Though I am known as recommending individual stocks as investments, I have been asked by my family, friends, and readers which mutual fund I would recommend for people who simply are too afraid to invest in individual securities and after studying plenty of different mutual funds, I think I have a good candidate. When I first began this journey, I had to get my "growth stock" way of thinking out of my mind, I mean I was trying to find an investment vehicle that even my sister (if you knew her you would understand) would not get nervous about. I also needed it to be highly rated by Morningstar, low in cost, and performance comparable to the S&P 500 over a long period of time. The fund that I have chosen is the Wellesley Income Fund (VWINX) from Vanguard.

The Fund Profile

According to Vanguard, The Wellesley Income fund has been around for 40 years and is considered a conservative balanced fund that typically invest in both stocks and investment-grade bonds. The fund is unique in its allocation: one-third to stocks and two-thirds to bonds. The fund is a no-load fund with a yield of around 2.3%. and an expense ratio of .25%. The Wellesley Income Fund also has a five-star rating from Morningstar.

The Performance

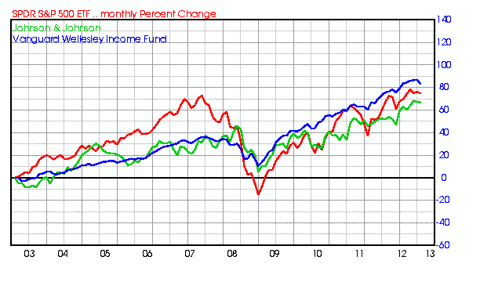

The Wellesley Income fund has had a total return of over 35% (dividends reinvested) over the last 5 years, this easily surpassed the total return of the S&P 500 of about 6% (dividends reinvested). The fund also managed to accomplish this with less volatility than the Index. I have also attached a chart showing the monthly percentage change over the last ten years (dividends reinvested) comparing The Wellesley Income Fund (VWINX) to both the S&P 500 (SPY) and the bellwether Johnson & Johnson (JNJ). The total return of The Wellesley Income Fund over the last ten years is around 96% with dividends reinvested which is slightly higher than the S&P 500 which returned about 93% and trumps the return of 70% for Johnson & Johnson. Statistics and descriptions form various sources including Yahoo!, MSN, Low-Risk Investing and Stock Rover.

Chart Courtesy of Barchart

Conclusion

It is rare to find mutual funds that can consistently beat the major market indexes, but to find a conservative balanced fund that can manage to do it is nothing short of a miracle in my opinion. The Wellesley Income Fund from Vanguard is the one fund that I can now recommend to long-term investors both new and old, with its low costs, market beating performance, and minimal volatility; it is truly a fund for everyone.

Disclaimer: All articles are written as an opinion of the writer or writers. The contributors on this website are not professional investment advisors. These articles are written to share investing ideas that may be of interest to the reader. Always seek the advice of a professional investment advisor before investing.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.