Trinity Biotech plc (TRIB) is a developer and manufacturer of diagnostic products for the point-of-care (POC) and clinical laboratory markets.

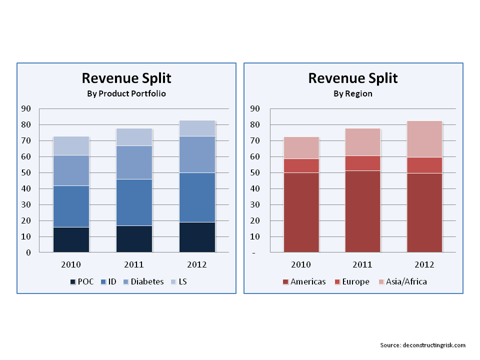

Trinity's POC products primarily relate to testing for the presence of HIV antibodies and made up 23% of 2012 revenues. Within the clinical laboratory product lines, there are three product portfolios - namely infectious diseases, diabetes and life science supply.

Trinity's largest and most diverse clinical laboratory product portfolio, at 37% of 2012 revenues, relates to tests for diagnosing a broad range of infectious diseases including kits for autoimmune diseases (e.g. lupus, celiac and rheumatoid arthritis), hormonal imbalances, sexually transmitted diseases (syphilis, chlamydia and herpes), intestinal infections, lung/bronchial infections, cardiovascular, lyme and a wide range of other diseases.

The next largest clinical laboratory product portfolio, at 28% of 2012 revenues, come from Trinity Biotech's 2005 acquisition of Primus Corporation and primarily relate to instruments and products for in-vitro diagnostic testing, using patented HPLC (high pressure liquid chromatography) technology, for haemoglobin A1c used in the monitoring of diabetes. One of the key drivers of future growth for TRIB is its latest device, Premier Hb9210, for detecting and monitoring diabetes which was launched in 2011.

Trinity's final clinical laboratory product portfolio, at 12% of 2012 revenues, relates to reagent products used for the diagnosis of many disease states from liver and kidney disease.

A split of TRIB's revenues for the past 3 years by product portfolio and geographical regions is as per the graph below.

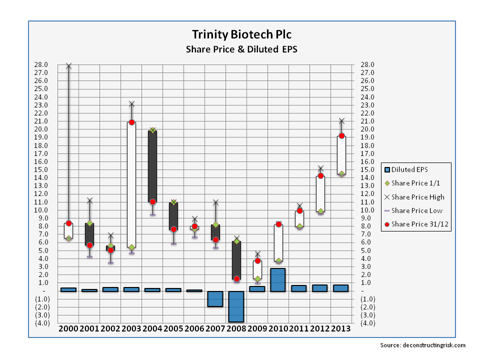

TRIB has been on a rollercoaster ride through its past as the graph below of its share price and diluted EPS from 2000 to today shows.

TRIB's shares dropped from a high of $20 in 2004 to a low just above $1 in 2009 and have since climbed steadily over the past 5 years to around $19 today. In 2007 and 2008, $19 million and $86 million of goodwill were written off in each year plus a few million in restructuring expenses and inventory over the two years after a number of missteps and lackluster results.

In 2010, TRIB sold its lower margin coagulation business for $90 million which resulted in a net gain of $46.5 million for the 2010 financial year. Acquisitions have always been a key aspect of TRIB's business model and following the sale of the coagulation business, TRIB acquired Phoenix Bio-tech Corp in 2011 and Fiomi Diagnostic in 2012. These companies made products for the detection of syphilis and tests for cardiac arrest and heart failure. In July 2013, TRIB announced the acquisition of Immco Diagnostics Inc for $32.75 million. Immco is a US diagnostic company specializing in the specialty autoimmune segment, where the competition is limited to a small number of key players, for conditions such as Rheumatoid Arthritis, Vasculitis, Lupus, Celiac and Crohn's disease, Ulcerative Colitis, Neuropathy, Hashimoto's and Graves disease.

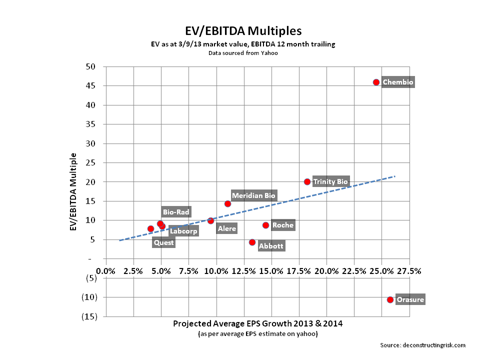

Generally, the entire Diagnostic Industry is set to gain from the ageing population and a rising demand for rapid test evaluations. TRIB has some core product catalysts over the next few years including the ramping up of sales of the Premier instruments for diabetes, its new cardiac product portfolio from Fiomi, a new range of POC products, and now the Immco acquisition. Gross margins are around a healthy 50% with net operating margins around 20%. With no debt and a healthy cash pile (albeit a reduced one to about $30 million after the Immco acquisition), TRIB's valuation has screamed ahead. The graph below shows its current EV/EBITDA multiple (adjusted for Immco purchase) against its peers using the analyst expected EPS growth from 2012 to 2014 (sourced from yahoo).

TRIB's valuation is clearly at a premium to its peers (Chembio and Orasure have their own issues and are smaller and less diversified than TRIB). So is it justified?

The first thing to note is that TRIB's intangibles have risen steadily since the 2007/8 write-downs on recent acquisitions to $75 million at year end 2012 and may touch the $100 million mark following the acquisition of Immco (this level of intangibles has not been seen since 2007). The company does provide detail in its 20F filing on its impairment methodology and the discounts used in its goodwill calculation.

Based upon the company's own guidance and the latest conference call, I have calculated initial EBITDA and EPS projections. Analysts estimate 0.80 and 1.06 EPS for 2013 and 2014. My projections generally agree with these EPS projections and also show EPS growth of 20% a year thereafter for 2015 to 2017. Based upon TRIB reverting to a more normal sector EV/EBITDA multiple of 15 in the medium term, I can see a reasonable target for TRIB of $30/$35 by 2016/17.

However, there is a lot of assumptions and execution risks in my analysis. My current risk appetite means that I would prefer to wait on the side-lines for a better entry point than the current $19. It seems to me that $16 or below would be an attractive risk/reward for a 3 to 4 year play (subject to relative macro-economic stability). That strategy risks the possibility of the boat already having sailed on this one as flawless execution on the Q3 and Q4 EPS may push the stock into the mid 20′s.

TRIB is a quality company with hard won experiences and an exciting product pipeline. For me, it's a pity about the frothy valuation.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.