- Digital Ally (DGLY) has been trying to break into the highly competitive wearable camera (or bodycams) market after the Ferguson, MI incident.

- 90% of DGLY's revenues come from in-car video recording systems, which is currently seeing price pressure.

- The bodycam market is much harder to break into than the in-car video recording market, because vendors with strong brand recognition take the lion's share of the market.

- Like a bad joke, DGLY's cloud based video website, vuvault.net, which it talks up as being able to compete with Taser's (TASR) evidence.com, is non-operational.

- DGLY hasn't had a profitable quarter in the past three years. With margins being squeezed in its core business, and an unsuccessful entry into the bodycam market, DGLY will remain unprofitable and continue diluting shareholders in order to survive as a going concern.

Digital Ally's Video Management Website Is Non-Operational

Digital Ally, Inc. (NASDAQ: DGLY) is promoting its stock by claiming it has received many more orders for its wearable camera since the Ferguson, MI incident. However, the reality is DGLY is having a hard time breaking into that market. Additionally, its cloud video management website, vuvault.net, is comically still non-operational.

Lately, DGLY has been promoting itself beyond hardware by promoting a new cloud based video data management solution called VuVault.net. DGLY claims it's designed to directly compete with Taser's (TASR) Evidence.com cloud solution. DGLY has been selling some bodycams, however, www.vuvault.net is not even operational. If you try and go to it, it says "this webpage is not available".

Video Cloud Management Is Essential For Police Departments

An article from the Wall Street Journal discusses the importance of video data management with police departments for their wearable camera footage.

NYPD Commissioner William Bratton said:

This is an extraordinarily complex initiative. It is not simply going down to your local RadioShack, buying one of these things, and putting it on. The storage issue is phenomenal.

Evidence.com is TASR's cloud solution. Most of Taser's bodycams are sold with an evidence.com subscription. That's a testament to the importance of an included cloud solution.

As stated in TASR's latest 10-K:

"EVIDENCE.com and AXON cameras are sold separately, but in most instances are sold together."

Digital Ally Getting Its Margins Squeezed In Its Core Business

Over 90 percent of DGLY's revenues in 2013 and so far in 2014 are from in-car video recording systems. This is DGLY's core business, and is currently seeing increased price pressure. From its latest 10-Q filed on 8/14/14:

"Our gross profit on sales decreased to 55.9% during second quarter 2014 from 59.4% during first quarter 2014...we are experiencing increased price competition and pressure from certain of our competitors that has led to pricing discounts on larger contract opportunities. We expect that this pricing pressure will continue as our competitors attempt to regain market share and revive sales and that it will have some negative impact on our efforts to improve gross margins during 2014."

DGLY is already unprofitable. Eroding gross margins will make it harder for the company to ever become profitable.

Fierce Competition In The Bodycam Space

There are also many competitors that sell bodycams. There's Vievu, a private company in Portland, and, of course, Taser (TASR). You can find more competitors on Google. If you google search "police body worn camera" it results in eight different brands and retailers, and Digital Ally isn't one of them in that particular Google search.

TASR is the price leader in body cameras. They can do this because the hardware is a commodity, and the real profit is from their subscription service cloud data management on evidence.com. DGLY can't compete with the price pressures from TASR. In TASR's 10-K it states:

"The AXON flex and the AXON body are currently being sold at low gross margins in an effort to continue to accelerate the Company's traction in the market."

A year ago, TASR reduced its AXON Flex price to only $499, down from $949. DGLY's bodycam, FirstVue, has a hefty $900 price tag.

In the long run, selling a cloud service provides much better profits than selling hardware because it's a subscription with recurring revenues and better economies of scale, whereas hardware has lower profit margins.

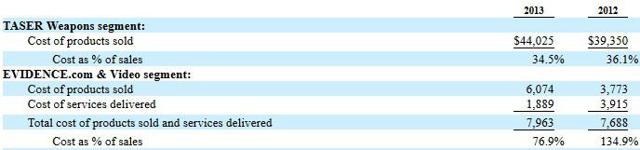

This is evidenced by TASR's Evidence.com and Video segment cost as a % of sales as shown in the 10-K:

As shown above, TASR's evidence.com & video segment cost as a % of sales got cut almost in half from 2012 to 2013, and wasn't profitable in 2012. It was profitable in 2013 because TASR had accumulated more evidence.com subscribers.

TASR offers the Evidence.com cloud solution to ease police dept IT tasks to manage large volume of video data. Police departments don't have strong IT support, usually only one IT guy.

DGLY's solution requires manually downloaded video files after each shift via USB port. This is cumbersome and not practical for a professional law enforcement office. DGLY's cloud solution (if it works), is based on MSFT Azure, which carries a higher cost compared to Taser's AWS-based Evidence.com offering.

DGLY's Overvalued Stock

This belief that DGLY can competitively enter the wearable bodycam space has made the stock very overvalued at over $10 per share. The company seems to agree. During DGLY's rally the company sold convertible bonds at a $6.10 conversion price, and warrants at a $7.32 exercise price. These conversion prices are much lower than where the stock is currently trading at over $12 per share.