I wrote a instablog piece yesterday pointing out how there has been a large buyer of (EOI) recently and that I felt (EXG) was a significantly better value and to make the swap out of EOI and into EXG.

Digging a little deeper, there seems to be more of a correlation with EOI and (ETJ) that may be more of an explanation for EOI's sudden popularity, up 1.8% today in a mixed market.

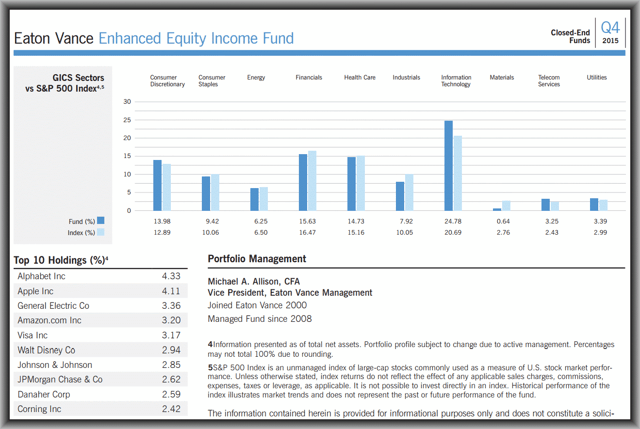

EOI and ETJ have almost the exact same top 10 holdings in order as well as the exact same sector weightings as of 12/31/15. In other words, the two fund's portfolios appear to be very similar. Here is EOI's fact sheet...

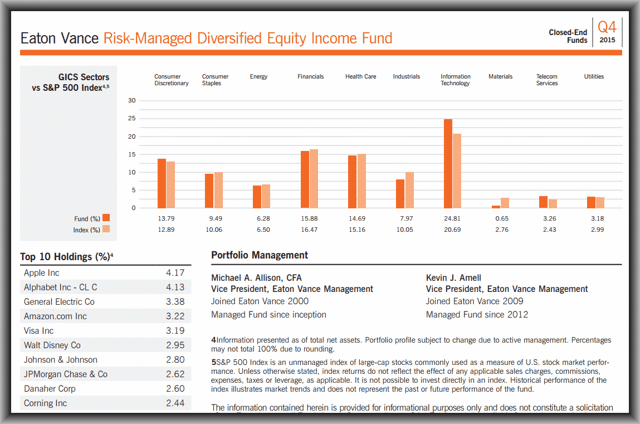

And here is ETJ's fact sheet...

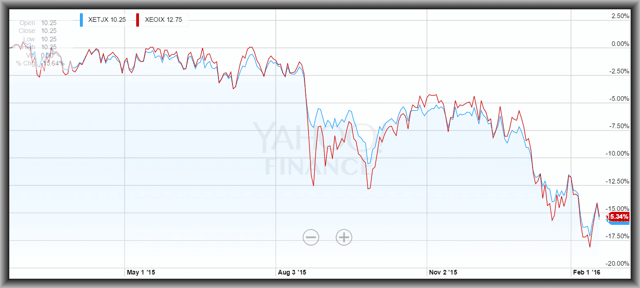

This can be further shown in a 1-year chart of the two fund's NAVs,(XEOIX) for EOI and (XETJX) for ETJ.

Now, obviously the difference in the two funds is their option sleeves. EOI sells (writes) call options against roughly 48% of its individual stock positions while ETJ writes 96% of the portfolio value against the S&P 500 index. ETJ also goes one more big step and buys S&P 500 index put options on 96% of the value of the portfolio as well, which makes ETJ very defensive.

So is someone making a bullish bet by swapping out of ETJ and into EOI? If so, you would have virtually the same equity portfolio but not nearly as much defensive option positions. ETJ, down -1.1% currently, has been somewhat weak recently so I'm wondering if maybe that is what is going on.

Considering ETJ's very defensive option positions, its NAV is only outperforming EOI's by a slight amount, -6.4% YTD for ETJ vs. -7.6% YTD for EOI so perhaps someone is thinking either the bulk of the correction in the markets is already over or perhaps they're thiking its not worth the added protection.

Or, one may have nothing to do with the other. But if, in fact, this is what is going on, I don't necessarily agree with this swap. If this advance for EOI holds up today, the fund will be at a very narrow discount while ETJ will be at roughly a -10% discount. This, for a fund that has dramatically more downside protection than EOI. I'm not sure that's a good bet.