Oct. 3, 2013

I took Dividend Champions list (from David Fish's table dripinvesting.org/tools/U.S.DividendCham... published 9/30/2013) and added numbers for from MSN.com (also from Yahoo.com if MSN doesn't provide info) about Insider and Institutional Ownerships (see table at the end of this post).

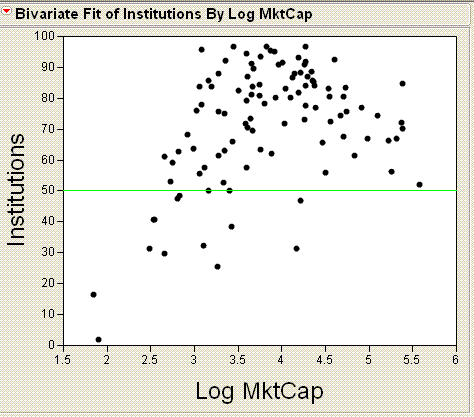

In average institutions hold about 71.5% and insiders about 3.5% of outstanding shares. Except very few exceptions the institutions hold more than half of shares (see picture below).

Presumably the insiders and institutions are "smart hands" with better understanding of a company than a small retail investor. It is also know that nowadays the institutions hold shares for less than 1 year (data before high-frequency trading became popular). All these mean that most probably your trading partner has "smart hands". Do you still trade often? I'm not. I think the only 2 advantages I have to compare with my trading partners are ability to hold stocks for long period (several years or decades) /see also seekingalpha.com/instablog/725729-sds-se.../ and possibility to buy nano-caps without price distortion (and with the same effect to my income as large caps have in case of equal weighting) /see also https://seekingalpha.com/instablog/725729-sds-seductive-dividend-stocks/787591-the-last-resort-a-few-words-about-liquidity-and-small-investors/.

| Symbol | Insiders | Institutions | MktCap ($Mil) | "Smart Hands" |

| ABM | 11.24 | 85.65 | 1463 | 96.89 |

| ADM | 1.73 | 76.87 | 24351 | 78.6 |

| ADP | 1.69 | 80.55 | 34923 | 82.24 |

| AFL | 0.82 | 65.62 | 28839 | 66.44 |

| APD | 0.33 | 85.8 | 22316 | 86.13 |

| ATO | 2.52 | 71.79 | 3859 | 74.31 |

| AWR | 1.53 | 76.03 | 1064 | 77.56 |

| BCR | 1.37 | 90.91 | 9193 | 92.28 |

| BDX | 0.43 | 87.2 | 19492 | 87.63 |

| BEN | 32.7 | 56.08 | 32028 | 88.78 |

| BF-B | 4.99 | 31.5 | 14560 | 36.49 |

| BKH | 2.07 | 75.13 | 2202 | 77.2 |

| BMS | 2.8 | 87.04 | 4014 | 89.84 |

| BRC | 2.07 | 83.69 | 1577 | 85.76 |

| BWL.A | 34.41 | 16.38 | 70 | 50.79 |

| CB | 0.5 | 85.5 | 23252 | 86 |

| CBSH | 3.72 | 57.6 | 3950 | 61.32 |

| CINF | 5.05 | 62.03 | 7711 | 67.08 |

| CL | 2.43 | 75.64 | 55333 | 78.07 |

| CLC | 1.53 | 96.76 | 2782 | 98.29 |

| CLX | 0.48 | 71.85 | 10740 | 72.33 |

| CSL | 2.11 | 91.18 | 4457 | 93.29 |

| CSVI | 4.12 | 29.93 | 448 | 34.05 |

| CTAS | 1.75 | 78.46 | 6253 | 80.21 |

| CTBI | 5.25 | 47.42 | 632 | 52.67 |

| CTWS | 4.7 | 40.64 | 348 | 45.34 |

| CVX | 0.05 | 72.07 | 233449 | 72.12 |

| CWT | 2.15 | 63.8 | 970 | 65.95 |

| DBD | 2.64 | 75.78 | 1870 | 78.42 |

| DCI | 4.28 | 93.43 | 5639 | 97.71 |

| DOV | 1.04 | 93.17 | 15371 | 94.21 |

| ED | 0.35 | 46.98 | 16151 | 47.33 |

| EFSI | 12.99 | 1.81 | 80 | 14.8 |

| EGN | 0.42 | 84.31 | 5513 | 84.73 |

| EMR | 0.68 | 74.29 | 46383 | 74.97 |

| EV | 9.57 | 83.78 | 4566 | 93.35 |

| FDO | 4.41 | 95.15 | 8281 | 99.56 |

| FRT | 1.1 | 96.69 | 6609 | 97.79 |

| FUL | 2.31 | 92.08 | 2256 | 94.39 |

| GPC | 0.9 | 80.28 | 12542 | 81.18 |

| GRC | 0.6 | 68.38 | 842 | 68.98 |

| GWW | 12.02 | 73.22 | 18232 | 85.24 |

| HCP | 0.9 | 96.73 | 18617 | 97.63 |

| HP | 3.04 | 95.4 | 7338 | 98.44 |

| HRL | 0.91 | 83.09 | 11145 | 84 |

| ITW | 0.21 | 83.3 | 34291 | 83.51 |

| JNJ | 0.08 | 70.14 | 243573 | 70.22 |

| KMB | 0.19 | 72.43 | 36246 | 72.62 |

| KO | 1.18 | 66.43 | 168414 | 67.61 |

| LANC | 2.22 | 52.65 | 2136 | 54.87 |

| LEG | 2.57 | 73.47 | 4396 | 76.04 |

| LOW | 0.27 | 80.55 | 50800 | 80.82 |

| MCD | 0.11 | 67 | 96345 | 67.11 |

| MCY | 0.24 | 38.54 | 2654 | 38.78 |

| MDT | 0.51 | 83.49 | 53767 | 84 |

| MGEE | 0.16 | 32.32 | 1261 | 32.48 |

| MHFI | 1.16 | 90.87 | 17991 | 92.03 |

| MKC | 1.29 | 80.3 | 8547 | 81.59 |

| MMM | 0.19 | 76.96 | 82178 | 77.15 |

| MO | 0.41 | 61.43 | 68769 | 61.84 |

| MSA | 8.46 | 61.58 | 1903 | 70.04 |

| MSEX | 2.1 | 40.62 | 339 | 42.72 |

| NC | 5.65 | 61.27 | 453 | 66.92 |

| NDSN | 8.02 | 89.63 | 4722 | 97.65 |

| NFG | 3.35 | 63.53 | 5745 | 66.88 |

| NUE | 0.82 | 81.84 | 15633 | 82.66 |

| NWN | 0.86 | 55.65 | 1132 | 56.51 |

| ORI | 1.23 | 79.27 | 3954 | 80.5 |

| PEP | 0.28 | 74.34 | 123066 | 74.62 |

| PG | 0.2 | 66.95 | 207585 | 67.15 |

| PH | 1.29 | 88.2 | 16232 | 89.49 |

| PNR | 0.32 | 86.82 | 13124 | 87.14 |

| PNY | 2.2 | 50.3 | 2491 | 52.5 |

| PPG | 0.48 | 84.19 | 23956 | 84.67 |

| RAVN | 9.37 | 77.91 | 1192 | 87.28 |

| RLI | 7.25 | 87.9 | 1863 | 95.15 |

| RPM | 2.01 | 69.65 | 4674 | 71.66 |

| SCL | 7.59 | 57.73 | 1302 | 65.32 |

| SHW | 1.92 | 92.03 | 18522 | 93.95 |

| SIAL | 0.58 | 91.61 | 10236 | 92.19 |

| SJW | 14.76 | 59.34 | 562 | 74.1 |

| SON | 1.82 | 70.7 | 3997 | 72.52 |

| SRCE | 4.92 | 62.93 | 656 | 67.85 |

| STR | 1.46 | 94.34 | 3947 | 95.8 |

| SWK | 1.69 | 88.1 | 14044 | 89.79 |

| SYY | 0.78 | 84.11 | 18873 | 84.89 |

| T | 0.09 | 56.4 | 181985 | 56.49 |

| TDS | 0.54 | 82.44 | 3203 | 82.98 |

| TGT | 0.29 | 92.65 | 40615 | 92.94 |

| TMP | 6.05 | 48.4 | 667 | 54.45 |

| TNC | 2.64 | 83.8 | 1132 | 86.44 |

| TR | 25.53 | 25.67 | 1839 | 51.2 |

| TROW | 6.66 | 77.58 | 18572 | 84.24 |

| UBSI | 2.49 | 50.14 | 1459 | 52.63 |

| UGI | 1.28 | 81.1 | 4470 | 82.38 |

| UHT | 1.47 | 53.09 | 531 | 54.56 |

| UVV | 3.95 | 95.73 | 1188 | 99.68 |

| VAL | 2.49 | 81 | 5533 | 83.49 |

| VFC | 0.79 | 88.6 | 21751 | 89.39 |

| VVC | 0.38 | 66.16 | 2745 | 66.54 |

| WAG | 0.69 | 67.57 | 50986 | 68.26 |

| WEYS | 12.06 | 31.31 | 305 | 43.37 |

| WGL | 1.13 | 63.22 | 2209 | 64.35 |

| WMT | 0.93 | 84.86 | 242441 | 85.79 |

| XOM | 0.42 | 52.03 | 381415 | 52.45 |

| AVERAGE | 3.455048 | 71.5224762 | 29203.12381 | 74.97752381 |

I really do not understand DGis who report about their portfolio each quarter and adjust it even more frequently.I think they must ask themselves the question I use in the title of this blogpost.