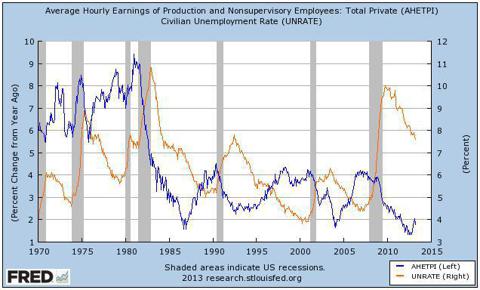

There is an inverse relationship between the unemployment rate and the wage inflation. Whenever people get unemployed, it means the economy isn't doing well. Employers won't be able to raise wages of the people during these difficult times, so you will get a low wage inflation trend (blue line). In these periods, the unemployment rate tends to go up (yellow line).

Chart 1: Wage Inflation Vs. Unemployment Rate |

The same can be said the other way round. When the unemployment rate declines, people will demand a higher salary as skilled workers get scarcer. At this stage the wages will inflate.

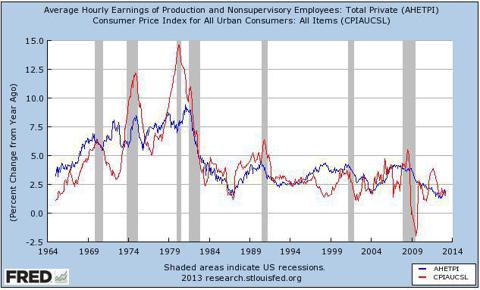

It is also so that wages correlate highly with the consumer price index (CPI). So if the unemployment rate declines, you can expect a higher CPI as you can see on Chart 2.

So if you don't believe the CPI the government is reporting, you just look at the average hourly earnings. The average hourly earnings were positive in March. So I expect the CPI to increase too.

Chart 2: Average Hourly Earnings Vs. CPI |