Great earning reports from Oracle Corporation and Research in Motion Ltd gave technology stocks a push in Asian markets today. Japanese exporters also continue to climb due to weakness in the yen against

the dollar; speculators believed that the Bank of Japan will continue to

sell the yen in order to stimulate its exports and Japanese economy. The Nikkei up +1.23% to 9,626.09; Taiwanese market TWSE up +0.72% to 8,158.33; Hong Kong Hang Seng up +1.29% to 21,970.86; Singapore STI up +0.30% to 3,076.37; South Korea, the Kospi up +0.86% to 1,824.35; Australia (the S&P/ASX 200) up +0.73% to 4,638.89; India market, the S&P/CNX 500 up +1.09% to 4,876.50. China markets, however, were down a little, the Shanghai Composite Index down -0.15% to 2,598.69; the Shanghai 180 A share index down -0.06% to 5,991.28.

the dollar; speculators believed that the Bank of Japan will continue to

sell the yen in order to stimulate its exports and Japanese economy. The Nikkei up +1.23% to 9,626.09; Taiwanese market TWSE up +0.72% to 8,158.33; Hong Kong Hang Seng up +1.29% to 21,970.86; Singapore STI up +0.30% to 3,076.37; South Korea, the Kospi up +0.86% to 1,824.35; Australia (the S&P/ASX 200) up +0.73% to 4,638.89; India market, the S&P/CNX 500 up +1.09% to 4,876.50. China markets, however, were down a little, the Shanghai Composite Index down -0.15% to 2,598.69; the Shanghai 180 A share index down -0.06% to 5,991.28.

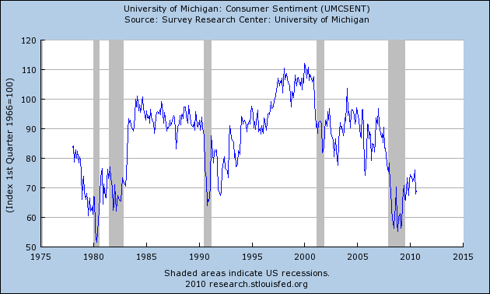

In the U.S. front, macroeconomic data were relatively neutral to bearish. August core Consumer Price Index was unchanged. AUG CPI edged up +0.3 versus +0.1% in July; this is in-line with expectation, the Labor Department said Friday. However, University of Michigan Confidence Sentiment Index fell to 66.6 versus 68.9 in August. This is quite bearish since it's the lowest level since August 2009; and it is way below economists' expectation of 70 range. Consumer sentiment data immediately caused investors to take profit; all indexes were in red right after the data released. Lucky for the bull, program buying was kicking in the last hour of trading, sending all major indexes to close in green by the closing bell. The DOW was slightly up +0.12% to 10,607.85, Nasdaq up +0.54%, and the S&P up +0.08%.

Art Hogan, managing director at Jefferies said there is a silver lining in the U.S equities market. Fund flow is getting better; there is a strong inflow into domestic equities ETFs last week, said Hogan. David Kelly, chief market strategist at JP Morgan Funds, doesn't believe the U.S. economy is facing a double-dip recession. Consumers will continue to worry until unemployment rate go down. U.S economy will eventually get through the "soft-patch" period; therefore, he recommended investors to overweight on equities now. Steve Grasso, director of institutional sales at Stuart Franklel, is still bullish Friday. He also predicted that the S&P 500 will go to 1200 range during midterm election season. Interestingly, Doug Kass, a prominent hedge fund manager at Seabreeze Partners, has turned bearish in the last few days, citing market breadth is deteriorating, weakness in the Russell Index, and thus he has been pressing his short positions Friday.

Technically, the market is overbought short term. The S&P 500 seemed to have significant struggle to climb above the June high at 1130s. It failed to do so in several attempts in August. We remained "very cautious" at this conjuncture. If the market can take off this strong resistance, we will have a potential “Triple Top break out” from June high, August high and September high. The potential targets from this break out are 1150, 1160, and MAY high at 1170s range. Next support levels are the 200d-MA at 1116.16, the 50d-MA at 1193.70, and the 20d-MA at 1087.70. Let’s see what the market will do next week into the FED meeting and wait for a high probability set-up. We would be a buyer if the June high is taken out with strong institutional participation and volume. And we would be a seller of the market if the S&P 500 fall bellow the 200d-MA at 1116.16 and especially below the 50d-MA at 1093.70. On that note, wishing everyone a great weekend.

Technically, the market is overbought short term. The S&P 500 seemed to have significant struggle to climb above the June high at 1130s. It failed to do so in several attempts in August. We remained "very cautious" at this conjuncture. If the market can take off this strong resistance, we will have a potential “Triple Top break out” from June high, August high and September high. The potential targets from this break out are 1150, 1160, and MAY high at 1170s range. Next support levels are the 200d-MA at 1116.16, the 50d-MA at 1193.70, and the 20d-MA at 1087.70. Let’s see what the market will do next week into the FED meeting and wait for a high probability set-up. We would be a buyer if the June high is taken out with strong institutional participation and volume. And we would be a seller of the market if the S&P 500 fall bellow the 200d-MA at 1116.16 and especially below the 50d-MA at 1093.70. On that note, wishing everyone a great weekend.

Best regards to all, and good luck in your trading.