The Race to Vegas

On Monday, Nov. 3, Nevada Division of Public and Behavioral Health (DPBH) will issue 66 retail medical marijuana establishment permits statewide. DPBH will also issue some number of production and cultivation permits. Nevada will have a medical marijuana free market system with well-financed for-profit operators right off the bat in a state that will go recreational in the coming years (with a 2.5 million population, that won't be hard).

The wildcard that has always been still remains-Vegas. A place unlike any on earth is adding legal marijuana to its list of vices for sale in the city that is globally known as the Mecca of getting fucked up. Over 40 million visitors per year come to Las Vegas. When Nevada goes recreational, Las Vegas will have a cannabis market four times the size of Amsterdam's… The biggest in the world.

This has drawn some legitimate private and public companies to aggressively pursue permits to operate flagship, next-generation facilitates requiring upfront capital investments of $10 million to $15 million with the prospects and allure of making 100% to 150%+ margins as a vertical operator. In this pursuit are two public companies: Terra Tech Corp (TRTC: OTCQB) and Growblox Sciences, Inc. (GBLX: OTCQB).

Both companies made strong showings on Oct. 29, 2014, in front of the Las Vegas City Council, winning special use permits for the operations of medical marijuana facilities, pending state approval. Both companies have institutional capital markets funding-TRTC from Dominion Capital, a New York firm, and GBLX from Lazarus Investment partners. Unlike most popularly traded marijuana OTC names, TRTC and GBLX are going to be directly cultivating and selling weed to consumers (at the rate of thousands of people per day) and lawfully reporting the revenue. There are a handful of dispensaries in California that do $20 million to $30 million per year in revenue. If one of these public companies secured a permitted facility that makes that much revenue, it would become a billion dollar company, similar to many public peers in social media, biotech, and other growth industries.

It's not all rosy-the sophisticated financial firms mentioned above own the majority of tradable shares and are sitting on 100% to 300% capital gains paper profits. The possibility of them dumping shares onto retail sheep is real (killing the price per share). Although the firms would be well advised to ride the industries high margins for a period of time before cashing in equity, they should want to hold through 2016 and wait for full recreational legalization.

In the long term, these companies will need to have real revenue recognition and strong margins to sustain higher market caps and valuations. Can they do it? That's anyone's best bet, as there are many operational hurdles that will cause inexperienced operators to stumble and fail.

The short-term idea among cannabis traders is a special situation strategy with the Nov. 3 binary catalyst that could lead to transformative corporate events (read: receiving permits). We have seen an influx of buying the past few days in anticipation of this decision. Based on the ranking systems used, the probability of certain applicants receiving permits is almost certain. Do the words 'shoe-in' come to mind?

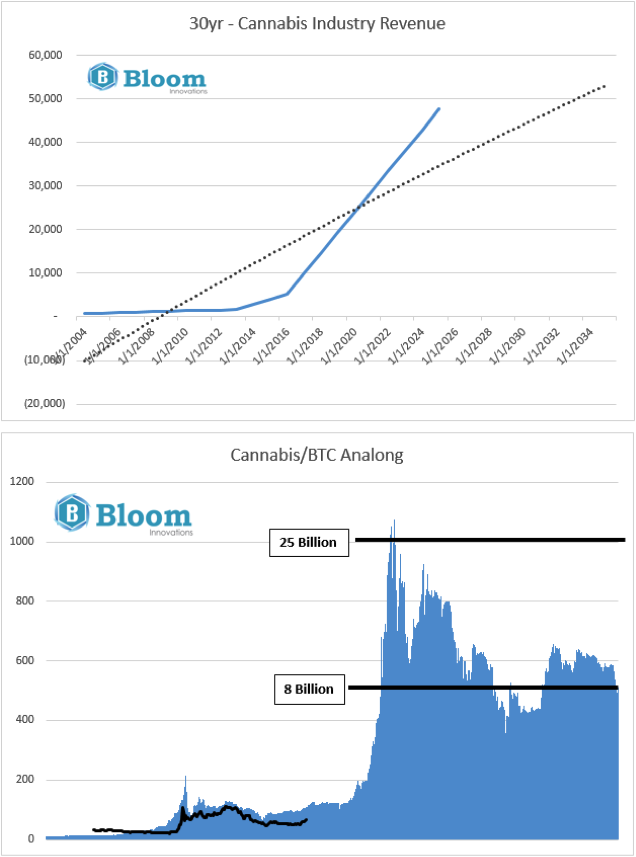

Cannabis Industry

Total regulated cannabis revenue in the U.S. is around $1.8 billion annually. It is assumed the grey and black markets do $30 billion to $40 billion annually in revenue. In the next three years, revenue transformation will come to regulated operators with permits. Free market practices in liberal states will drive consumer market growth. The positive feedback loops associated with cannabis being a "smart drug" will drive the younger generation away from alcohol in favor of cannabis. The alcohol industry produces $300 billion in "economic benefits" annually. It is a conservative estimate that the cannabis industry is worth one-tenth of the alcohol industry, reinforcing the $30 billion cannabis annual revenue estimate.

The invisible hand will guide cannabis legalization on the state level for tax revenue. Attention to cannabis on the federal level will come when 2016 electoral candidates start taking stances. Likely cannabis decriminalization will be a center-of-the-aisle stance for both parties. In time, the federal government will reschedule cannabis as Schedule 3 and effectively end its century-long prohibition. The federal government will require cannabis taxes and leave states to regulate their own cannabis markets.

Investment Strategy

The question remains: what is the most effective way to position yourself as an institution or individual investor to capture the alpha that will be created within public and private cannabis companies? Most active equity market participants will only be looking to make short-term trades as these regulatory special situations present themselves. This strategy works well for institutional traders and retail traders alike. When you're on the profitable side of the trade, you will achieve superior investment results that outperform Paul Tudor Jones and Stanley Druckenmiller. However, this strategy in the OTC marijuana world is limited by its scalability and liquidity constraints. For a true long-term value investor looking to put $5 million to $10 million to work in the cannabis industry, this special situation equity market strategy would not be ideal.

The value investor looking to get into the cannabis industry would be much better off with a strategy that focuses on capitalizing on the favorable operating margins within the industry while investing in a capital structure that allows for the shared benefit of enterprise value appreciation. These types of investments are often early stage, project specific, and limited to accredited investors only. However, new crowd funding regulation gives limited access to sophisticated non-accredited investors. These opportunities are few and far between, and you must be seeking them out-they will not come to you.

As a value investor myself, I answered this question with action. I helped create Bloom Innovations, Inc. A few months ago I was recruited to help a group out of Oakland, CA structure Securities and Exchange compliant cannabis investments and begin the process of writing their S-1. This group is now Bloom Innovations, Inc. Our team has over 100 years combined of cannabis industry experience. We helped submit applications for nine medical marijuana permits in Nevada and will play an integral role in the development and operations of those facilities. In addition, we have product and licensing agreements in California and Arizona. We have conducted two successful rounds of equity offerings.

Bloom Innovations, Inc. manages a diverse network of cannabis assets in the form of property, plants, equipment, real estate, intellectual protocols and procedures, pending patents, smokeless products, and marketable securities in publicly traded cannabis companies. In addition, the company provides cannabis operators with ancillary consulting and management services. Bloom's intellectual property includes trade secrets involving cultivation, production, and infused-product development (edibles and smokeless products). Bloom operates commercial scale, vertical facilities for permitted operators.

Disclosure

I own common stock equity in TRTC and GBLX. I find these names to be reasonably valued given the potential growth of the industry and their ability to lawfully represent the revenue earned. Unlike like most OTC names, these companies do have somewhat respectable reporting requirements and are "fully reporting" (or so they say). It's conceivable they could up-list to the NASDAQ within one to two years. The amount of money I have invested in these names is nominal in relation to my income/savings. I highly discourage any investor to take a position that could adversely affect their lifestyle if their investment thesis is wrong. I am the CFO of Bloom Innovations, Inc. and have an uncomfortable amount of my money invested in my own company. If you are someone like myself that wants to capitalize on the industry, I suggest finding true operators and investing in tangible cannabis-related projects. Only if your behavior is unconventional is your investment performance likely to be above average.

- See more at: thenug.com/galleries/the-race-to-vegas-v...