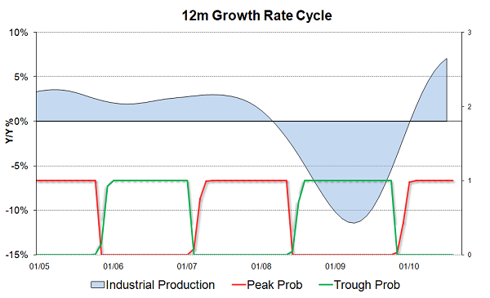

Industrial production annual growth has probably peaked in July to confirm that we have been in a slowdown phase already for about a month (remember that statistics is the past!). Risks of annual growth rate falling below zero have significantly increased. Slowdown will continue at least till Q2 2011.

Employment figures are likely to weaken and disinflation is likely to continue. FED is well aware of the risks and we are likely to see another round of quantitative easing or at least extension of existing one until business cycle turns up again.

Risks are lying within the government sector. Fiscal consolidation may turn out to be quite unpleasant for the economy. There is a clear need for very gradual withdrawal of the stimulus.

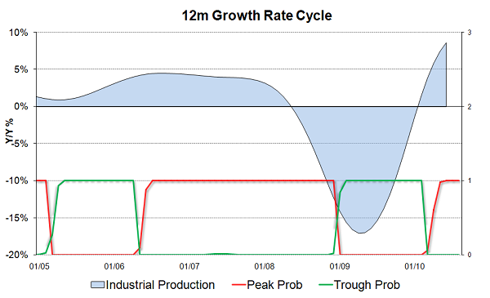

We have likely seen a peak of the annual industrial production growth meaning that we are in a active phase of the slowdown. Slowdown is going to continue for the next 2-3 quarters. In contrast to US, for now there are no risks of industrial production growth dipping below zero.

As in US employment will be under a pressure as well as inflation during a slowdown phase.

ECB remains cautious and is likely to provide unlimited liquidity until business cycle turns up again. The same applies to interest rates.

Risk aversion should increase in the markets as together with amount of negative news in the media.

Approach

Just a few words about approach. I use purely quantitative approach for business cycle analysis. Model consumes various leading indicators and produces an output in form of the probability of change in the underlying regime: expansion or contraction.

Just a few words about approach. I use purely quantitative approach for business cycle analysis. Model consumes various leading indicators and produces an output in form of the probability of change in the underlying regime: expansion or contraction.

I follow US and Euroarea economies. Here you will find the latest updates of the models and my comments:

NOTE: You can find and download sample indicators data from the pages above.