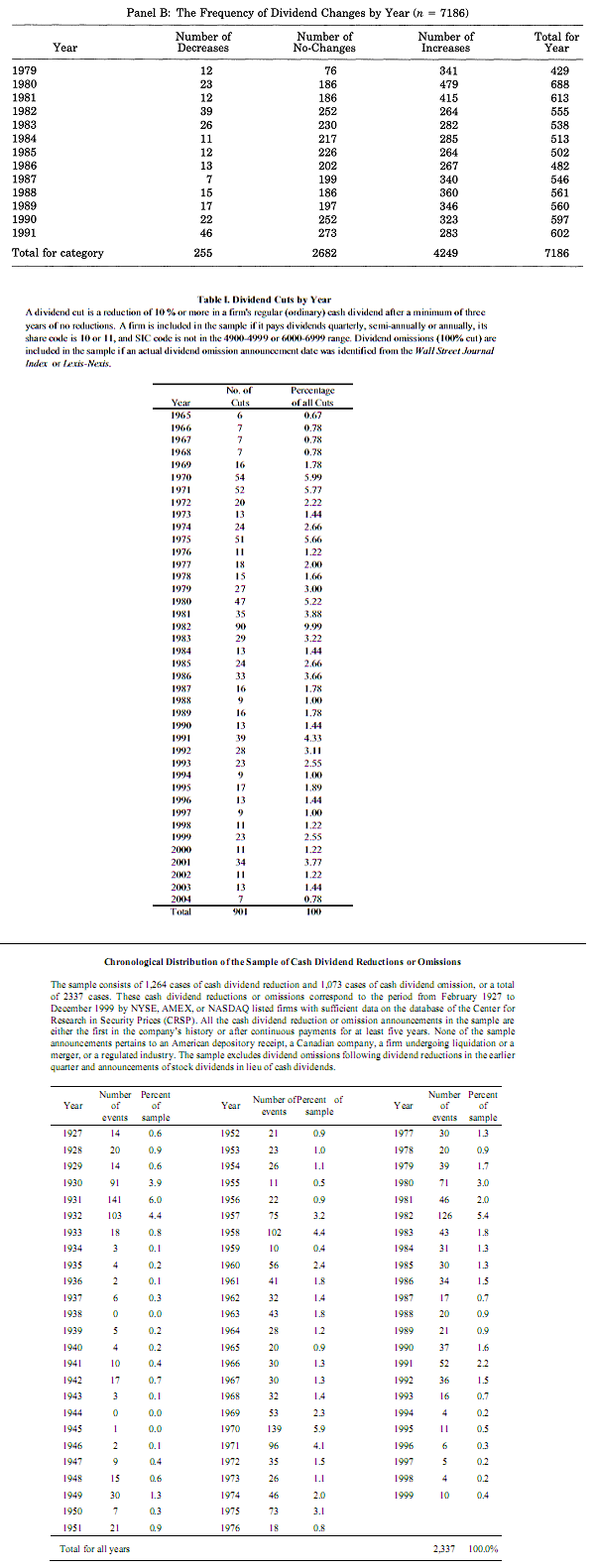

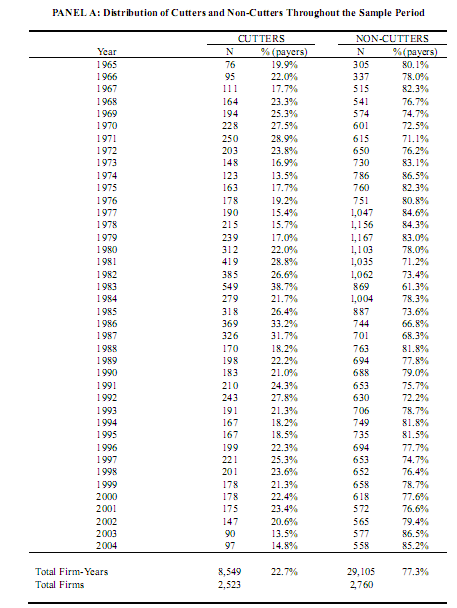

Probability of dividends cuts have been studied in few academic papers. The results depend on requirements to pre-cut dividends history and magnitude of cut. For simplest case cut is just the case if current dividend is smaller than previous dividend (even if previous was huge special dividend) about 23% of companies reduce dividends (fig. 1).

When few years of "positive" dividend history (e.g. 5 years of non-decreasing dividends), minimal cut (e.g. at least 15%) and special dividends are considered the results are not so scare (fig. 2).

Moreover, some authors note that probability of dividends cut is smaller if a company increased dividends in few previous years to compare with companies with fixed (constant) dividends.

Recent (around year 2009) massive dividend cuts change this statistics but hopefully good selection of dividend stocks reduces risk of cuts for a smart investor. Not so smart investor can diversify portfolio between several various dividend stocks, so each cut will be not so damaging.

The old Wall Street sayings goes as "the only thing that goes up in a bear market is correlation". I'd add from 2008-2011 experience and numbers presented in the tables above another thing that goes up in a bear market is the number of dividend cuts and omissions.

Added 1 May 2013:

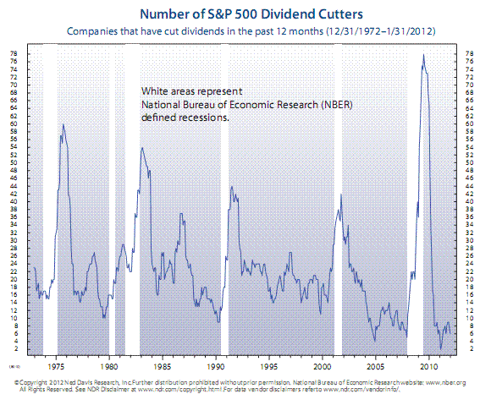

The following graph shows number of dividend cuts for S&P 500 companies:

Please not that not ALL S&P 500 companies had DG or steady dividends patterns before the cut. Anyway it seems that average annual probability of the cut is about 4%.