For most of the past 15-20 years, the market has been flush with cash, and many stocks have traded at astronomical heights without real businesses to support them. In this exuberant market, fundamentals mattered little while momentum and technical rule the day. However, as excess liquidity dries up and global economic concerns weigh on the minds of investors, the reconciliation between cash flows and valuations has arrived. Now, fundamentals matter…a lot. Over the long term, it only makes sense to deploy capital into those businesses that actually generate adequate returns on invested capital (ROIC). Due to change in market mentality, and in light of the recent downturn in the market, we felt it time to revise our price target for Proofpoint (PFPT)

Proofpoint's Business Has Not Improved

We put Proofpoint in the Danger Zone in October 2015. Since then, PFPT is down 33% while the S&P 500 is down only 7%. Our report pointed out many problems with Proofpoint, which included:

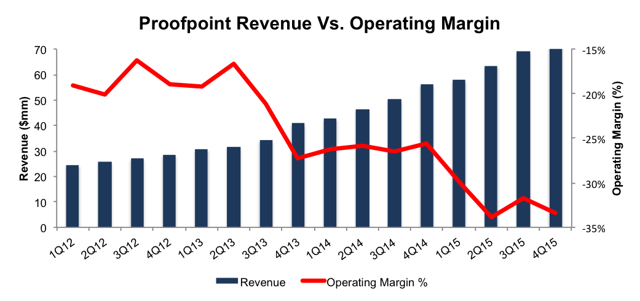

- Declining operating margins amidst revenue growth

- Operating in a crowded market

- More profitable competitors

- Minimal buyout value

- Overvalued stock price

Figure 1 shows that not only is revenue growth slowing, but Proofpoint's operating margins remain highly negative. Operating margin has fallen from -19% in 1Q12 to -33% in 4Q15. Proofpoint's after-tax profit (NOPAT) has fallen from -$19 million in 2012 to -$70 million over the last twelve months.

Figure 1: Proofpoint's Margins Continue To Lag

Sources: New Constructs, LLC and company filings

Ignore Non-GAAP Nonsense

Proofpoint is another company that tries to fool investors with non-GAAP metrics when reporting its results. Despite reporting GAAP net income of -$31 million in 4Q15, Proofpoint reports a positive $573,000 in adjusted EBITDA. How so? Proofpoint removes stock based compensation ($16 million in 4Q15, 22% of revenue), acquisition related expenses, and litigation expenses to help appear profitable when the reality of the business is in stark contrast.

Shares Remain Highly Overvalued

Despite a 33% decline in share price, Proofpoint remains significantly overvalued. In order to justify its current price of $40/share, Proofpoint must immediately achieve pre-tax (NOPBT) margins of 10% (compared to -29% over last twelve months) and grow revenue by 21% compounded annually for the next 22 years. In this scenario, Proofpoint would be generating over $13 billion in revenue in 22 years, which is nearly double one of its main competitors, Symantec's (SYMC) 2015 revenue.

Looking at a more reasonable (but still aggressive) scenario further highlights the downside risk in PFPT. If Proofpoint can achieve pre-tax margins of 10% and grow revenue by 15% compounded annually for the next decade, the stock is worth $2/share today - a 95% downside. In fact, without significantly higher revenue growth, Proofpoint's valuation remains negative with any pre-tax margin below 10%. It's clear how much downside risk still remains in PFPT.

Disclosure: David Trainer and Kyle Guske II receive no compensation to write about any specific stock, style, or theme.