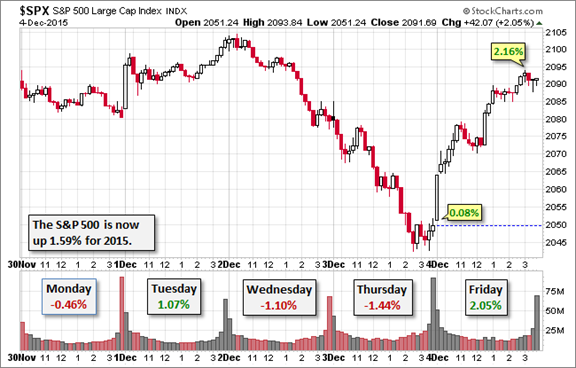

The S&P 500 Index closed on Friday at 2,091.69, up 0.07% on the week. The stock market shrugged off weaker than expected economic reports and a tepid stimulus move from Mario Draghi of the European Central Bank. Friday's very strong November jobs report and further comments by Federal Reserve chair Janet Yellen encouraged the market that a Fed interest rate hike will indeed take place at their December 15/16 meeting. The ensuing rally was the strongest in 3 months and shows how much the markets want this uncertainty cleared up, especially as it would indicate the Fed's affirmation of a strong U.S. economic outlook.

The week started with the Institute of Supply Management's Manufacturing Index coming in at 48.5, under the 50 reading that indicates growth in the manufacturing sector. Sharp cut backs in energy spending, which are well known to market participants, contributed to the weak reading. The week ended, however on a strong note, as mentioned above, with a November Employment Report on Friday that showed significant growth in the job market and an increase in average hourly wages.

These reports contain much of the data that the Fed will consider when making its rate hike decision and obviously the stock market wants a rate hike at this point in time

We once again rallied back up to the lower end of resistance in the 2,100 - 2,135 area, but failed penetrate it. The fact that market breadth as measured by advancing vs. declining stocks and New Highs vs. New Lows, was poor on Friday is concerning. When combined with continuing negative Power Bar readings for the S&P 500 Index and negative Chaikin Money Flow as the SPY ETF reached overbought territory, a cautionary stance, at least until the Fed's announcement on the 16th, is warranted.

While we continue to like the longer-term prospects for the U.S. economy and the stock market, the continued inability to break out to new highs in a pre-election year is disturbing.

Below is an intra-day chart of the S&P 500 Index, courtesy of Doug Short at advisorperspectives.com, which shows the market's sensitivity to the Fed's impending rate hike decision. Once again we see the S&P 500 Index hit a wall at the lower end of the 2,100 - 2135 resistance area. Friday's rally erased most of the mid-week losses and the S&P 500 Index actually closed up a tad on the week.

Continue to use market declines of 1 ½ to 3% to buy stocks with bullish Chaikin Power Gauge Ratings.

You can find classic Chaikin bulls and bears in our Hot Lists where you can also find recently bullish stocks in a new Chaikin Hotlist called Bullish Turnarounds in the Featured Bulls and Bears tab in Chaikin Analytics.

For more stock market insights like this, subscribe to Power Suite Premium, which includes Marc Chaikin's weekly (Sunday) stock market analysis report, Market Insights.

Disclaimer: Chaikin Analytics LLC is not registered as a securities broker-dealer or advisor either with the U.S. Securities and Exchange Commission or with any state securities regulatory authority. Chaikin Analytics does not recommend the purchase of any stock or advise on the suitability of any trade. The information presented is generic in nature and is not to be construed as an endorsement, recommendation, advice or any offer or solicitation to buy or sell securities of any kind, but solely as information requiring further research as to suitability, accuracy and appropriateness. Users bear sole responsibility for their own stock research and decisions. Read the entire disclaimer.