Time can be used as one of the tests of excellence. 60 months on! covering a raging bull market, followed by a furious bear market, followed by another bull market and continuing to deliver overall outperformance is a true test that options trading can be done for consistent profits regardless of the market direction.

OP Income Newsletter September 2012 portfolios are on track to deliver double digit gains. As of Friday Aug 27th, overall portfolio is up +9.2% excluding gains from OPNExtra! which is a FREE feature for OPN members that includes directional as well as earning trades.

For Earnings special last month, there were a total of 17 closed trades of which 88% are winner (15 trades). Each of the 7 mini-portfolios of OPNewsletter posted positive gains ranging from 6.6% to 80%. Also as an OP blog reader, I hope you enjoyed my earning previews on GOOG, AAPL and LNKD. Should you have any suggestions, pls post your comments on how to improve those.

I have been experimenting on straddles/strangles for quite some time (ever since I reviewed Jeff's book Volatility Edge in Options Trading and interviewed him). Based on past several month's experimentation, I have developed multiple straddles/strangles that I plan to introduce one by one into OPN style of income trading.

If you are on twitter, please connect with me (FREE) to get some real time updates on market internals, trade ideas and to receive interesting articles that I think might be useful for your trading.

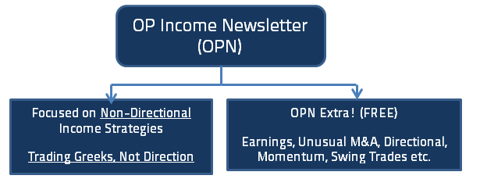

So as to make the distinction very clear, OptionPundit's key objective is income trading and deliver 5-7% returns per month via diversification, scalability and appropriate risk management (How large is OPN portfolio). Most of the portfolio capital is allocated to income option trading strategies focusing on options' greeks vs taking a directional view. (For example- Iron Condor Spread, Calendar Spread, Diagonal spread, Credit and debit spreads, etc). Objective is to consistent growth while use some capital via OPNExtra! to accelerate returns. I don't count OPNEXtra performance in OPNewseltter's performance calculation. These trades are suited to more active traders who can trade almost everyday.

All of the above trades (excluding stocks) can be done with a US$10,000 portfolio.

We have great time ahead, volatilities are low and as we move to the most crucial 3months of the year, specific set-of opportunities are arising. If you are still on sidelines and have missed past several weeks' action, sign-up for OPNewsletter now. There is no waiting list currently and OPIncome Newsletter subscription is open to all.

More on OP Income Newsletter.

Profitable Trading, OP