China's Recovery Falters as Manufacturing Growth Cools - Bloomberg.

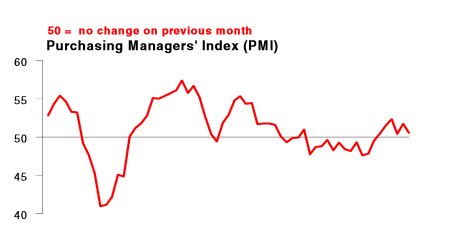

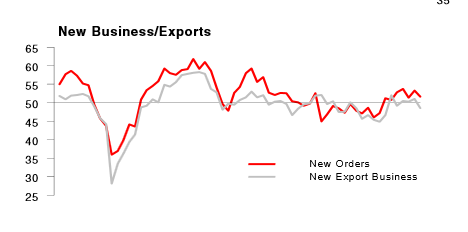

The China recovery meme will die hard. Despite its economy slowing to stall amidst a decline in new export orders, commentators seem to believe that China has solved the problem of the business cycle.

The country has been maintaining its growth rate through a credit boom leading to malinvestment in the housing market and state industries. Since these assets are providing no returns, a nasty recession is in China's future, but not today.

Jim O'Neill: I Wouldn't Put My Family Money in Bunds.

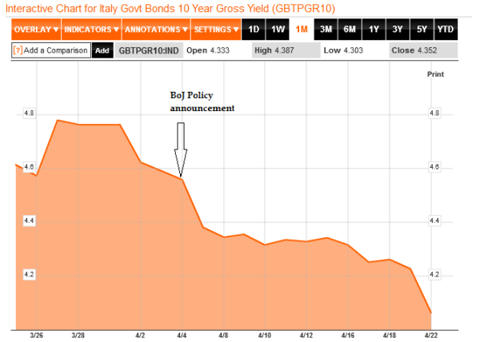

The most interesting thing about this article is that the Mr. O'Neill has spotted the same trend that we have been following for a few weeks now. He believes that cheap yen is flooding the markets pushing asset prices up. European sovereign bonds have definitely benefited from the money and from traders frontrunning the promise of moar money in the future.

Note the recent performance of Italian bonds above and remember that the country is experiencing a nasty recession and has not had a government for nearly two months.

Emerging-Market Returns Unhinge From Developed: Chart of the Day - Bloomberg.

This is an interesting chart. The article reports that wage inflation is sapping growth in the BRICs leading to stock market divergence, but I do not agree. It seems that established stock markets are just receiving more cheap central bank money, because they are perceived as less risky. The BRICs are growing faster than Europe and Japan and about even with the U.S., so differing growth rates do not provide a compelling explanation for this divergence.

Italy's Napolitano accelerates search for new government | Reuters.

Even though Napolitano is pressing ahead with forging a government, I still believe that a second round of elections is in Italy's future. Only a grand coalition between the left and right has a chance of forming a government. Berlusconi's bloc is not objecting to new Democratic Left leader Matteo Renzi, so it will allow a government to form. However, the center right is now ahead in the polls by 9 points. Surely, Berlusconi must realize that he has a decent chance of forming a government after a second round of elections. Meanwhile, the 5 Star movement does nothing.

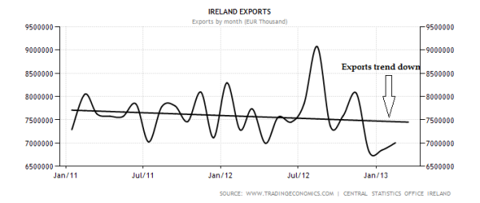

Ireland says will invest in economy only if targets are met | Reuters.

I think that Ireland is getting ahead of itself here. It is counting on projected economic growth to raise tax receipts and reduce its budget deficit to 4.5%. Unfortunately, its largest trading partners are performing poorly sapping demand for Irish exports. Growth will be hard to come by in 2013 and the budget deficit and unemployment will remain stubbornly high for the immediate future.