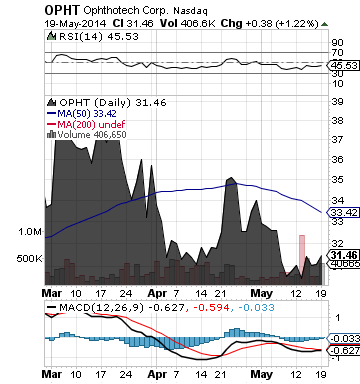

Ophthotech Corporation (OPHT)

Ophthotech Corporation (OPHT)

OPHT said that it has entered into an ex-US licensing and commercialization agreement with Novartis Pharmaceuticals (NVS) focused on the treatment of wet age-related macular degeneration (AMD).

Under the agreement, the company grants Novartis exclusive rights to commercialize OPHT's Fovista(R), in markets outside the United States while OPHT retains sole rights to commercialize Fovista(R) in the U.S.

Potential payments to OPHT under the agreement could total over $1 billion in upfront and milestone payments, not including future royalties. OPHT could receive immediate payment and near-term milestones totaling up to $330 million, including an upfront fee of $200 million and Fovista(R) Phase 3 enrollment-based milestones of up to $130 million. OPHT is entitled to receive royalties on ex-US Fovista(R) sales.

OPHT's Fovista(R) is the most advanced anti-PDGF agent in development for the treatment of wet AMD and, if approved, is expected to be first to market in this class of therapies for wet AMD.

Brokerage firm JPMorgan has raised its price target for OPHT from $40.00 to $51.00 per share

OPHT is a biopharmaceutical company specializing in the development of novel therapeutics to treat diseases of the eye, with a focus on developing innovative therapies for age-related macular degeneration (AMD).

More about Ophthotech Corporation (OPHT) at www.ophthotech.com

**

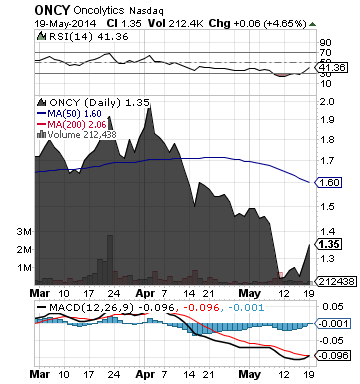

Oncolytics Biotech Inc. (ONCY)

Oncolytics Biotech Inc. (ONCY)

ONCY reported that an abstract detailing early data from translational study looking at the intravenous administration of its REOLYSIN(R) to patients with primary or metastatic brain tumors will be presented at the at the American Society of Clinical Oncology Annual Meeting being held May 30 - June 3, 2014 in Chicago, Illinois.

Based on the findings, the researchers concluded they have shown for the first time that an oncolytic virus, wild-type reovirus, infects and replicates in brain tumors following intravenous administration. It is anticipated this trial could pave the way for phase I/II trials and combination studies using wild-type reovirus in patients with high grade gliomas and brain metastases.

Treatment options for patients with brain cancer often include invasive surgery and local administration of therapeutic agents.

According to ONCY, with this early data suggesting that reovirus can cross the blood brain barrier, it may provide physicians with another, less invasive option in the treatment of both primary brain cancer and metastatic disease associated with other cancer types, which is estimated to occur in about one quarter of all cancer cases where it spreads through the body

The abstract, titled "Oncolytic wild-type reovirus infection in brain tumors following intravenous administration in patients," contends that intravenous delivery to brain tumors would be easier, cheaper and more acceptable to patients than intralesional administration. To date, no oncolytic virus has been shown to infect brain tumors following intravenous delivery.

ONCY is focused on the development of oncolytic viruses as potential cancer therapeutics.

More about Oncolytics Biotech Inc. (ONCY) at www.oncolyticsbiotech.com.

**

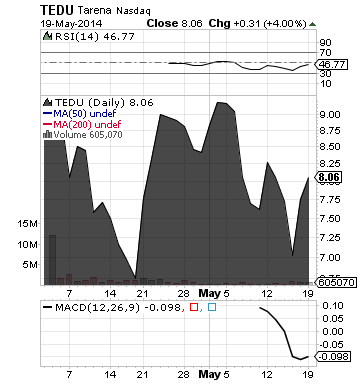

Tarena International, Inc. (TEDU)

Tarena International, Inc. (TEDU)

Keep a close eye on TEDU. The company reported strong performance on its first quarterly financial results as a public company.

For the first quarter 2014, TEDU posted net revenues of $24.3 million, a 60.7% increase year over year, gross profit of $15.8 million, a 72.6% increase compared to the same period the prior year, and net income of $1.0 million, representing a 1998.3% increase compared to the first quarter 2013

TEDU expects total net revenues for the second quarter of 2014 to be between $30.5 million and $31.5 million, representing an increase of 47% to 51% on a year-over-year basis.

TEDU is a leading provider of professional education services in China.

More about Tarena International, Inc. (TEDU) at ir.tarena.com.cn

**

Read Full Disclaimer at www.finance.crwe-pr.com/disclaimer

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.