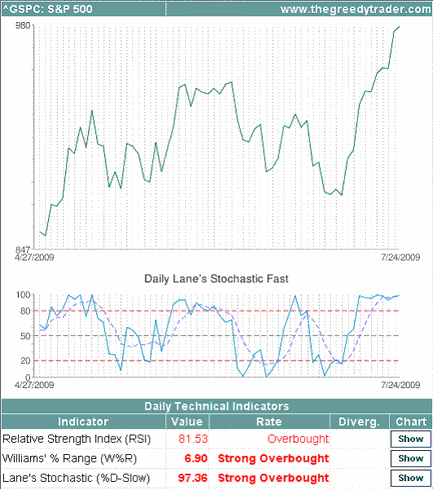

The Standard & Poor's 500 Index gained more than 12.7% since July 8th, and almost 47% since March 6th, reaching 979.8 on Friday, the highest level since November 5th, 2008. Daily Lane's Stochastic, Williams' % Range and Relative Strength Index are overbought/strongly overbought for all three major US indices. Weekly Williams' % Range is strongly overbought, signaling that market is moving too fast in a weekly time frame as well; and the rally may not be sustainable for a long period. 109 out of S&P 500 members are overbought, 51 stocks have daily MACD bearish divergence, indicating that the rally is already slowing down. The next resistance level for S&P 500 index is around 993. Considering overbought technical indicators, it would be difficult to break this resistance level; and chances are high that the stock market trend may reverse soon.

S&P 500 technical indicators

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.