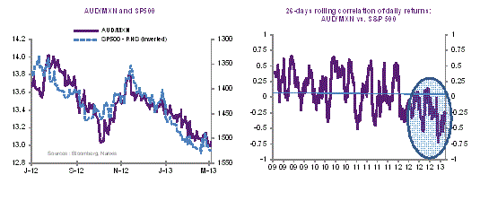

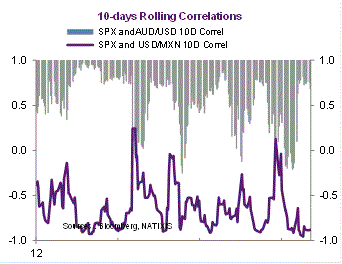

For many traders, the USD/MXN is considered the best hedge against SP 500 adverse moves. Said differently, the pair continues to react strongly to risk-on/risk-off episodes. On the contrary, the Aussie dollar is more sensitive to domestic factors as the correlation with the SP500 has weakened significantly

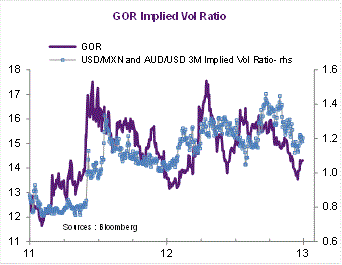

To dig deeper into this disconnect, I focused on the implied volatilities of both pairs. The chart below shows that the ratio of USD/MXN to AUD/MXN 3-month implied volatility is tracking the Gold-to-Oil ratio quite well. A higher GOR means higher risk aversion (gold outperforms oil when risk aversion rises), which comes along with an increase in the volatility ratio.

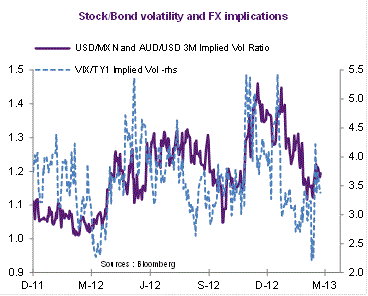

I also compared this implied-FX-volatility ratio to the ratio of VIX (implied stock market volatility) and the implied volatility of options on the first nearby T-Note future (see chart below).

Despite some temporary divergences, the link is quite robust: the FX ratio is highly sensitive to the relative implied volatilities of stocks vs. bonds. For that reason I say that MXN is Stocks and AUD is Bonds.

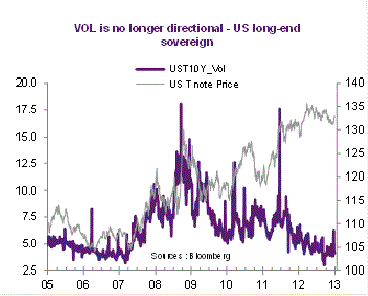

For medium run investors afraid of the Fed's exit from QE, it might be a useful tool: the chart below shows a wide disconnect between the price and the implied volatility of the first nearby T-Note future. Normalization of the monetary policy would come along with a (slow) convergence of bond price and volatility, pressuring the VIX/bond volatility ratio upward.

In the short run, the likelihood of a lower AUD/MXN and higher stock prices remains, if the correlation observed since 2012 does not break down (see in particular the negative correlation between the SP 500 and the AUD/MNN circled in the second chart below).

Based on the recent cross-asset relationships, the continuity of the equity rally should translate into a lower AUD/MXN.

The recent rebound of the AUD/MXN on a major support may temporarily halt the relationship, unless a slightly more hawkish RBA and a better than expected GDP utterly changes the ongoing negative reading of Australia's data. Something that remains dubious.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.